As renewable energy adoption accelerates, the need for stable and efficient grid storage systems has never been greater, positioning LTO batteries as a critical component in modernizing global energy infrastructure. With governments implementing stricter carbon neutrality goals and industries focusing on decarbonization, the demand for high-performance, sustainable battery technologies is creating massive opportunities for LTO manufacturers. The growing emphasis on safety, longevity, and quick turnaround charging further boosts the appeal of LTO across sectors like aerospace, defense, and heavy-duty transportation. Market players are rapidly scaling production, investing in research, and forging strategic alliances to leverage the expanding commercial applications of LTO batteries.

Moreover, the automotive sector is playing a major role in driving the LTO market forward, especially with the rapid expansion of electric vehicle production. LTO batteries are increasingly seen as a reliable alternative in EV applications due to their fast-charging capabilities, excellent thermal stability, and extended life cycles, making them highly suitable for high-performance and commercial electric vehicles that demand consistent performance under rigorous conditions. As global automakers intensify their focus on decarbonization and sustainable innovation, LTO batteries are emerging as a practical solution for fleets, buses, and urban mobility platforms. Their ability to endure thousands of charge-discharge cycles with minimal degradation adds significant value by reducing long-term operational costs, aligning with both environmental and economic goals.

The LTO market is segmented based on grade and battery type. Nano powder LTO dominated the market in 2024, contributing USD 3.2 billion. The use of nanopowders improves the surface area-to-volume ratio of LTO batteries, enhancing their electrochemical properties such as capacity, cycle stability, and charge/discharge rates. Improved conductivity and uniform particle size distribution make nanopowders an ideal material choice for energy storage systems and electric vehicles.

The market is also categorized by battery type, with lithium-ion batteries holding the largest share. In 2024, the lithium-ion battery segment accounted for USD 2.9 billion, representing a 59.6% share. While LTO batteries excel in safety, longevity, and fast charging, their lower energy density and higher cost compared to conventional lithium-ion batteries limit widespread adoption. However, their demand continues to rise due to their distinct advantages.

The U.S. Lithium Titanium Oxide Market reached USD 864.3 million in 2024, propelled by rising demand for high-performance energy storage across industries. LTO batteries are gaining strong traction due to their outstanding reliability, safety, and ability to operate under extreme temperatures, making them ideal for the automotive, aerospace, and renewable energy sectors.

Key players in the Global Lithium Titanium Oxide Industry include BTR New Material Group, NEI Corporation, Microvast Holdings, Ossila, and SAT Nano Technology Material. These companies are continuously innovating manufacturing processes, enhancing application technologies, expanding R&D investments, and forging strategic partnerships to strengthen their position in the rapidly growing LTO market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this lithium titanium oxide market report include:- BTR New Material Group

- Microvast Holdings

- NEI Corporation

- Ossila

- SAT Nano Technology Material

- Stanford Advanced Materials

- Tokyo Chemical Industry India

- Xiamen AOT Electronics Technology

- Xiamen TOB New Energy Technology

- Xiamen Tmax Battery Equipments

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 263 |

| Published | April 2025 |

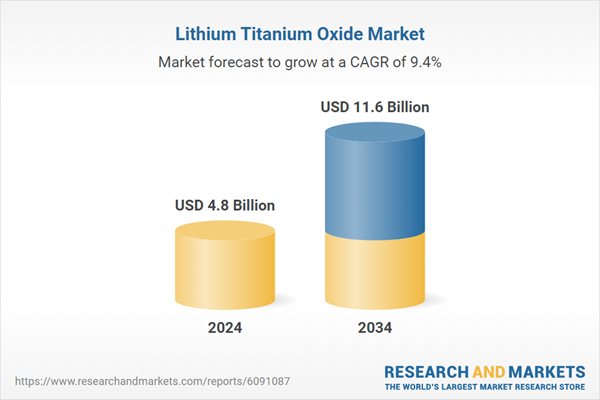

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.8 Billion |

| Forecasted Market Value ( USD | $ 11.6 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |