With digital transformation accelerating, organizations are facing newer, more complex threats stemming from cloud integration, AI deployment, and real-time data processing. These shifts are prompting enterprises to invest heavily in predictive and responsive risk management strategies that can navigate high levels of operational uncertainty. Legislative authorities and global regulators continue tightening compliance and risk disclosure mandates, leading to the widespread adoption of enterprise-wide risk frameworks. Disclosure requirements around cybersecurity, climate risks, and governance reporting are now critical business imperatives, forcing organizations to rethink how they embed risk into daily workflows. Risk solutions are moving far beyond traditional auditing and evolving into agile, intelligence-driven platforms that support real-time insights, operational resilience, and performance continuity. As hybrid work models solidify and decentralized IT infrastructures expand, the market is redefining how risk is monitored, mitigated, and forecasted, with a clear focus on building resilience, adaptability, and real-time scenario modeling.

In 2024, the solutions segment accounted for a 68% share of the global risk management market and is projected to maintain strong growth with a CAGR of 14.7% through 2034. The broad adoption of risk management solutions stems from their ability to manage a wide range of risks, from governance and cybersecurity to regulatory compliance and operational threats. Integrated platforms are especially favored in industries like finance and manufacturing due to their ability to automate monitoring, ensure regulatory adherence, and adapt quickly to evolving industry-specific risks. The holistic approach these solutions offer has made them indispensable for companies aiming to protect their operations against today’s dynamic challenges.

Cloud-based deployment models captured a 64% market share in 2024, reflecting organizations’ preference for scalable and flexible systems. As remote and hybrid work environments become standard, cloud platforms enable seamless access, real-time risk visualization, and rapid adaptability. Their agility is particularly critical in highly regulated sectors like finance, healthcare, and manufacturing, where compliance demands are stringent and continuously evolving. Cloud-based systems now play a central role in helping enterprises improve response times, mitigate dynamic risks, and sustain business continuity.

The U.S. Risk Management Market generated USD 3.98 billion in 2024, supported by a robust digital infrastructure, a complex regulatory landscape, and strong prioritization of data privacy and operational transparency. Federal policies governing financial reporting, cybersecurity, and infrastructure protection continue to drive widespread adoption of advanced risk management practices. Organizations across the U.S. are integrating sophisticated frameworks that enhance compliance, strengthen cybersecurity defenses, and elevate operational governance, making the country a powerhouse of innovation in the global risk management sector.

Top players in the Global Risk Management Market include NAVEX Global, Riskonnect, BitSight, ServiceNow, Moody’s, Microsoft, IBM, LogicGate, Fiserv, and FIS Global. Companies are focusing on AI-enabled analytics, end-to-end ERP integrations, automated compliance tracking, expanding cloud-native capabilities, and strengthening data visualization tools. Investment in cross-domain interoperability is another strategic priority, helping enterprises stay aligned with evolving risk regulations and enhancing decision-making accuracy and business resilience.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this risk management market report include:- BitSight

- FIS Global

- Fiserv, Inc.

- Genpact

- IBM Corporation

- LogicGate

- LogicManager

- MetricStream

- Microsoft

- Moody's

- Navex Global

- OneTrust

- ProcessUnity

- Protiviti

- Rapid7

- Resolver

- Riskonnect

- RiskWatch

- SecurityScorecard

- ServiceNow

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2025 |

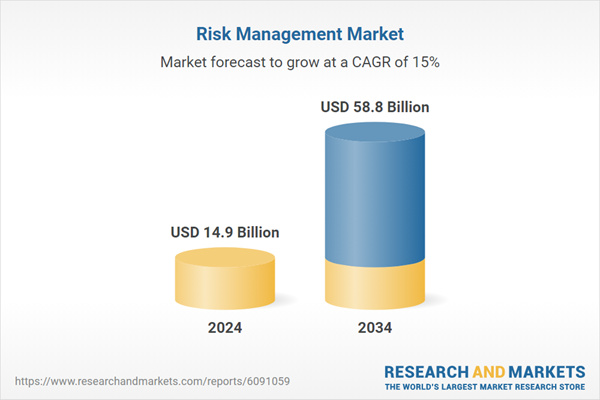

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 14.9 Billion |

| Forecasted Market Value ( USD | $ 58.8 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |