Speak directly to the analyst to clarify any post sales queries you may have.

The Financial Institutions Insurance Market is evolving rapidly, shaped by digital transformation, regulatory shifts, and growing complexity in risk management. Senior executives require actionable insights to navigate these developments and implement effective strategies.

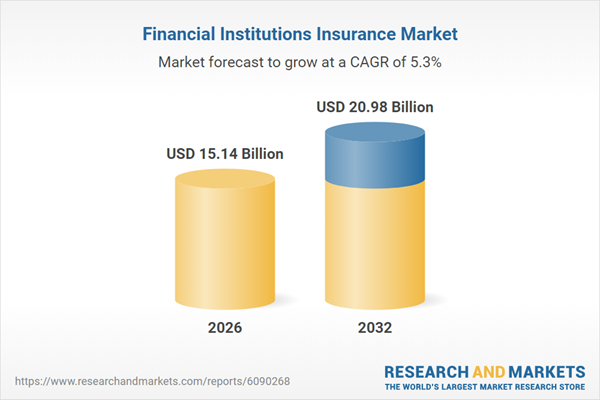

Market Snapshot: Financial Institutions Insurance Market

The Financial Institutions Insurance Market grew from USD 14.56 billion in 2025 to USD 15.14 billion in 2026. With a compound annual growth rate (CAGR) of 5.34%, the market is projected to reach USD 20.98 billion by 2032. This trajectory reflects heightened demand for tailored coverage as financial services providers respond to emerging risks and regulatory uncertainty.

Scope & Segmentation

- Product Types: Crime & Fraud Insurance, Cyber Insurance, Employment Practice Liability, Investment Management Insurance, Pension Trustee Liability Insurance, and Professional Indemnity Insurance.

- Policy Duration: Long-Term Policies, Short-Term Policies—with differing renewal and capital allocation dynamics.

- Distribution Channels: Bancassurance and Insurance Brokers, influencing accessibility and program complexity.

- End-User Archetypes: Asset & Wealth Management Firms, Banks & Lending Institutions, Fintech & Digital Banks, Insurance Companies—each with unique coverage and risk control requirements.

- Regional Coverage: Americas, Europe, Middle East & Africa, Asia-Pacific—each region characterized by distinct regulatory, technological, and litigation environments.

- Key Technologies: Cloud-native architectures, API ecosystems, artificial intelligence, and machine learning are actively reshaping underwriting and claims processes.

Key Takeaways for Decision-Makers

- Digital risk evolution, including cyber threats and third-party integrations, prompts underwriters to reassess aggregation, incident response, and operational resilience within financial institutions insurance portfolios.

- Global regulatory changes are demanding stricter oversight in policy wording, exclusions, and vendor risk management; this trend requires robust governance from both insurers and clients.

- InsurTech innovations and increased reliance on co-insurance and reinsurance are driving new product structures and influencing appetite for complex, layered coverages.

- Multi-channel distribution is growing in importance; bancassurance focuses on integrated client offerings, while brokers excel at complex, specialist placements.

- Capital management and scenario-based underwriting are increasingly critical for limiting accumulation risk, supporting pricing discipline, and addressing macroeconomic volatility.

- Regional variations impact the relevance and customization of financial institutions insurance products, with strong cyber, technology, and legal adaptation needs in specific markets.

Tariff Impact: Navigating 2025 Tariff Measures

Recent United States tariff measures have introduced operational uncertainties that ripple through credit markets, supply chains, and liability exposures for financial institutions. These changes challenge insurers to recalibrate loss severity assumptions in business interruption, trade credit, and supply chain policies. Furthermore, cross-border and regulatory complexities are heightened, requiring close evaluation of policy wording and contract enforceability under new trade conditions. The interplay between tariffs, currency fluctuation, and investment flows adds another dimension to liability management for both insurers and institutional buyers.

Methodology & Data Sources

This analysis is grounded in practitioner interviews, regulatory document reviews, and scenario-based stress testing. Insights were validated through collaboration with senior underwriters, risk officers, brokers, and legal counsel, plus examination of supervisory guidance and claims precedents. This mixed-methods approach ensures recommendations reflect market realities and the evolving landscape for institutional insurance.

Why This Report Matters

- Enables risk leaders and strategy teams to anticipate structural trends and adapt underwriting or policy development in line with global and regional drivers.

- Helps executive teams identify growth segments, refine client engagement, and differentiate their offerings by leveraging analytical and risk-engineering capabilities.

- Supports resilience and continuity by aligning product design, partner collaboration, and distribution innovation with the complex needs of institutional buyers.

Conclusion

The Financial Institutions Insurance Market continues to be redefined by digital, regulatory, and external pressures. Organizations that proactively align data-driven underwriting, clear policy design, and collaborative risk strategies will be best placed to enhance both resilience and competitive positioning in this sector.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

- Allianz SE

- American International Group, Inc.

- Arch Capital Group Ltd.

- Aspen Insurance Holdings Limited

- AXA XL

- AXIS Capital Group

- Beazley Plc

- Berkshire Hathaway European Insurance DAC

- Chubb Group of Insurance Companies

- CNA Financial Corporation

- HCC Insurance Holdings, Inc.

- Hiscox Ltd

- Liberty Mutual Insurance Company

- Markel Group Inc.

- Old Republic Professional Liability, Inc.

- QBE Holdings, Inc.

- RLI Corp.

- Sompo International Holdings Ltd.

- The Hartford Insurance Group, Inc.

- The Travelers Companies, Inc.

- W.R. Berkley Corporation.

- Zurich Insurance Company Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 15.14 Billion |

| Forecasted Market Value ( USD | $ 20.98 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |