Speak directly to the analyst to clarify any post sales queries you may have.

The Health ATM Market is rapidly transforming access and delivery within healthcare, propelled by innovations that enable organizations to offer personalized, seamless, and scalable care in diverse settings. Senior decision-makers will find this landscape marked by evolving stakeholder needs, expanded technology deployments, and dynamic supply chain considerations, informing both growth and risk mitigation strategies.

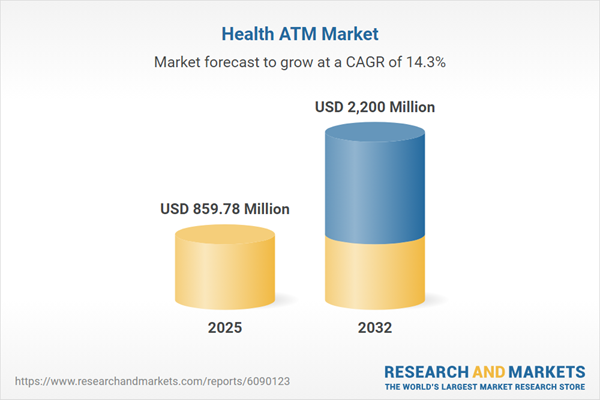

Market Snapshot: Growth Trajectory for the Health ATM Market

The Health ATM Market grew from USD 756.25 million in 2024 to USD 859.78 million in 2025. It is expected to continue growing at a CAGR of 14.31%, reaching USD 2.20 billion by 2032. Widespread adoption is reinforced by a shift toward decentralized healthcare delivery, demand for immediate diagnostics, and integration with telehealth platforms and electronic records. Heightened adoption in both public and private sectors demonstrates broad applicability and resilient demand across regions.

Scope & Segmentation: Comprehensive View of the Health ATM Market

- Component: Hardware (including biometric sensors and medical-grade touchscreens); Software (featuring diagnostic and telehealth integration modules).

- Form Factor: Portable/mobile kiosks for rapid deployment; Standalone stations for permanent, high-traffic installations.

- Applications: Chronic disease management, health assessment & screening, remote consultation & diagnostics, vital sign monitoring.

- End-Users: Airports & public transport stations, corporate organizations, educational institutions, hospitals and clinics, retail pharmacies.

- Regional Coverage: Americas (including United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (with detailed coverage of European Union, Middle Eastern, and African markets), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan).

- Key Players: YoloHealth, HealthNovo, Phoenix Microsystems, Clinics On Cloud, Olea Kiosks Inc., Meridian Kiosks, Fabcon, XIPHIAS Software Technologies, REDYREF, Sri Laxmi Kravia Techlabs, CliniVantage, Qmatic Group, Qisda Corporation, Advantech, Mechmann Water Solution Systems.

Key Takeaways for Senior Decision-Makers

- Automated health kiosks are central to meeting rising demand for accessible, user-driven preventive care in locations where traditional clinical infrastructure is limited.

- Integration with electronic health records and telemedicine platforms is bridging physical and digital care gaps, driving enhanced patient engagement and continuity of care.

- Regulatory changes and reimbursement policy evolution are encouraging deployment across multiple sectors, especially where value-based care models and wellness initiatives are prioritized.

- Component and supply chain choices, including nearshoring and open-source software, are increasingly used to manage geopolitical disruptions and optimize cost structures.

- Subscription and cloud-native software models are influencing both customer expectations and provider revenue streams, supporting long-term service and support agreements.

- Regional variation in policy, infrastructure readiness, and technology adoption is shaping the pace and model of kiosk deployments; organizations benefit from aligning strategies with specific local requirements.

Tariff Impact: Supply Chain Shifts and Strategic Adaptation

Recent tariff measures, especially in the United States, have driven up costs for core components—such as medical sensors and communication modules—prompting manufacturers to diversify sourcing strategies and invest in nearshoring. Software developers are adopting modular, open architectures to lower dependency on cross-border licensing. Logistics adaptations, including optimized distribution corridors and diversified warehousing, are mitigating tariff risks and maintaining operational margins through 2025.

Methodology & Data Sources

This analysis is based on a robust mixed-method approach: structured interviews and workshops with clinical, engineering, telehealth, and policy leaders were conducted to capture qualitative insights. Secondary data included peer-reviewed research, industry reports, regulatory filings, and primary procurement records. Scenario planning and competitive benchmarking ensured that findings are comprehensive and actionable.

The Health ATM Market: Why This Report Matters

- Offers senior executives a holistic, regionally nuanced understanding of technology, regulatory, and supply chain drivers shaping competitive advantage in Health ATM investments.

- Highlights deployment models and strategic partnerships that deliver actionable outcomes for organizations pursuing improved care delivery and operational efficiency.

Conclusion

The evolving Health ATM Market demands agile strategies that balance innovation, regulatory compliance, and stakeholder collaboration. Decision-makers who align investments with technology, local policy, and lived user needs will unlock sustainable value as the market advances.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Health ATM Market report include:- YoloHealth

- HealthNovo

- Phoenix Microsystems

- Clinics On Cloud

- Olea Kiosks Inc.

- Meridian Kiosks

- Fabcon

- XIPHIAS Software Technologies Pvt. Ltd.

- REDYREF

- Sri Laxmi Kravia Techlabs Pvt. Ltd

- CliniVantage Healthcare Technologies

- Qmatic Group

- Qisda Corporation

- Advantech Co., Ltd.

- Mechmann Water Solution Systems Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 859.78 Million |

| Forecasted Market Value ( USD | $ 2200 Million |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |