That said, the market still faces hurdles that can’t be ignored. Tariffs on imported raw materials and components, originally introduced under earlier U.S. trade policies, have led to a noticeable spike in production costs. Manufacturers are at a crossroads - either absorb the added costs, increase prices for consumers, or pivot to local suppliers to avoid high import duties. This shift has intensified the focus on optimizing supply chains, finding domestic or alternative raw material sources, and reevaluating supplier partnerships. On top of that, ongoing disruptions in international trade and logistics continue to test the resilience of inventory strategies. Companies are increasingly investing in agile inventory systems and diversifying sourcing methods to ensure stability. Innovation in material sourcing, automation, and operational efficiency has emerged as a critical differentiator in staying ahead of the competition and maintaining margins in a volatile market landscape.

In terms of product type, the caps segment led the global composite cardboard tube packaging market with a dominant 61% share in 2024. Their popularity is largely due to secure closure features that ensure product safety during shipping while maintaining ease of use for consumers. Lightweight caps also support cost-effective transportation and align well with sustainability goals by minimizing material usage. Additionally, brands are leveraging this format to enhance customer experience through tactile finishes, embossed logos, QR codes, and smart labeling technologies. The ability to blend functional security with high-end design elements gives caps an edge across multiple verticals - particularly in food, cosmetics, and personal care - where both protection and branding are equally critical.

Small-sized tubes measuring up to 4 inches are gaining traction as the fastest-growing segment, projected to expand at a CAGR of 6.8% through 2034. What is fueling this demand is the consumer shift toward compact, travel-friendly packaging options, especially in skincare, beauty, and on-the-go food products. These tubes are not only portable and user-friendly but also provide durability and a premium touch that elevates brand experience. As consumers seek packaging that combines minimalism with eco-conscious appeal, small tubes are delivering on both fronts - functionality and form.

The United States Composite Cardboard Tube Packaging Market is expected to reach USD 1.1 billion by 2034, driven by heightened awareness of sustainable packaging and a robust e-commerce ecosystem. Domestic manufacturers are stepping up by investing in recyclable, biodegradable tube innovations that meet regulatory benchmarks while enhancing shelf visibility. These new designs are helping brands cut down on transportation emissions by optimizing weight and volume and are boosting product safety with better structural design. As regulations around plastic usage become more stringent, businesses are gravitating toward cardboard tubes as a reliable, compliant, and brand-friendly solution.

Leading players such as Sonoco, Smurfit Kappa Group, Paper Tubes & Sales, Visican Ltd, and Marshall Paper Tube Co., Inc. are actively deploying strategies to strengthen their footprint in the market. These include embracing automated production lines to ramp up output and cut labor costs, partnering for secure raw material access, expanding product customization to serve niche markets, and integrating higher percentages of recycled content. To stay relevant and ahead, they are banking heavily on innovation - blending design, sustainability, and performance into a single packaging solution that resonates with both brands and end users.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this composite cardboard tube packaging market report include:- Ace Paper Tube Corp

- CBT Packaging

- Chicago Mailing Tube Co.

- Darpac P/L

- Hansen Packaging

- Heartland Products Group

- Marshall Paper Tube Co., Inc.

- Paper Tubes & Sales

- Smurfit Kappa Group

- Sonoco

- Valk Industries

- Visican Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2025 |

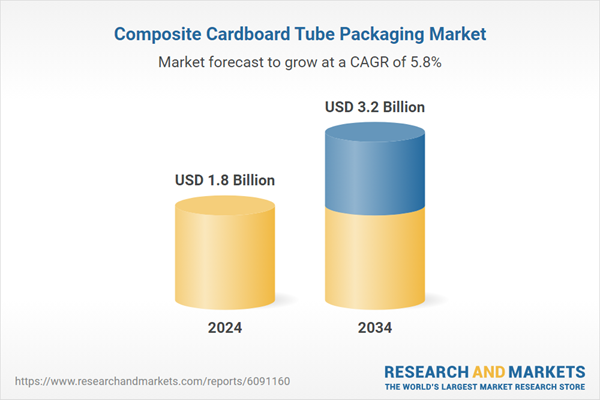

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |