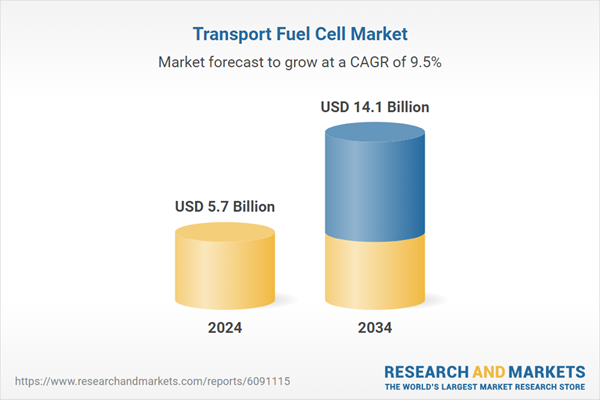

This growth trajectory is fueled by the rising push for decarbonization and clean energy adoption across global transportation networks. Enhanced performance metrics in modern fuel cell systems, such as improved durability, cost optimization, and better efficiency, are making them a preferred solution in various transport applications. As hydrogen infrastructure continues to mature and national hydrogen targets are being rolled out by leading economies, the viability of fuel cells is expanding rapidly. Government mandates focused on slashing emissions across the mobility sector are prompting a large-scale shift toward zero-emission solutions, where fuel cells offer a strong alternative, particularly for heavy-duty, long-haul, and off-grid applications. These systems generate electricity to power electric motors, eliminating tailpipe emissions while delivering consistent output performance like combustion engines. Despite clear momentum, the market still contends with high upfront capital costs, operational reliability issues in extreme conditions, and underdeveloped hydrogen logistics, particularly in less mature regions. However, ongoing investment and public-private partnerships are working to mitigate these constraints and enhance global accessibility.

The railway segment will grow at a CAGR of 9.5% through 2034, driven by the increasing use of fuel cells in both passenger and freight transport. These fuel cell-powered trains enable emission-free operations on rail networks lacking electrification, minimizing infrastructure costs and offering lower maintenance and quieter service. The technology is proving especially attractive in countries with vast rail networks needing sustainable retrofitting.

The fuel cells in the 200 kW to 1 MW capacity segment held a 34.7% share in 2024 and are projected to grow at an 8.5% CAGR through 2034. This power band is ideally suited for medium-duty commercial fleets, freight locomotives, and mid-sized marine vessels. It strikes a balance between energy output, system complexity, and cost, making it optimal for many real-world transport applications.

Europe Transport Fuel Cell Market is expected to reach USD 3 billion by 2034, influenced by the European Green Deal and heavy investment in hydrogen infrastructure. The region is witnessing strong deployment in rail applications and growing uptake in marine systems. Countries including Germany, Norway, and the Netherlands are actively shaping fuel cell transportation innovation, boosting overall product demand and infrastructure support.

Leading companies in the Global Transport Fuel Cell Market include Toyota Motor Corporation, Ballard Power Systems, Hyundai Motor Company, Honda Motor, BorgWarner Inc., Doosan Fuel Cell, Intelligent Energy Limited, ZF Friedrichshafen AG, Freudenberg, PowerCell Sweden, ElringKlinger, AISIN Corporation, Symbio, Nuvera Fuel Cells, Oorja Fuel Cells, AFC Energy PLC, Cummins, Wuhan Tiger Fuel Cell, Toshiba Corporation, and Nedstack Fuel Cell Technology. To strengthen their position in the transport fuel cell industry, key players are heavily investing in research and development to enhance the efficiency and lifecycle of their fuel cell systems. Many companies are forming partnerships with automotive and rail manufacturers to integrate their technologies into commercial vehicles and fleets. Several firms are scaling up production capacity and regional manufacturing hubs to support global demand and reduce supply chain friction.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Transport Fuel Cell market report include:- AISIN Corporation

- AFC Energy PLC

- BorgWarner Inc

- Ballard Power Systems

- Cummins

- Doosan Fuel Cell

- ElringKlinger

- Freudenberg

- Hyundai Motor Company

- Honda Motor

- Intelligent Energy Limited

- Nuvera Fuel Cells

- Nedstack Fuel Cell Technology

- PowerCell Sweden

- Oorja Fuel Cells

- Symbio

- Toyota Motor Corporation

- Toshiba Corporation

- Wuhan Tiger Fuel Cell

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 14.1 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |