Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Foundations of Calcium Hydroxylapatite Fillers in Aesthetic and Medical Applications Revolutionizing Tissue Regeneration and Patient Outcomes

Calcium hydroxylapatite fillers have emerged as a versatile biocompatible solution for restoring volume, enhancing facial contours, and stimulating endogenous collagen synthesis. As a synthetic analogue of the mineral component found in human bone, this advanced filler diverges from traditional hyaluronic acid and collagen-based products by offering both immediate volumetric correction and long-term tissue remodeling. Initially embraced by aesthetic practitioners, the clinical applications have since extended into dental procedures, maxillofacial surgery, and orthopedic reconstruction, reflecting its broad therapeutic potential.Advances in formulation science have optimized particle size distribution and carrier gel composition, enhancing injectability and reducing post-procedure discomfort. Regulatory approvals across major markets have underscored its safety profile and reinforced physician confidence. Concurrently, patient preferences for minimally invasive treatments with durable outcomes have driven greater adoption, making calcium hydroxylapatite a mainstay in modern aesthetic practices.

Looking ahead, continued collaboration between material scientists, clinicians, and regulatory bodies is poised to unlock further applications. From targeted facial volumization to structural bone grafting, the foundation for sustained growth is firmly established, setting the stage for dynamic shifts in clinical protocols and market strategies.

Mapping the Paradigm Shift in Calcium Hydroxylapatite Filler Technology and Practice as Patient Demand and Regulatory Dynamics Reshape Industry Standards

The landscape of calcium hydroxylapatite fillers has undergone profound transformation as regulatory landscapes evolve and patient expectations shift toward personalized treatments. Innovations in biocompatible carrier gels and microsphere formulations have deepened the therapeutic versatility of these products, enabling practitioners to tailor volumetric correction strategies with unprecedented precision. Meanwhile, digital imaging technologies and three-dimensional treatment planning have become critical tools, facilitating reproducible outcomes and elevating practitioner confidence in complex procedures.At the same time, an increasing emphasis on safety has prompted collaboration with professional societies to standardize injection techniques and complication management protocols. These efforts coincide with a surge in cross-disciplinary training, where aesthetic medicine intersects with dental and orthopedic practices to deliver holistic patient care. The confluence of scientific advancements and clinician expertise is transforming calcium hydroxylapatite from a niche aesthetic solution into a broadly applied regenerative tool.

Furthermore, shifting demographic trends and the growing accessibility of aesthetic treatments in emerging markets are reshaping competitive dynamics. As new entrants push for differentiation through specialty applications and proprietary delivery systems, established manufacturers are consolidating their positions by expanding global manufacturing footprints and forging strategic partnerships. Together, these dynamics signal a maturation of the market where innovation, regulation, and education coalesce to define the next generation of filler technologies.

Assessing the Ripple Effects of United States Tariffs on Calcium Hydroxylapatite Fillers in 2025 and Their Influence on Global Supply Chains and Pricing

The imposition of new United States tariffs in 2025 on medical device components has created a ripple effect throughout the calcium hydroxylapatite filler supply chain. Manufacturers that rely on imported raw materials are reassessing cost structures, with several electing to diversify sourcing strategies or explore domestic production capabilities. These adjustments have realigned relationships with key suppliers and prompted negotiations with distributors to mitigate downstream pricing impacts.Practitioners and purchasing managers have responded to cost pressures by scrutinizing value propositions, seeking clear evidence of long-term outcomes and safety benefits. In turn, some manufacturers have introduced tiered product lines or explored alternative packaging formats to preserve accessibility while protecting profitability. Longer lead times and inventory management challenges have also underscored the importance of supply chain visibility and agility, encouraging investment in digital tracking and demand forecasting tools.

Over the medium term, the tariff-driven environment may accelerate the formation of regional manufacturing clusters, reducing exposure to cross-border trade fluctuations. Collaborations between local component suppliers and global filler companies are advancing to establish resilient ecosystems. As stakeholders adapt, the cumulative impact of these tariffs will likely influence strategic planning, drive innovation in cost-efficient formulations, and redefine competitive differentiation based on supply chain robustness and product value.

Illuminating Market Segmentation Insights into Formulation Application End User and Distribution Channel Trends for Calcium Hydroxylapatite Fillers

A nuanced segmentation of the calcium hydroxylapatite filler market reveals the interplay of formulation types, clinical applications, end users, and distribution pathways in shaping growth trajectories. Injectable suspension remains the preferred format for physicians valuing on-the-fly dosage adjustments and versatility across treatment areas. Meanwhile, prefilled syringe solutions have gained traction among high-volume practices focused on operational efficiency and consistency of administration.Clinical use cases span aesthetic medicine, where anti-aging treatments, dermal volumization, facial contouring, and lip augmentation command significant attention, to dental procedures emphasizing bone graft support and implantology. Beyond these, maxillofacial surgeries leverage the material's structural properties to reinforce bone defects, and a burgeoning portfolio of orthopedic solutions deploys microsphere-enhanced bone cements, robust bone reconstruction matrices, and innovative tissue engineering scaffolds.

Cosmetic surgery and dermatology clinics serve as primary points of adoption, driven by practitioner expertise and patient demand for minimally invasive interventions. Hospitals are integrating filler procedures into multidisciplinary care pathways, particularly in reconstructive scenarios. Supply chain channels reflect a diverse mix of offline pharmacies-both hospital dispensaries and retail outlets-and online pharmacies that cater to remote ordering and discreet delivery preferences. Together, these segmentation dimensions underscore a complex market ecosystem where targeted product development and channel optimization are paramount.

Deciphering Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Reveal Growth Catalysts and Market Drivers

Regional dynamics exert a profound influence on calcium hydroxylapatite filler adoption, as each major geography exhibits distinct drivers and barriers to growth. In the Americas, a well-developed aesthetic infrastructure, favorable reimbursement policies, and high consumer awareness have fostered early uptake. North American practitioners often lead in adopting next-generation formulations, while South American markets embrace injectable solutions that address diverse skin tones and body types.Across Europe, Middle East, and Africa, regulatory harmonization within the European Union has streamlined product approvals, boosting confidence among clinics and distributors. Eastern and southern European nations are notable for collaborative research initiatives, whereas the Middle East has seen rapid growth in medical tourism and high-volume aesthetic practices. In parts of Africa, infrastructure investments and partnerships with global firms are beginning to unlock new opportunities, despite ongoing logistical challenges.

Asia-Pacific represents the fastest-evolving landscape, characterized by a rising middle-class population, expanding medical tourism corridors, and local manufacturing innovations. Regulatory frameworks are maturing, with expedited pathways emerging in several nations. As demand for minimally invasive cosmetic and reconstructive procedures escalates, stakeholders are investing in practitioner training and localized marketing strategies. The convergence of demographic changes and healthcare modernization in this region suggests sustained momentum for years to come.

Uncovering Competitive Landscape Insights Revealing Strategic Moves Research Innovation and Partnerships Shaping Calcium Hydroxylapatite Filler Manufacturers

Leading manufacturers in the calcium hydroxylapatite filler space are differentiating through robust research investments, strategic alliances, and tailored product portfolios. Established players have accelerated pipeline development, seeking to refine microsphere uniformity and gel carrier properties to enhance injectability and longevity. Collaborative relationships with academic institutions and clinician stakeholders have fueled advancements in precision delivery systems and adjunctive therapy protocols.At the same time, niche innovators are carving out competitive advantage by focusing on specialized application segments such as dental bone grafting and orthopedic reconstruction. These companies often combine proprietary surface modification techniques with targeted training programs, equipping practitioners to navigate complex anatomical challenges. Partnerships between global corporations and regional distributors are expanding geographic reach, while some organizations are pursuing vertical integration to secure quality-controlled raw material sources.

The competitive landscape is further shaped by patent activity and regulatory filings, which signal future areas of differentiation and potential market entrants. Mergers and acquisitions continue to reshape the field, as larger entities seek to bolster their portfolios with complementary technologies. Overall, the interplay of innovation, collaboration, and strategic expansion underscores an industry in which agility and scientific rigor determine market leadership.

Actionable Strategies for Industry Leaders to Navigate Technological Innovations Regulatory Challenges Market Complexities in Calcium Hydroxylapatite Fillers

To capitalize on emerging opportunities and mitigate evolving challenges, industry leaders should pursue a multifaceted strategic agenda. First, diversifying supply chains by forging partnerships with regional raw material producers can reduce exposure to tariff fluctuations and logistical disruptions. Investing in localized manufacturing capabilities not only preserves margin but also deepens market responsiveness.Second, accelerating development of prefilled syringe formats and specialty formulations tailored to the needs of dental or orthopedic specialists will unlock new end-user segments. Concurrently, designing comprehensive training and certification programs in collaboration with professional societies will elevate practitioner proficiency and reinforce product confidence.

Third, harmonizing regulatory strategies across key markets and engaging proactively with health authorities will streamline approvals and expedite time to market. Digital transformation initiatives-ranging from e-commerce distribution platforms to supply chain analytics-can enhance customer experiences and operational transparency. Lastly, deploying targeted patient education campaigns that clearly articulate safety data, expected outcomes, and post-treatment care protocols will bolster adoption among discerning consumer segments. By aligning these actions with agile decision-making and continuous performance monitoring, organizations can secure sustainable growth in the dynamic calcium hydroxylapatite space.

Comprehensive Research Methodology Covering Data Sources Analytical Frameworks Interviews and Rigorous Quality Control for Calcium Hydroxylapatite Fillers

This study synthesizes insights from a rigorous research methodology designed to ensure comprehensive, credible findings. Initially, secondary research encompassed peer-reviewed journals, regulatory submissions, patent databases, and publicly available company disclosures. This broad literature foundation provided the technical context and historical perspective necessary for robust analysis.Primary research involved in-depth interviews with industry veterans, leading clinicians, distribution executives, and regulatory experts. These conversations yielded qualitative perspectives on product performance, adoption hurdles, and emerging clinical applications. Triangulation of primary input with secondary data validated key trends and competitive dynamics.

An analytical framework segmented the market by formulation type, application area, end user, and distribution channel, aligning with the complex ecosystem of calcium hydroxylapatite fillers. Each regional scenario was assessed through targeted surveys and expert consultations to capture local regulatory nuances and market maturity. Data quality assurance protocols, including cross-verification and iterative stakeholder reviews, underpinned the integrity of all conclusions. This layered approach ensures that the report's insights rest on a foundation of methodological rigor and transparent validation.

Conclusive Insights Synthesizing Key Findings Strategic Implications and Emerging Opportunities in Calcium Hydroxylapatite Filler Innovation and Adoption

The cumulative analysis underscores that calcium hydroxylapatite fillers occupy a distinctly multifaceted role at the intersection of aesthetics, reconstructive medicine, and orthopedic innovation. Key findings reveal a technology that continues to evolve through formulation refinements, delivery system advances, and cross-disciplinary applications. Regional insights highlight the importance of tailored market approaches, as regulatory maturity and consumer preferences vary significantly across the Americas, EMEA, and Asia-Pacific.Segmentation analysis demonstrates that injectable suspensions sustain high clinical value, while prefilled syringes represent a fast-growing convenience-driven segment. Application diversity-from anti-aging interventions to bone graft and tissue engineering solutions-illustrates the material's inherent versatility. Competitive analysis shows that success hinges on sustained R&D investment, strategic partnerships, and supply chain resilience, particularly in response to evolving trade policies.

Strategically, industry leaders who embrace agile manufacturing, targeted product innovation, and proactive regulatory engagement will shape the next frontier of market growth. Equally, structured practitioner education and patient-centric communication will drive adoption and trust. In conclusion, the calcium hydroxylapatite filler landscape presents a dynamic blend of challenges and opportunities, where informed decision-making and strategic foresight are essential for long-term success.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Form

- Injectable Suspension

- Prefilled Syringe

- Application Area

- Aesthetic Medicine

- Anti Aging

- Dermal Volumization

- Facial Contouring

- Lip Augmentation

- Dental Procedures

- Bone Grafts

- Implantology

- Maxillofacial Surgery

- Orthopedic Solutions

- Bone Cements

- Bone Reconstruction

- Tissue Engineering

- Aesthetic Medicine

- End User

- Cosmetic Surgery Clinics

- Dermatology Clinics

- Hospitals

- Distribution Channel

- Offline Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Offline Pharmacies

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AbbVie Inc.

- CG Bio Co., Ltd

- CAM Bioceramics Inc.

- Cytophil Inc.

- Dermax Co., Ltd.

- Merck & Co., Inc.

- Merz Pharma GmbH & Co. KGaA

- Plasma Biotal Limited

- Thermo Fisher Scientific Inc.

- Dr. Korman Laboratories Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Calcium Hydroxylapatite Filler market report include:- AbbVie Inc.

- CG Bio Co., Ltd

- CAM Bioceramics Inc.

- Cytophil Inc.

- Dermax Co., Ltd.

- Merck & Co., Inc.

- Merz Pharma GmbH & Co. KGaA

- Plasma Biotal Limited

- Thermo Fisher Scientific Inc.

- Dr. Korman Laboratories Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

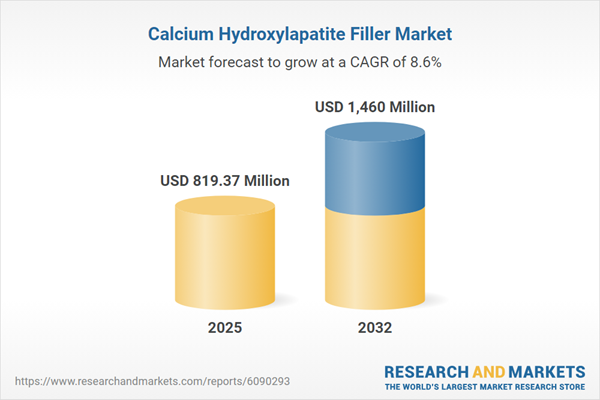

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 819.37 Million |

| Forecasted Market Value ( USD | $ 1460 Million |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |