Speak directly to the analyst to clarify any post sales queries you may have.

A strategic opening that positions mobile phone cooling as an essential technology trend reshaping product development, distribution, and end-user expectations

This executive summary opens with a clear exposition of why mobile phone cooling solutions have moved from niche accessories to strategic components in device ecosystems. Rapidly increasing device performance, concentrated thermal loads driven by high-refresh displays, and extended usage patterns have elevated thermal management from aftermarket oddity to operational necessity. As a result, product teams, accessory manufacturers, and channel partners confront new technical, commercial, and regulatory considerations that demand coordinated responses.The introduction frames core themes that recur throughout the report: product innovation across mechanical and thermal domains, distribution channel evolution driven by digital commerce, and the interplay between consumer behavior and professional use cases such as competitive mobile gaming and content creation. It also establishes the structure used to analyze the landscape, including segmentation by product type, cooling method, application, distribution channel, and end-user, thereby preparing readers for the focused insights and practical recommendations that follow.

An in-depth view of converging technological and commercial shifts that are accelerating design innovation and reshaping routes to market in the mobile phone cooling arena

The landscape for mobile phone coolers is undergoing transformative shifts driven by several converging forces that reshape product lifecycles, go-to-market strategies, and competitive positioning. First, technological diversification has broadened the design space: manufacturers are integrating air cooling, liquid cooling, phase change cooling, and vibration-based cooling into form factors that range from clip-on devices to integrated case solutions. This diversification enables targeted performance trade-offs between size, noise, energy consumption, and cooling capacity.Second, user behavior is changing as high-performance applications impose sustained thermal loads; gamers, content creators, and professionals running compute-intensive apps now expect uninterrupted performance. Third, distribution channels are evolving as online marketplaces accelerate discovery and aftermarket innovation while offline retail continues to play an important role for demonstration and immediate purchase. Finally, supply chain optimization and regional manufacturing strategies are producing faster product iteration cycles and variable lead times. Taken together, these shifts require companies to be more agile in product development, more precise in value communication, and more adaptive in route-to-market planning.

A focused examination of how 2025 U.S. tariff measures catalyzed resilient sourcing adjustments, design modularity, and logistical safeguards across the mobile phone cooler supply chain

Policy changes and tariff adjustments originating in the United States in 2025 have exerted a material influence on sourcing, pricing behavior, and supply chain design for mobile phone cooling products. Increased duties on selected components and assemblies created immediate cost pressures for manufacturers reliant on globalized supply chains. In response, several suppliers re-evaluated supplier contracts, adjusted inventory strategies to mitigate near-term cost volatility, and accelerated dual-sourcing initiatives to diversify risk.Consequently, procurement teams prioritized supplier qualification and logistical flexibility, while manufacturers reprioritized product roadmaps to favor modular designs that allow substitution of tariff-affected components without compromising core performance. Retailers and distributors also rebalanced assortments and negotiated longer payment terms to buffer margin compression. Meanwhile, product developers pursued design simplification and component consolidation where possible to limit tariff exposure. Overall, the tariff environment catalyzed structural adjustments across the value chain, driving more resilient sourcing models and faster strategic decision cycles without sacrificing product quality or consumer-facing performance.

Granular segmentation insights exposing how product form factor, thermal technology, application demands, channel dynamics, and user profiles drive differentiated product strategies

Segmentation analysis reveals distinct opportunity pockets and technical requirements that vary by product type, cooling method, application, distribution channel, and end-user. By product type, clip-on mobile phone coolers, fixed mobile phone coolers, phone case coolers, and portable mobile phone coolers each carry different constraints around attachment mechanisms, thermal contact, and user ergonomics; clip-on and fixed variants often prioritize high heat flux removal for gaming sessions, while phone case coolers trade peak performance for integration and aesthetics.When viewed through the lens of cooling method, air cooling, liquid cooling, phase change cooling, and vibration-based cooling demonstrate divergent pathways in terms of noise, reliability, and form factor. Air cooling tends to offer reliable, low-complexity solutions; liquid cooling delivers higher sustained performance but introduces sealing and longevity considerations; phase change systems supply burst cooling for short, intense loads; and vibration-based cooling presents novel options for localized heat dissipation. Application segmentation across gaming phones, high-performance mobile devices, smartphones, and tablets highlights the importance of load profile analysis: gaming and high-performance devices demand sustained thermal management, while mainstream smartphones and tablets require moderate, user-friendly solutions. Distribution channel distinctions between offline channel and online channel show that offline retail remains important for tactile evaluation and immediate acquisition, whereas online channels provide discovery, reviews, and rapid iteration in SKUs. Finally, end-user segmentation into businesses/corporates, gamers and tech enthusiasts, and individual consumers underscores diverging purchase drivers: enterprises value reliability and warranty terms, gamers prioritize performance and ergonomics, and individual consumers often balance cost, convenience, and aesthetic fit.

Regional dynamics and buyer behaviors across the Americas, Europe, Middle East & Africa, and Asia-Pacific that fundamentally influence product design, certification, and channel strategy

Regional dynamics shape product design priorities, go-to-market tactics, and partnership models across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, early adoption by competitive mobile gamers and a strong aftermarket accessory culture favor high-performance clip-on and portable solutions, supported by digital marketing channels and influencer-driven demand. Retailers in this region often emphasize quick fulfillment and a broad price-performance spectrum to cater to both enthusiasts and cost-conscious buyers.Across Europe, Middle East & Africa, regulatory heterogeneity and varying purchasing power influence product certification and distribution decisions, with an emphasis on safety standards and cross-border logistics. The region's fragmented retail environment rewards local partnerships and targeted certification strategies. In Asia-Pacific, dense manufacturing ecosystems, proximity to component suppliers, and robust mobile gaming communities create fertile ground for both high-volume portable coolers and more technically ambitious liquid or phase change systems. This region also leads in rapid product iteration cycles and localized customization. Taken together, these regional characteristics necessitate differentiated product roadmaps, pricing strategies, and channel investments to match local buyer expectations and operational realities.

Competitive and innovation dynamics showing how intellectual property, supplier partnerships, and manufacturing proximity determine market positioning and speed to market

Competitive dynamics among established manufacturers, component suppliers, and emerging niche entrants reflect intensive focus on intellectual property, manufacturing scale, and strategic partnerships. Leading firms are investing in proprietary thermal interface materials, compact blower designs, and integration methods that simplify installation and enhance user experience. Concurrently, component specialists are advancing fan motor efficiency, microfluidic channels, and durable phase change materials that improve longevity under repeated thermal cycling.New market entrants often compete on novel form factors or by bundling complementary services such as firmware-driven fan control or app-based performance tuning. Partnerships between accessory makers and device OEMs have begun to emerge, enabling tighter mechanical and thermal integration in dedicated high-performance models. In addition, several companies are leveraging contract manufacturers located near component clusters to reduce lead times and enhance quality oversight. Across the competitive landscape, winners will be those that balance meaningful technological differentiation with manufacturing prudence and clear channel-value propositions.

Practical strategic and operational imperatives that combine modular engineering, material investment, and hybrid channel engagement to build resilient market leadership

Industry leaders should pursue a combination of technical, commercial, and operational actions to secure advantage in the evolving mobile phone cooler ecosystem. First, prioritize modular, serviceable designs that allow rapid substitution of components affected by trade policy or supply disruption, thereby reducing time-to-adapt without extensive redesign. Second, invest in thermal materials and control software that deliver measurable performance gains while maintaining manufacturability and cost discipline.Furthermore, expand channel strategies by combining online direct-to-consumer initiatives with selective offline retail partnerships to capture both discovery-driven and immediate-purchase demand. Strengthen supplier relationships through collaborative forecasting and joint risk-sharing agreements to stabilize lead times and margins. Finally, integrate user feedback loops from gamers, enterprise pilots, and consumer testers into iterative product development cycles to align technical performance with real-world usage patterns. Implementing these actions will create more resilient product portfolios and clearer value propositions for distinct end-user segments.

A rigorous mixed-methods research approach blending expert interviews, technical benchmarking, patent and trade analysis, and scenario planning to ensure robust insights

The research approach combined primary engagement with key industry participants and rigorous secondary analysis to produce evidence-based insights. Primary inputs included structured interviews with product engineers, procurement leads, channel managers, and end-users to capture diverse perspectives on thermal requirements, attachment mechanisms, and purchase drivers. These interviews were complemented by technical evaluations of sample devices and comparative benchmarking of noise, cooling capacity, and energy consumption under reproducible load profiles.Secondary analysis drew on public company disclosures, patent filings, trade shipment data, and regulatory documentation to validate supply chain movements, component innovations, and certification requirements. The methodology also incorporated scenario-based analyses to assess operational responses to tariff changes and supply disruptions. Data integrity was ensured through cross-validation across independent sources and iterative follow-ups with subject-matter experts to reconcile discrepancies and reinforce actionable conclusions.

A concise synthesis of implications and strategic priorities that frames thermal management as a cross-functional imperative for product, procurement, and channel leaders

In conclusion, mobile phone cooling has matured into a strategically important accessory category that intersects device performance, user experience, and supply chain resilience. Thermal management solutions now demand coordinated product engineering, channel strategies, and procurement practices that anticipate regulatory and tariff-driven shocks while delivering tangible performance benefits for end users. The most effective responses will combine technical rigor with commercial pragmatism, aligning material and manufacturing choices with targeted distribution and messaging.Looking ahead, stakeholders that adopt modular design principles, cultivate supplier redundancy, and invest in validated thermal technologies will be better positioned to navigate volatility and capture sustainable value. Importantly, clear segmentation by product type, cooling method, application, distribution channel, and end-user will enable more precise product-market fit and stronger commercial outcomes. This research provides the context and practical direction to help decision makers translate insight into action and to prioritize investments that deliver measurable improvements in product reliability, user satisfaction, and operational resilience.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Clip-on Mobile Phone Coolers

- Fixed Mobile Phone Coolers

- Phone Case Coolers

- Portable Mobile Phone Coolers

- Cooling Method

- Air Cooling

- Liquid Cooling

- Phase Change Cooling

- Vibration-based Cooling

- Application

- Gaming Phones

- High-performance Mobile Devices

- Smartphones

- Tablets

- Distribution Channel

- Offline Channel

- Online Channel

- End-User

- Businesses/Corporates

- Gamers & Tech Enthusiasts

- Individual Consumers

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Anker Innovations Technology Co., Ltd.

- ASUStek Computer Inc.

- Beijing Huaqi Information Digital Technology Co., Ltd.

- Black Shark Technology Co., Ltd.

- BlitzWolf

- Cooler Master Co., Ltd.

- Cubonic GmbH

- Flydigi Electronics Tech. Co., Ltd.,

- Ivy Air, LLC

- Kingston Technology Company, Inc.

- Lenovo Group Limited

- Lepow Technology Co., Ltd.

- Luna Technologies Co., Ltd.

- NexDock Inc.

- Nubia Technology Co., Ltd

- Pelham GmbH

- Razer Inc.

- Shenzhen Baseus Technology Co., Ltd

- Verilux by Bear Down Brands, LLC

- Volution Group plc

- Xiaomi Corporation

- Xtreme Technologies Co., Ltd.

- ZTE Corporation

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Mobilephone Cooler market report include:- Anker Innovations Technology Co., Ltd.

- ASUStek Computer Inc.

- Beijing Huaqi Information Digital Technology Co., Ltd.

- Black Shark Technology Co., Ltd.

- BlitzWolf

- Cooler Master Co., Ltd.

- Cubonic GmbH

- Flydigi Electronics Tech. Co., Ltd.,

- Ivy Air, LLC

- Kingston Technology Company, Inc.

- Lenovo Group Limited

- Lepow Technology Co., Ltd.

- Luna Technologies Co., Ltd.

- NexDock Inc.

- Nubia Technology Co., Ltd

- Pelham GmbH

- Razer Inc.

- Shenzhen Baseus Technology Co., Ltd

- Verilux by Bear Down Brands, LLC

- Volution Group plc

- Xiaomi Corporation

- Xtreme Technologies Co., Ltd.

- ZTE Corporation

Table Information

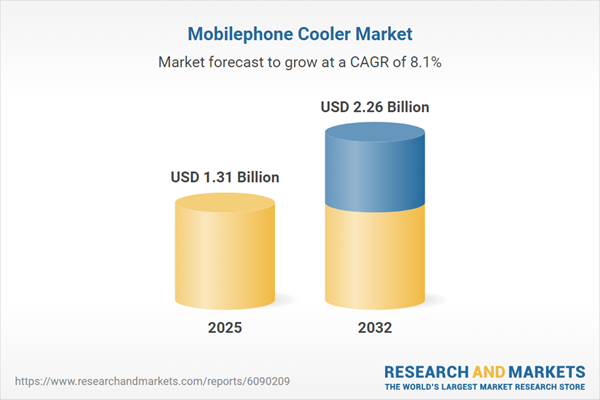

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.31 Billion |

| Forecasted Market Value ( USD | $ 2.26 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |