Speak directly to the analyst to clarify any post sales queries you may have.

The watering can market is experiencing a strategic transformation driven by sustainable innovation, evolving user preferences, and renewed focus on supply chain resilience. Manufacturers, retailers, and institutional buyers are adapting rapidly as digital platforms and material advances reshape the sector’s competitive landscape.

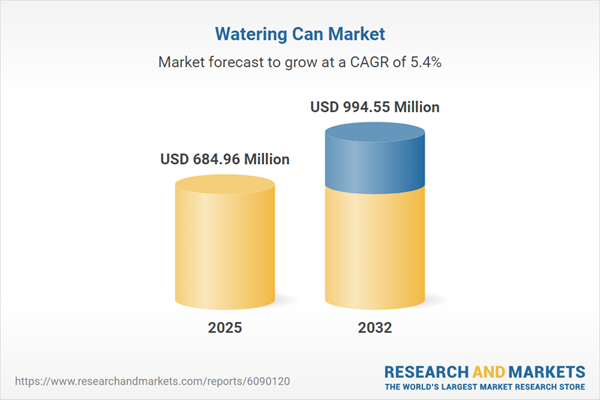

Market Snapshot: Watering Can Market Size, Growth, and Outlook

The global watering can market grew from USD 650.98 million in 2024 to USD 684.96 million in 2025. With a projected CAGR of 5.44%, the market is forecast to reach USD 994.55 million by 2032.

Demand is rising as both professional and home gardening segments seek solutions that combine durability, ergonomic design, and sustainability. Market players are responding with advanced manufacturing, regional adaptation, and targeted product innovations.Scope & Segmentation

This report provides a detailed analysis of product segments, customer applications, and geographic trends. Key segmentation categories include:

- Material Composition: Ceramic, composite materials, metal (aluminum, copper, stainless steel), and plastic options meeting varying durability, sustainability, and cost requirements.

- Capacity: Products ranging from under 2 liters to more than 10 liters to address ornamental, personal, and commercial users’ diverse watering volumes.

- Application: Commercial horticulture and nursery operations, decorative indoor and outdoor use, educational gardens, home gardening, and large-scale landscaping.

- Distribution Channel: Offline sales via department stores, direct sales, and specialty stores; online engagement through company websites and e-commerce platforms.

- Regions Covered: Americas (North America, Latin America), Europe, Middle East & Africa (Europe, Middle East, Africa), and Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan).

- Representative Companies: Leading manufacturers and brands include Fiskars Corporation, Husqvarna Group, Haws Company, Rain Bird Corporation, The AMES Companies, and others in diversified subsectors.

Key Takeaways for Decision-Makers

- Material innovation—particularly composite blends and recyclable metals—is influencing purchase decisions, aligning with sustainability initiatives among institutional and corporate customers.

- Digital transformation in manufacturing (precision molding, 3D printing) accelerates product cycles and enables tailored ergonomic solutions for specific end-user segments.

- Distribution strategies increasingly rely on omnichannel models, combining direct-to-consumer expansion with personalized service in brick-and-mortar outlets.

- Smart watering technologies, including sensor integration and mobile connectivity, are being tested for next-generation gardening applications.

- Adaptive supply chains with dual sourcing, regional warehousing, and nearshore partnerships support rapid response to regulatory and market fluctuations.

- Regional market trends highlight the importance of adapting capacity and material choices to local climates and consumer preferences.

Tariff Impact: Navigating Trade and Supply Chain Dynamics

Recent United States tariff adjustments have created complexities for global watering can production and sourcing. Higher import duties on metals and composite polymers have challenged cost structures, prompting manufacturers to diversify raw materials and prioritize regionalized supply. These measures have increased the urgency for flexible procurement, investment in alternative materials such as domestically sourced ceramics, and renegotiation of vendor contracts. Resilient supply chains and agile sourcing have become critical for mitigating geopolitical risks and seasonal shifts in demand.

Methodology & Data Sources

This report is built on robust primary and secondary research, including industry interviews, end-user surveys, and a comprehensive review of trade data, regulatory filings, and patent records. Data triangulation and benchmarking support the reliability of the trends and projections presented here, ensuring actionable insights for senior leadership.

Why This Report Matters

- Equips stakeholders with strategic clarity on key market drivers, emerging technologies, and the growing influence of sustainability and circular economy principles.

- Supports decision-making on product development, channel expansion, and supplier partnerships by providing granular segmentation and regional trend analysis.

- Enables risk assessment and forward planning in the face of shifting trade policies and evolving customer expectations.

Conclusion

As the watering can market evolves, industry leaders who prioritize sustainable materials, technology integration, and agile distribution will be well positioned for growth. Strategic adaptation to regional trends and regulatory shifts ensures continued relevance and operational excellence in the global landscape.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Watering Can Market report include:- Fiskars Corporation

- Behrens Manufacturing, LLC

- Bloem Company

- Algreen Products Inc.

- Bosmere USA, Ltd.

- Elho Group

- Emsa GmbH

- Epoca SpA

- Ferm Living

- Robert Bosch GmbH

- Gilmour, Inc.

- Haws Company, Inc.

- Hozelock Ltd.

- Husqvarna Group

- Keter Group Ltd.

- KisanKraft Limited

- Novelty Manufacturing Co.

- Rain Bird Corporation

- Scotts Miracle‑Gro Company

- Stiga AB

- Suncast Corporation

- The AMES Companies, Inc.

- Unison Engg. Industries

- Viking Manufacturing, Inc.

- Stanley Black & Decker Outdoor GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 684.96 Million |

| Forecasted Market Value ( USD | $ 994.55 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |