The transition to liquefied hydrogen is extending beyond industrial operations and making strong inroads into mobility, energy storage, and distributed power generation. Worldwide government initiatives are accelerating the momentum, offering subsidies and policy incentives to adopt greener technologies. Tightening emission regulations are making hydrogen solutions increasingly attractive across transportation, power generation, and heavy industry. Liquefied hydrogen storage is gaining strong traction in these fast-evolving applications, setting the stage for long-term, sustainable energy solutions that align with global climate targets.

The industrial sector accounted for a dominant 63.8% share in 2024 as sectors like chemicals, refineries, and high-heat manufacturing integrate hydrogen to phase out fossil-based fuels. Liquefied hydrogen remains the preferred choice due to its higher energy density, making it ideal for large-scale storage and high-efficiency operations. The growing need for high-capacity, long-range energy storage is also making liquefied hydrogen a game-changer for transportation systems focused on zero-emission performance. Its ability to deliver extended energy outputs within compact storage frameworks is critical as industries tackle space and efficiency constraints. As the expansion of intermittent renewable energy sources accelerates, hydrogen’s role in balancing supply and demand is becoming even more vital to ensuring grid stability.

The United States Liquefied Hydrogen Storage Market reached USD 446.7 million in 2024, fueled by robust investment in hydrogen infrastructure, especially in fueling stations and large storage projects. Advanced manufacturing capabilities and the growing electric and hydrogen vehicle industries are propelling demand. Federal initiatives, including those led by the Department of Energy, are aggressively supporting R&D efforts to enhance storage scalability and reliability for the future.

To stay competitive, companies like FuelCell Energy, Cockerill Jingli, ITM Power, SSE, Air Products and Chemicals, ENGIE, Linde, McPhy Energy, Air Liquide, Gravitricity, GKN, and Nel are doubling down on innovation and strategic partnerships. Key strategies include expanding production capacities, advancing cryogenic insulation technologies, investing in long-term research, and forming collaborative ventures to fast-track deployment and product diversification. Active participation in government-backed programs is also helping these players secure funding and build early-mover advantages across emerging markets.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this liquefied hydrogen storage market report include:- Air Liquide

- Air Products and Chemicals

- Cockerill Jingli

- ENGIE

- FuelCell Energy

- GKN

- Gravitricity

- ITM Power

- Linde

- McPhy Energy

- Nel

- SSE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | April 2025 |

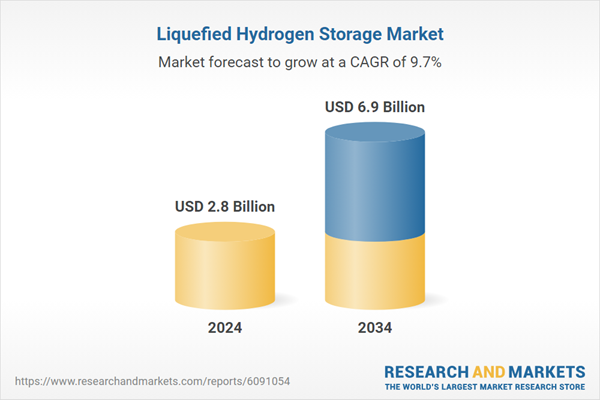

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 6.9 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |