Military forces worldwide are focusing on faster deployment and more secure infrastructure, supporting the sustained demand for these solutions. Political trade decisions in recent years, such as tariffs affecting raw materials like steel, aluminum, and specialized fabrics, disrupted traditional supply chains and drove up costs. However, this shift also prompted a move toward domestic or untariffed sourcing, creating a new supply dynamic that further shapes market resilience.

The tents segment was valued at USD 476.2 million in 2024. Tents are preferred for their flexibility in tactical missions and emergency response scenarios, including field-based medical care, operational command posts, and temporary shelters. Their usage continues to grow due to the need for portable, durable, and quick-to-install structures in conflict zones and crisis environments. Modern military-grade tents now feature advanced textile technologies like UV resistance, infrared-blocking layers, fire retardancy, and blackout linings. These innovations significantly improve stealth and environmental protection, meeting the demands of both defense and civil agencies.

The fabrics segment generated USD 513.7 million in 2024. Military operations now demand lightweight, durable materials to optimize shelter deployment efficiency. Enhanced textile solutions such as ripstop, flame-resistant, and infrared-reflective fabrics are being widely adopted. These materials offer both resilience in rough terrains and superior concealment capabilities, aligning with modern combat and emergency support strategies. As mobility and tactical responsiveness remain critical, the need for high-performance fabrics continues to grow.

United States Deployable Military Shelters Market was valued at USD 311.2 million in 2024. Its growing international military presence and the operational needs of specialized forces are key factors driving market growth. Units such as quick response teams and support divisions require mobile, mission-ready infrastructure that can be rapidly deployed in the field. Domestically, agencies involved in disaster response have also accelerated the adoption of deployable shelters. The integration of these structures into emergency frameworks for handling events like hurricanes and earthquakes highlights their increasing utility beyond defense.

Major companies influencing the Deployable Military Shelters Industry include Sprung Structures, AAR, Weatherhaven Global Resources, Western Shelter Systems, Litefighter Systems, CAMSS Shelters, Rubb Buildings, UTS Systems, Alaska Structures, General Dynamics, Camel Manufacturing, Rapid Deployable Systems, Losberger, HDT Global, Marshall Aerospace and Defense Group, Outdoor Venture, and Saab. These companies play a significant role in shaping market trends through innovation and global supply chain partnerships.

Leading companies in the deployable military shelters market are focusing on several key strategies to strengthen their market presence. Many are expanding product lines by introducing modular and multifunctional shelter systems that support diverse mission needs. Innovation in lightweight and high-durability materials is central to improving portability and deployment speed. Firms are also entering strategic collaborations with defense departments and humanitarian organizations to secure long-term supply contracts.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- AAR

- Alaska Structures

- CAMSS Shelters

- Camel Manufacturing

- General Dynamics

- HDT Global

- Litefighter Systems

- Losberger

- Marshall Aerospace and Defense Group

- Outdoor Venture

- Rapid Deployable Systems

- Rubb Buildings

- Saab

- Sprung Structures

- UTS Systems

- Weatherhaven Global Resources

- Western Shelter Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

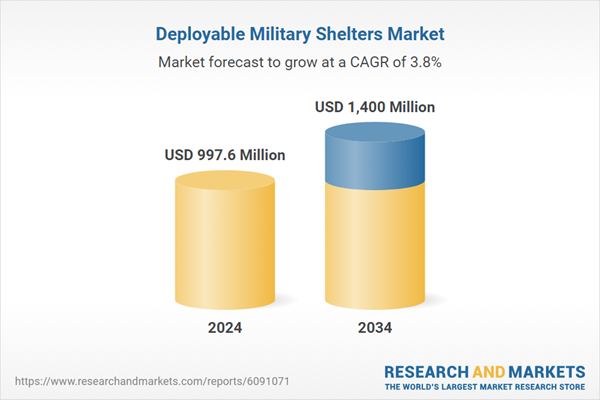

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 997.6 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |