Speak directly to the analyst to clarify any post sales queries you may have.

The green antimicrobial market is rapidly transforming industrial safety and sustainability standards as organizations pivot to eco-friendly alternatives in microbial control. Senior leaders must recognize shifting regulations, technology advances, and evolving procurement needed to stay competitive in this dynamic sector.

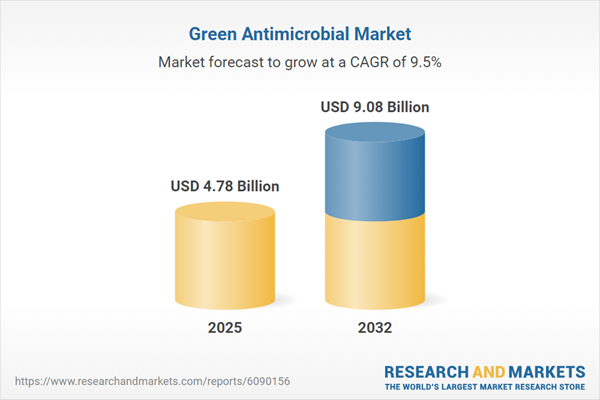

Market Snapshot: Green Antimicrobial Market Size and Growth

The Green Antimicrobial Market grew from USD 4.39 billion in 2024 to USD 4.78 billion in 2025. It is expected to continue growing at a CAGR of 9.49%, reaching USD 9.08 billion by 2032. This robust trajectory reflects accelerating adoption across agriculture, construction, food & beverage, healthcare, textiles, and water treatment sectors. Senior decision-makers will find this market increasingly relevant as sustainability and regulatory imperatives reshape procurement and innovation priorities.

Scope & Segmentation of the Green Antimicrobial Market

- Type: Antibacterial, Antifungal, Antiparasitic, Antiviral

- Source: Animal-Derived (Chitosan, Lysozyme), Enzyme-Based, Microbial-Derived (Algae, Microalgae), Plant-Based (Essential Oils, Plant Extracts)

- Form: Extract, Films, Hydrogel, Powder

- Distribution Channel: Offline, Online

- End-Use: Agriculture, Construction, Consumer Products, Food & Beverage (Food Packaging, Food Preservation, Processing Equipment Sanitation), Healthcare & Medical (Hospital Surfaces, Medical Devices, Sanitizers & Disinfectants, Wound Care), Textiles, Water Treatment (Industrial, Municipal, Wastewater)

- Regional Coverage: Americas (North America – United States, Canada, Mexico; Latin America – Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (Europe – United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland; Middle East – United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel; Africa – South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Key Companies: AMR Industry Alliance Secretariat, Arxada AG, Avient Corporation, BASF SE, Byotrol Group of Companies, Greencraft Labs Private Limited, HeiQ Materials AG, ICL Group, Locus Fermentation Solutions, Milliken & Company, Organisan Corporation, Parx Materials NV, PURE Bioscience Inc., RTP Company, SANITIZED AG, Sciessent LLC, The Dow Chemical Company, United-Guardian Inc.

Technological and Segment Relevance

The deployment of green antimicrobial solutions spans advanced enzyme-based biotechnology, bioengineered peptides, nanoemulsions, and solvent-free green synthesis. Animal- and microbial-derived inputs provide proven efficacy, while plant-based and enzyme approaches enable clean-label appeals and regulatory compliance. Market segmentation emphasizes the growing significance of antifungal and antiparasitic types across emerging applications, and highlights region-specific drivers such as Europe’s regulatory mandates and Asia-Pacific’s scalable production capabilities. The market’s primary keyword, "green antimicrobial," is central to cross-sector adoption.

Key Takeaways for Senior Decision Makers

- Innovative green antimicrobial alternatives are replacing traditional biocides in key applications, supporting new competitive benchmarks for safety and sustainability.

- Advances in sourcing—such as partnerships for local extraction and investments in domestic fermentation—mitigate input cost volatility and reinforce supply chain resilience.

- Digital traceability and real-time data analytics strengthen compliance, bolster customer trust, and enable rapid response to evolving microbial threats.

- Strategic collaborations among academia, biotech startups, and established industry players accelerate product innovation and commercialization pipelines.

- Diversified sourcing between animal, microbial, enzyme-based, and plant-derived inputs is vital for aligning cost structures and sustainability objectives.

- Adaptable manufacturing lines and tailored solutions across multiple product formats expand end-use market penetration.

Tariff Impact on Sustainable Antimicrobial Supply Chains

The recent introduction of US tariffs on key inputs—animal-derived polymers, enzymes from Europe, microbial compounds, and plant-based oils—has created new cost and supply chain challenges. Manufacturers are adopting risk-sharing arrangements, nearshoring, and regional distribution hubs to offset tariff impacts and reinforce procurement strategies. These measures are fostering a more robust and agile market landscape that can withstand policy fluctuations and streamline industrial operations.

Methodology & Data Sources

This report is grounded in extensive secondary research, including peer-reviewed journals, regulatory datasets, and patent filings. Complementary primary interviews with executives and technical experts validated qualitative trends and end-user perspectives. Data was triangulated through supplier disclosures, trade statistics, and company reports to ensure comprehensive and accurate market segmentation.

Why This Report Matters

- Enables senior leaders to adjust sourcing, R&D, and regulatory strategies in response to emerging green antimicrobial market realities.

- Delivers granular insight into disruptive technologies, supply chain risks, and regional growth opportunities for accountable decision-making.

- Empowers organizations to align product development, compliance, and channel management with evolving stakeholder and customer expectations.

Conclusion

The green antimicrobial sector is poised for substantial growth, shaped by sustainability-driven innovation, regulatory evolutions, and technologically-enabled supply chains. Leaders equipped with these insights can build resilient strategies and capitalize on new opportunities for value creation.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Green Antimicrobial market report include:- AMR Industry Alliance Secretariat

- Arxada AG

- Avient Corporation

- BASF SE

- Byotrol Group of Companies

- Greencraft Labs Private Limited.

- HeiQ Materials AG

- ICL Group

- Locus Fermentation Solutions

- Milliken & Company

- Organisan Corporation

- Parx Materials NV

- PURE Bioscience, Inc.

- RTP Company

- SANITIZED AG

- Sciessent LLC

- The Dow Chemical Company

- United-Guardian, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 4.78 Billion |

| Forecasted Market Value ( USD | $ 9.08 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |