The H-Series led the product segment and was valued at USD 984.4 million in 2024. This series is anticipated to witness a CAGR of 8.4% between 2025 and 2034. It remains the most commercially successful product line due to its strong combination of chemical resistance, corrosion protection, and wear durability. Its effectiveness has proven reliable across numerous industrial uses where both performance and appearance matter. The market comprises other product lines as well, such as the C-Series, Elite Series, Glacier Series, and Clear Coats, each developed to meet specific performance benchmarks in line with various application needs.

Cerakote coatings are classified based on substrate compatibility, with metals, polymers & plastics, composites, and wood serving as the primary material categories. Metals dominated the segment in 2024, accounting for 58.5% of the global market share. This dominance stems from the widespread use of metallic components in industries where environmental exposure, wear resistance, and longevity are essential. The coating’s superior adhesion to both ferrous and non-ferrous metals adds to its attractiveness in high-stress environments. Cerakote’s molecular bonding capability plays a significant role in reinforcing metals used in manufacturing and heavy-duty applications.

Polymers and plastics are typically coated with C-Series formulations, which cure at ambient temperatures to maintain the structural integrity of the base materials. In contrast, wood substrates benefit from the coating’s moisture resistance and scratch protection, especially in aesthetic-focused uses where surface design matters. These coatings offer more than just protection; they allow for creative customization without sacrificing material durability.

In terms of end-use industries, the defense and firearms sector emerged as the largest contributor, with a market value of USD 3.6 billion in 2024 and an expected CAGR of 6.7% through 2034. This segment represented 31% of the overall market, driven by growing demand for coatings that perform reliably under extreme conditions. The thermal stability and abrasion resistance of cerakote make it particularly suitable for tactical equipment and weaponry, where performance and surface integrity are critical.

Application methods in the cerakote market are primarily segmented into spray coating, heat curing, and air drying. Spray coating continues to lead due to its efficiency in producing even, thin layers, which is critical for applications where visual appeal and smooth finishes are essential. Heat curing is mainly applied in situations that demand peak durability and chemical resistance, whereas air drying is more appropriate for heat-sensitive substrates, including plastics, composites, and wood.

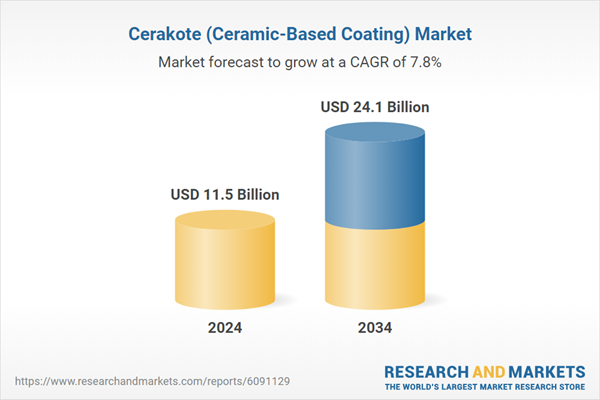

In 2024, the United States held a significant share of the global market, with a valuation of USD 2.02 billion. The domestic market is forecasted to grow at a 7.8% CAGR between 2025 and 2034. Increased demand from high-performance industries such as automotive, military, and consumer goods continues to boost growth. Customized aesthetic finishes and extended component lifecycles are key drivers for market expansion. Regulatory awareness around durable coatings and industry standards has also led to increased adoption of ceramic-based solutions.

The competitive environment is intensifying as leading manufacturers invest heavily in innovation, strategic collaborations, and expansion of global distribution networks. Top-tier companies are focusing on optimizing production techniques, maintaining consistency in product quality, and strengthening their presence across OEM and aftermarket channels. Key players are also prioritizing certifications, in-house testing capabilities, and technical services to build brand trust and customer loyalty. As demand for high-performance and visually appealing coatings grows, manufacturers are racing to meet expectations through advanced R&D and process development.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this cerakote (ceramic-based coating) market report include:- Arrow Finishing

- Cerakote

- KECO Coatings

- KOTEC Ceramic Coatings

- MSP Manufacturing

- Mueller Coatings

- NIC Industries

- Spectrum Coating

- Sun Coating Company

- Tanury Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 11.5 Billion |

| Forecasted Market Value ( USD | $ 24.1 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |