Speak directly to the analyst to clarify any post sales queries you may have.

Groundbreaking Introduction to the Evolving Global Antimicrobials Landscape Reflecting Heightened Demand and Complex Regulatory Pressure

The global antimicrobials sector has emerged as a critical battleground in the fight against rising drug resistance and mounting public health challenges. Healthcare systems, agricultural operations, and consumer product manufacturers alike are grappling with the consequences of diminishing drug efficacy and the need for more robust stewardship frameworks. As stakeholders collaborate to develop novel therapies, the protection of existing assets has taken on renewed urgency.Innovations in molecular biology and computational screening have accelerated the discovery pipeline, enabling researchers to identify promising compounds with greater precision. At the same time, regulatory authorities are implementing more stringent guidelines to curb overuse and promote responsible prescription practices. This dual emphasis on innovation and regulation is reshaping the sector's strategic priorities, compelling organizations to balance speed to market with rigorous safety and efficacy standards.

Supply chain resilience remains an ever-present concern, as disruptions in raw material sourcing and manufacturing capacity create vulnerabilities. These challenges are driving investment in diversified production methods and alternative sourcing strategies. In parallel, the industry is witnessing an escalation in cross-sector collaboration, where pharmaceutical firms, biotech innovators, and academic centers form consortia to share insights and streamline development pathways.

In response to this evolving environment, leading companies are harnessing digital platforms and advanced analytics to optimize research workflows and manufacturing efficiencies. Such efforts are not only enhancing productivity but also reinforcing quality assurance across the entire value chain. This introduction sets the stage for a deeper examination of the transformative shifts, tariff impacts, segmentation dynamics, and strategic imperatives that define the current antimicrobial landscape.

Pivotal Transformative Forces Reshaping the Antimicrobials Sector through Innovation Regulation and Supply Chain Modernization

The antimicrobial sector is undergoing a profound metamorphosis as technological breakthroughs, regulatory reforms, and shifting stakeholder expectations converge. Precision medicine initiatives have enabled targeted therapies that leverage genomic insights to combat resistant strains more effectively. Meanwhile, advances in formulation science are facilitating diverse delivery methods, from inhalable aerosols to topical treatments, which enhance patient adherence and therapeutic outcomes.Regulatory bodies worldwide are synchronizing efforts to harmonize approval pathways, expediting access to critical treatments while maintaining rigorous safety standards. Emerging stewardship programs emphasize data-driven prescription monitoring and the integration of real-world evidence to refine treatment guidelines. These programs are fostering greater transparency and accountability across healthcare networks, shaping the way antimicrobials are prescribed and deployed.

Supply chain innovations are also reshaping the competitive landscape, with modular manufacturing and single-use bioreactors reducing lead times and capital expenditure. This shift enables more agile responses to sudden demand spikes, whether driven by outbreak scenarios or changes in agricultural practice. In parallel, sustainable sourcing initiatives are gaining momentum, prompting companies to explore natural origin compounds alongside synthetic alternatives to mitigate environmental impact.

Together, these transformative forces are redefining product portfolios and strategic roadmaps for stakeholders. Organizations that anticipate regulatory trends, invest in digital infrastructure, and cultivate cross-disciplinary partnerships will emerge as pioneers in this dynamic market. The subsequent sections will delve into the specific ramifications of tariff policies, segmentation insights, regional nuances, and competitive strategies that are shaping the future of antimicrobials.

Comprehensive Analysis of the 2025 United States Tariff Regime and Its Strategic Implications for Global Antimicrobial Supply Chains

The implementation of new tariff measures by the United States in 2025 is exerting multifaceted pressure on global antimicrobial trade flows and cost structures. Manufacturers reliant on imported raw materials, including specialized precursors and active pharmaceutical ingredients, are recalibrating their procurement strategies to mitigate tariff-induced price escalations. As a result, regional supply hubs are gaining favor, enabling producers to localize sourcing and reduce exposure to international tariff volatility.Beyond cost considerations, the tariffs are influencing strategic alliances and production footprints. Companies are evaluating joint ventures and licensing agreements in low-tariff jurisdictions to maintain competitive pricing and secure market access. These partnerships often encompass technology transfer and co-development arrangements, fostering deeper collaboration across geographies.

At the same time, downstream customers are renegotiating contracts and exploring alternative supplier networks to preserve margin integrity. Forward-looking organizations are conducting scenario planning exercises to anticipate further regulatory shifts and safeguard supply reliability. In this evolving context, tariff dynamics are not merely a short-term hurdle but a catalyst for structural realignments in the global antimicrobial ecosystem.

By reassessing manufacturing networks, investing in regional production capacity, and leveraging strategic partnerships, industry players can navigate the tariff landscape effectively. The following sections will expand on how segmentation, geographic differentiation, and competitive intelligence intersect with these tariff-driven transformations, illuminating pathways to sustainable growth.

In-Depth Segmentation Insights Highlighting Type Formulation Origin End-Use and Distribution Nuances Driving Antimicrobials Demand

A nuanced understanding of market segments reveals critical insights into product development priorities and commercialization strategies. Anthelminthics, antibiotics, antifungals, antiprotozoals, and antivirals each present distinct therapeutic challenges and regulatory pathways, with resistance patterns and disease burden guiding research investments. Meanwhile, advancements in formulation science have diversified delivery routes, enabling inhalable, injectable, oral, and topical options that meet varied patient needs and healthcare settings.Origin considerations further inform R&D pipelines and sustainability agendas. Natural derivatives are experiencing a resurgence due to their favorable ecological profiles, whereas synthetic compounds offer scalability and structural versatility. Balancing these attributes is essential for companies seeking to optimize both cost efficiency and environmental stewardship.

End-use domains, spanning agriculture, construction, consumer products, food and beverage, healthcare and medical, textiles, and water treatment, are driving differentiated demand patterns based on application-specific requirements. The food and beverage sector, encompassing packaging solutions, preservation techniques, and equipment sanitation, underscores the need for antimicrobial efficacy without compromising safety or taste. Within healthcare and medical environments, focus areas such as hospital surfaces, medical devices, sanitizers and disinfectants, and wound care demand rigorous compliance and performance standards. Water treatment applications, ranging from industrial to municipal and wastewater contexts, emphasize contaminant eradication and system integrity, requiring robust antimicrobial formulations.

Finally, evolving distribution channels, both offline and online, are reshaping go-to-market strategies. Digital platforms enhance customer engagement and data-driven insights, while traditional channels remain vital for complex supply agreements and regulatory fulfilment. These segmentation insights underscore the diverse pathways through which stakeholders can align portfolio development with market demand.

Comprehensive Regional Perspectives That Illuminate Americas EMEA and Asia-Pacific Drivers Influencing Antimicrobials Adoption

Regional dynamics play a pivotal role in shaping antimicrobial market trajectories, with each geography exhibiting unique drivers and challenges. In the Americas, robust pharmaceutical infrastructures and strong public health mandates foster rapid adoption of next-generation therapies, while supply chain resilience initiatives address vulnerabilities exposed by past disruptions. This region's regulatory environment balances expedited approval pathways with stringent post-market surveillance protocols.Across Europe, the Middle East, and Africa, regulatory convergence efforts are streamlining approval processes, though disparities in economic development and healthcare access continue to influence demand. Collaborative frameworks among governments, research institutions, and industry consortia are advancing stewardship programs and incentivizing local production capacity to reduce import dependencies.

The Asia-Pacific region is characterized by rapid expansion of production capabilities and a growing focus on domestic innovation. Nations are investing in biomanufacturing infrastructure and fostering public-private partnerships to accelerate clinical development and technology transfer. Furthermore, rising consumer awareness and government-driven antimicrobial stewardship campaigns are shaping prescription practices and post-market surveillance protocols.

Interregional trade agreements and tariff structures further modulate these regional trends, creating both opportunities and obstacles for multinational stakeholders. Ultimately, tailoring strategies to the regulatory, economic, and healthcare landscapes of each region will be essential for sustained growth and resilience in the global antimicrobial market.

Key Competitive Intelligence Spotlighting Innovation Pipelines Strategic Alliances and Value-Added Commercialization Approaches

The competitive arena within the antimicrobial industry is defined by dynamic alliances, intensive R&D investments, and differentiated product portfolios. Leading organizations are leveraging advanced biotechnological platforms, including high-throughput screening and AI-driven molecular design, to accelerate candidate identification. Simultaneously, strategic alliances between pharmaceutical giants and specialized biotech firms are proliferating, facilitating resource sharing and risk mitigation throughout the development lifecycle.Innovation pipelines are increasingly focused on next-generation modalities, such as bacteriophage therapies, antimicrobial peptides, and targeted enzyme inhibitors. These novel approaches seek to outpace emerging resistance mechanisms while satisfying evolving regulatory benchmarks. Companies that integrate translational research capabilities with scalable manufacturing platforms are well positioned to transition promising candidates into late-stage clinical trials.

On the commercialization front, differentiation is emerging through value-added services like antimicrobial stewardship tools, digital adherence monitoring, and companion diagnostics. These offerings not only reinforce competitive positioning but also deliver enhanced clinical outcomes, bolstering stakeholder trust and uptake in both medical and non-medical applications.

To thrive in this competitive landscape, organizations must foster a culture of continuous innovation, cultivate strategic partnerships across the value chain, and align their R&D agendas with unmet clinical and industrial needs. This approach will enable market leaders to sustain momentum and expand their footprint in a rapidly evolving environment.

Actionable Roadmap for Industry Leaders Emphasizing Data-Driven Collaboration Sustainable Practices and Operational Agility

Industry leaders must proactively align strategic initiatives with emerging market dynamics to sustain growth and resilience. Investing in advanced analytics and real-world evidence platforms will enable more informed decision-making across research, regulatory engagement, and commercial operations. By integrating data from stewardship programs, patient outcomes, and supply chain performance, organizations can optimize product lifecycles and therapeutic positioning.Collaborative frameworks should extend beyond traditional partnerships to include cross-sector alliances with agricultural, water treatment, and consumer goods stakeholders. Such collaborations can uncover novel application opportunities and facilitate knowledge transfer across end-use domains. Furthermore, establishing regional centers of excellence that combine R&D, manufacturing, and regulatory expertise will enhance responsiveness to tariff fluctuations and local policy changes.

Developing robust sustainability strategies around natural origin sourcing and green manufacturing processes will strengthen brand reputation and satisfy stakeholder expectations. Simultaneously, embracing digital engagement models-such as telehealth integration and e-commerce platforms-can expand market reach and improve customer experience. Prioritizing cybersecurity and data privacy within these digital initiatives is paramount to maintain stakeholder trust.

Ultimately, industry leaders who adopt a holistic approach-blending technological innovation, strategic partnerships, and operational agility-will be best positioned to navigate the complexities of the antimicrobial landscape and achieve sustainable competitive advantage.

Rigorous Multi-Dimensional Research Methodology Integrating Primary Expert Interviews Secondary Data Analysis and Scenario Modeling

This research employs a rigorous methodology that combines primary and secondary data sources to ensure comprehensive and accurate insights. Primary research included in-depth interviews with key opinion leaders across pharmaceutical, biotech, and regulatory agencies, as well as consultations with end-use specialists in agriculture, food safety, and water treatment. These qualitative discussions provided nuanced perspectives on emerging trends and strategic imperatives.Secondary research encompassed an extensive review of scientific publications, patent filings, regulatory guidelines, and industry white papers. Publicly available databases and governmental reports were analyzed to track policy developments, trade regulations, and tariff changes. Data triangulation techniques were applied to validate the findings and reconcile any discrepancies.

Quantitative analyses involved mapping technology adoption curves and assessing comparative R&D investment patterns across regions. Scenario planning models were utilized to evaluate the implications of tariff shifts and supply chain disruptions. The integration of statistical tools and expert elicitation ensured that the strategic recommendations are grounded in both empirical evidence and practitioner insights.

By applying this multi-dimensional research framework, the report delivers robust, actionable intelligence designed to support decision-makers in navigating the complexities of the global antimicrobial market. The transparent methodology underscores the credibility and reliability of the insights presented.

Conclusive Strategic Synthesis Highlighting Critical Drivers Regulatory Complexities and Collaborative Imperatives in Antimicrobials

The global antimicrobial landscape is at a pivotal juncture, shaped by accelerating resistance patterns, evolving regulatory regimes, and strategic realignments prompted by tariff measures. Stakeholders must navigate a mosaic of innovation drivers, from precision medicine and advanced formulation techniques to sustainable sourcing and stewardship initiatives. The convergence of these factors is fostering both challenges and opportunities.Segment-specific insights reveal the importance of diversified pipelines that balance natural and synthetic origins while addressing the broad spectrum of therapeutic and industrial applications. Regional nuances underscore the need for tailored strategies that align with the distinct regulatory, economic, and healthcare contexts of the Americas, Europe, Middle East and Africa, and Asia-Pacific.

Competitive dynamics are being redefined by collaborative R&D models, value-added service offerings, and digital engagement platforms. At the same time, evolving tariff structures and supply chain vulnerabilities are catalyzing structural adaptations in manufacturing and distribution networks.

Moving forward, organizations that integrate data-driven decision-making, foster cross-sector partnerships, and embrace sustainable practices will be best positioned to achieve resilient growth. By leveraging the insights and strategic imperatives outlined in this executive summary, stakeholders can confidently chart a course through the complexities of the antimicrobial ecosystem and realize long-term success.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Type

- Anthelminthics

- Antibiotics

- Antifungals

- Antiprotozoals

- Antivirals

- Formulation

- Inhalable

- Injectable

- Oral

- Topical

- Origin

- Natural

- Synthetic

- End-Use

- Agriculture

- Construction

- Consumer Products

- Food & Beverage

- Food Packaging

- Food Preservation

- Processing Equipment Sanitation

- Healthcare & Medical

- Hospital Surfaces

- Medical Devices

- Sanitizers & Disinfectants

- Wound Care

- Textiles

- Water Treatment

- Industrial Water Treatment

- Municipal Water Treatment

- Wastewater Treatment

- Distribution Channel

- Offline

- Online

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Abbott Laboratories

- Arxada AG

- Avient Corporation

- BASF SE

- Byotrol Group of Companies

- Cipla Inc.

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Greencraft Labs Private Limited.

- GSK PLC

- HeiQ Materials AG

- ICL Group

- Locus Fermentation Solutions

- Merck KGaA

- Milliken & Company

- Organisan Corporation

- Parx Materials NV

- Pfizer Inc.

- PURE Bioscience, Inc.

- RTP Company

- SANITIZED AG

- Sciessent LLC

- Sun Pharmaceutical Industries Ltd

- The Dow Chemical Company

- Thermo Fisher Scientific Inc.

- United-Guardian, Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Antimicrobials market report include:- Abbott Laboratories

- Arxada AG

- Avient Corporation

- BASF SE

- Byotrol Group of Companies

- Cipla Inc.

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Greencraft Labs Private Limited.

- GSK PLC

- HeiQ Materials AG

- ICL Group

- Locus Fermentation Solutions

- Merck KGaA

- Milliken & Company

- Organisan Corporation

- Parx Materials NV

- Pfizer Inc.

- PURE Bioscience, Inc.

- RTP Company

- SANITIZED AG

- Sciessent LLC

- Sun Pharmaceutical Industries Ltd

- The Dow Chemical Company

- Thermo Fisher Scientific Inc.

- United-Guardian, Inc.

Table Information

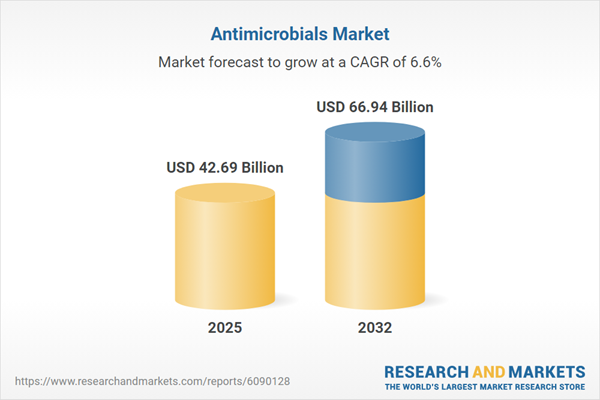

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 42.69 Billion |

| Forecasted Market Value ( USD | $ 66.94 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |