Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for the Evolving Landscape of Long Wavelength Infrared Cameras and Core Modules with Strategic Perspectives

The realm of long wavelength infrared cameras and core modules has evolved into a strategic cornerstone for industries ranging from security to healthcare. As sensing technologies advance, the demand for high-performance detectors that operate in the thermal band has surged, driven by needs for precise temperature detection, improved imaging clarity, and robust environmental resilience. Recent breakthroughs in materials and integration techniques have opened new avenues for both cooled and uncooled detectors, reshaping expectations for performance, size, and power consumption.Amid this technological renaissance, stakeholders are navigating an increasingly complex ecosystem of camera components and core modules. Modular architectures enable scalable solutions across fixed-mount systems, handheld devices, and pan-tilt platforms, while spectral selectivity continues to target the unique demands of applications spanning industrial inspection to medical diagnostics. In this landscape of rapid innovation, clarity is vital; decision-makers require an in-depth comprehension of component interactions, supply chain dependencies, and emerging use-case priorities.

This executive summary offers a structured exploration of the factors transforming this market segment. Through an assessment of policy influences, segment-level insights, regional dynamics, and competitive positioning, forthcoming sections will equip leaders with the knowledge to anticipate shifts, optimize procurement strategies, and foster collaborations that unlock new growth trajectories. By grounding strategic planning in robust analysis, organizations can harness the full potential of long wavelength infrared imaging to establish sustained competitive advantage.

Uncovering the Critical Technological and Market Shifts Redefining Performance, Integration, and Applications in Infrared Imaging Across Industries

The market for long wavelength infrared imaging is undergoing profound technological and operational shifts as industry participants pursue greater sensitivity, reduced power consumption, and enhanced form factor integration. Innovations in microbolometer and pyroelectric detector designs have elevated performance benchmarks, enabling clearer imaging at higher frame rates and under challenging environmental conditions. Meanwhile, the maturation of cooled infrared modules has expanded their viability beyond defense applications, unlocking commercial opportunities in fields such as industrial automation and predictive maintenance.This transformative wave is also reflected in the adoption of novel materials and fabrication techniques that optimize thermal contrast while minimizing calibration requirements. System integrators are increasingly leveraging modular core designs, which facilitate seamless upgrades and tighter interoperability with artificial intelligence-driven analytics platforms. Consequently, the convergence of advanced signal processing, machine learning, and infrared imaging is redefining how anomalies are detected and addressed in real time.

Moreover, the proliferation of handheld and pan-tilt infrared platforms underscores a shift from fixed-installation use cases toward mobile and remotely monitored operations. As regulatory bodies emphasize safety and environmental standards, manufacturers are embedding wireless connectivity and edge-computing capabilities to support remote diagnostics and automated control loops. In this rapidly evolving context, companies that anticipate these shifts and align their R&D roadmaps accordingly will be well positioned to lead the next wave of market expansion.

Analyzing the Influence of United States Tariff Changes on Supply Chains, Procurement Strategies, and Cost Structures for Infrared Camera Components

In 2025, adjustments to United States tariff structures have introduced new considerations for procurement strategies within the infrared imaging ecosystem. Components such as infrared detectors, specialized lenses, and electronics subassemblies that originate from several international suppliers now incur modified duties, prompting a reevaluation of supply chain footprints and sourcing allocations. As a result, organizations are reconciling cost pressures with the imperative to maintain high standards of quality and performance.Procurement teams are increasingly exploring nearshoring alternatives and regional distribution hubs to mitigate lead time volatility and duty exposure. Concurrently, manufacturers are investing in domestic assembly capabilities and strategic partnerships to localize critical subcomponent production. This adaptive response extends to contract negotiations, where total landed cost analyses now factor in tariff scenarios alongside logistics and compliance overhead.

Over time, these dynamics are expected to influence supplier selection, design priorities, and capital investment decisions. Companies that proactively engage with tariff data and reconfigure their sourcing strategies can preserve margin integrity while ensuring uninterrupted access to advanced infrared camera modules. As the broader trade environment continues to shift, a nimble approach to supply chain optimization will remain essential for organizations seeking sustainable growth in the infrared imaging sector.

Illuminating Key Product, Technology, Spectral, Application, Component, and End-User Industry Dynamics Driving Infrared Camera Market Segmentation Decisions

Market segmentation in long wavelength infrared imaging unfolds along multiple dimensions, each revealing distinct patterns of equipment performance and end-use customization. Based on component distinctions, the market divides between cameras and core modules, reflecting the choice between integrated systems and modular units that serve as foundational elements for OEM designs. In terms of product type, offerings range from fixed-mount infrared cameras designed for static monitoring to handheld devices that enable portability, as well as pan-tilt platforms offering dynamic target tracking and remote orientation control.Technological segmentation further differentiates between cooled and uncooled infrared solutions. Cooled infrared detectors deliver higher sensitivity and faster response times, while uncooled variants relying on microbolometer arrays or pyroelectric detectors offer more compact, cost-effective implementations. Spectral range also directs product development, with imaging capabilities focused on the 3-5 micrometer band for applications requiring precise thermal contrast or on the 8-14 micrometer range optimized for broader temperature mapping and environmental sensing.

Beyond hardware distinctions, applications shape solution specifications across building inspection, industrial automation, medical imaging, and security and surveillance domains. Each use case imposes unique requirements on detector resolution, calibration stability, and integration with analytics software. Finally, end-user industries such as aerospace and defense, automotive and transportation, electronics and semiconductors, healthcare, and oil and gas articulate distinct priorities for performance, compliance, and lifecycle support. Together, these segmentation insights illuminate the nuanced decision criteria that guide technology selection and influence supplier value propositions.

Examining Regional Dynamics Shaping Demand, Innovation, and Adoption Rates for Infrared Imaging Solutions Across Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the adoption and development of infrared imaging solutions. In the Americas, robust investment in defense modernization programs and infrastructure resilience initiatives fuels demand for high-resolution detectors and integrated analytics platforms. The presence of leading semiconductor manufacturers also supports local production of microbolometer technologies, fostering a collaborative environment for research and early-stage innovation.Within Europe, the Middle East, and Africa, regulatory emphasis on environmental monitoring and public safety applications is driving uptake of portable and fixed infrared systems. This region’s diverse industrial base-from advanced manufacturing hubs to energy exploration operations-generates demand for specialized modules that can withstand harsh operating environments. Additionally, the push toward digital transformation in several EMEA markets has accelerated integration of infrared cameras with Industry 4.0 architectures.

Asia-Pacific stands as a dynamic growth engine for long wavelength infrared imaging, underpinned by rapid expansion in automotive and consumer electronics sectors. Investments in smart city initiatives and automated inspection solutions are catalyzing adoption of both cooled and uncooled systems. Also, collaborations between local research institutes and global technology providers are enhancing capabilities in microbolometer film deposition and high-speed readout electronics. Across these three regions, nuanced regulatory landscapes, industrial priorities, and innovation ecosystems collectively define the contours of market opportunity.

Profiling Leading Infrared Camera and Core Module Innovators to Illuminate Strategic Collaborations, Technological Leadership, and Market Positioning Trends

Leading companies in the long wavelength infrared camera and core module space are leveraging strategic alliances, technological acquisitions, and vertical integration to strengthen their market positions. Some industry frontrunners have distinguished themselves by mastering advanced cooling systems that support ultra-high sensitivity detectors, targeting defense and aerospace customers with rigorous detection requirements. In parallel, innovators in uncooled microbolometer development have driven cost efficiencies and miniaturization, making handheld and pan-tilt platforms increasingly accessible to commercial end-users.A subset of organizations is prioritizing software-defined functionality, embedding real-time image analytics and AI-driven detection algorithms directly within core modules. This integration not only enhances user experience but also fosters vendor lock-in through proprietary data formats and cloud connectivity frameworks. Conversely, companies with a focus on open architecture designs are building ecosystems of third-party application developers, expanding the breadth of use cases from industrial inspection to environmental monitoring.

Global supply chain optimization remains a recurring theme among top players. Strategic investments in manufacturing facilities across multiple continents, alongside partnerships with specialized optics and electronics suppliers, are enabling these firms to mitigate geopolitical risks and meet tightening delivery timelines. Collectively, these approaches underscore a dual focus on technological leadership and operational resilience as critical enablers of sustained competitive advantage.

Delivering Strategic Recommendations for Industry Leaders to Optimize Innovation, Supply Chains, Partnership Models, and Go-to-Market Strategies in Infrared Imaging

Industry leaders seeking to capitalize on emerging opportunities in long wavelength infrared imaging should focus on a multifaceted strategy that aligns research and development with supply chain agility. First, investing in modular architectures that support seamless upgrades and cross-platform interoperability will enable rapid response to evolving application requirements. Pairing this with collaborative R&D partnerships-both with material science institutes and software developers-will help to accelerate innovation cycles and reduce time to market.Simultaneously, diversifying manufacturing footprints across geographies can minimize exposure to tariff fluctuations and logistical disruptions. Organizations should explore nearshoring of critical component production and consider strategic alliances that reinforce localized capabilities. In tandem, embedding advanced analytics directly within core modules will differentiate offerings by providing actionable insights at the edge, reducing reliance on external processing and enhancing user autonomy.

Finally, cultivating an ecosystem of integrators and end-users through open application programming interfaces and developer support initiatives will broaden market reach. By balancing proprietary enhancements with collaborative extensibility, companies can simultaneously drive premium value and foster broader adoption across adjacent industries. This holistic focus on innovation, operational resilience, and partnership ecosystems will position industry leaders for sustained growth in a competitive landscape.

Detailing the Rigorous Research Methodology Underpinning Infrared Imaging Market Insights Including Data Collection, Validation, and Analytical Frameworks

The insights presented in this summary are underpinned by a rigorous research methodology designed to ensure accuracy, relevance, and depth. Primary research included structured interviews with executive-level stakeholders across manufacturing, system integration, and end-user organizations. These discussions provided firsthand perspectives on technology adoption, regional expansion plans, and supply chain optimization strategies.Secondary research drew on peer-reviewed academic publications, patent filings, and industry white papers to trace the evolution of detector materials, cooling mechanisms, and signal processing techniques. Regulatory filings and public procurement records supplemented this foundation by revealing policy trends and sourcing decisions across key geographies. Quantitative analyses of patent activity and investment flows further enriched the qualitative insights, highlighting areas of concentrated innovation.

Data validation employed triangulation techniques, cross-referencing findings from multiple sources to minimize bias and ensure coherence. An iterative review process with subject matter experts refined the segmentation frameworks and competitive assessments. The resulting analytical schema captures the multifaceted dynamics of the long wavelength infrared imaging market, offering stakeholders a comprehensive and defensible basis for strategic decision-making.

Synthesizing Key Insights on Infrared Camera Market Evolution to Support Informed Decision-Making and Strategic Planning for Industry Stakeholders

Drawing together the key findings, it is evident that long wavelength infrared cameras and core modules are at a transformative inflection point. Technological breakthroughs in detector materials and integration approaches are enhancing performance while diversifying application reach. Regulatory shifts and tariff realignments are introducing new complexities into procurement and supply chain management, underscoring the need for adaptability.Segmentation analyses reveal that distinct product types and technologies cater to a wide array of end-user requirements, from high-sensitivity defense applications to cost-effective industrial inspection solutions. Similarly, regional variations in regulatory frameworks and innovation ecosystems demand tailored market strategies. Leading companies are responding with a blend of proprietary ecosystem development, strategic partnerships, and global manufacturing footprints to maintain competitive resilience.

Industry stakeholders equipped with these insights can navigate evolving market conditions with greater confidence. By aligning strategic planning with robust research, organizations will be better positioned to harness emerging opportunities, mitigate risks, and drive sustainable growth in the rapidly advancing domain of long wavelength infrared imaging.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Component

- Cameras

- Core Modules

- Product Type

- Fixed-Mount Infrared Cameras

- Handheld Infrared Cameras

- Pan-Tilt Infrared Cameras

- Technology

- Cooled Infrared

- Uncooled Infrared

- Microbolometers

- Pyroelectric Detectors

- Spectral Range

- 3-5 Micrometers

- 8-14 Micrometers

- Application

- Building Inspection

- Industrial Automation

- Medical Imaging

- Security & Surveillance

- End-User Industry

- Aerospace & Defense

- Automotive & Transportation

- Electronics & Semiconductors

- Healthcare

- Oil & Gas

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Axiom Optics Inc.

- BAE Systems PLC

- Excelitas Technologies Corp.

- Exosens S.A.

- FLIR Systems by Teledyne Technologies Incorporated

- HGH Infrared Systems SAS

- Hikvision Digital Technology Co., Ltd.

- InfraTec GmbH

- IRay Technology Co., Ltd.

- L3Harris Technologies Inc.

- Leonardo DRS Inc.

- Lockheed Martin Corporation

- Lynred

- Northrop Grumman Systems Corporation

- Opgal Optronic Industries Ltd.

- SATIR Europe (Ireland) Company Ltd.

- Seek Thermal, Inc.

- Sierra-Olympic Technologies, Inc.

- Testo SE & Co. KGaA

- Thermoteknix Systems Ltd.

- WUHAN GLOBAL SENSOR TECHNOLOGY CO,. LTD

- Wuhan Guide Infrared Co., Ltd.

- Yuneec International

- Zhejiang Dali Technology Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Long Wavelength Infrared Cameras & Core Modules market report include:- Axiom Optics Inc.

- BAE Systems PLC

- Excelitas Technologies Corp.

- Exosens S.A.

- FLIR Systems by Teledyne Technologies Incorporated

- HGH Infrared Systems SAS

- Hikvision Digital Technology Co., Ltd.

- InfraTec GmbH

- IRay Technology Co., Ltd.

- L3Harris Technologies Inc.

- Leonardo DRS Inc.

- Lockheed Martin Corporation

- Lynred

- Northrop Grumman Systems Corporation

- Opgal Optronic Industries Ltd.

- SATIR Europe (Ireland) Company Ltd.

- Seek Thermal, Inc.

- Sierra-Olympic Technologies, Inc.

- Testo SE & Co. KGaA

- Thermoteknix Systems Ltd.

- WUHAN GLOBAL SENSOR TECHNOLOGY CO,. LTD

- Wuhan Guide Infrared Co., Ltd.

- Yuneec International

- Zhejiang Dali Technology Co., Ltd.

Table Information

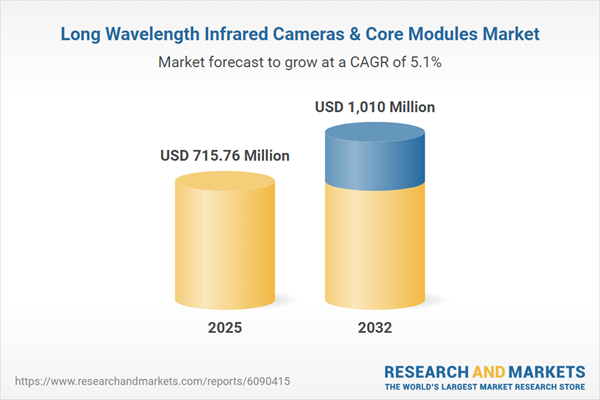

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 715.76 Million |

| Forecasted Market Value ( USD | $ 1010 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |