Rising regulatory pressure on reducing plastic waste and promoting eco-friendly practices has become a key growth catalyst for the market. Many businesses are proactively shifting from rigid, heavy-duty formats to smarter, flexible options that can be easily customized and shipped at lower costs. Across emerging economies - especially in Asia-Pacific - these trends are even more pronounced, where the spike in online retail activity is accelerating demand for packaging that is both protective and economical. Flexible protective packaging formats such as bubble wraps, foam inserts, padded mailers, and air pillows are gaining traction because they offer strong cushioning with less material consumption. Their space-saving nature not only drives down logistics costs but also helps reduce carbon emissions during transportation.

Ongoing tariff policies introduced during earlier U.S. trade administrations have added cost pressures on domestic manufacturers relying on imported raw materials. These tariffs have prompted companies to rethink their supply chains, leading to a shift in sourcing strategies and investments in regional manufacturing hubs. In doing so, manufacturers are enhancing their resilience while optimizing cost-efficiency. Flexible protective packaging plays a vital role in this landscape - it helps reduce material usage, lowers dimensional shipping costs, and allows easy scalability across product lines, giving businesses a competitive edge in an evolving market.

Among material types, plastic continues to dominate the flexible protective packaging space, generating USD 4.8 billion in 2024. Common plastic resins such as polyethylene, polypropylene, and polystyrene remain popular due to their low cost, durability, and high impact resistance. These materials are extensively used in packaging solutions like air pillows, foam inserts, and bubble wraps, which are essential for protecting fragile items during long-haul shipments. With the rise of digital retail, particularly in sectors like consumer electronics and cosmetics, the demand for these lightweight, high-performance materials shows no signs of slowing down.

The foam wraps segment is projected to generate USD 5.6 billion by 2034, making it one of the fastest-growing areas in flexible protective packaging. Foam wraps are widely used due to their lightweight nature and strong cushioning properties, which are ideal for safeguarding delicate items during transit. These wraps effortlessly mold to irregular shapes, ensuring that items remain securely cushioned without adding excessive bulk. Industries handling precision equipment - such as medical devices, electronics, and luxury glassware - are increasingly depending on foam wraps to reduce the risk of breakage, returns, and customer dissatisfaction.

In the U.S., the flexible protective packaging market is forecasted to generate USD 5.2 billion by 2034, fueled by a strong e-commerce ecosystem and the nation's growing emphasis on sustainable packaging. As online shopping habits intensify, businesses are rapidly adopting biodegradable wraps, paper-based cushioning, and recyclable poly mailers to meet demand across industries such as food, pharmaceuticals, and consumer goods. These sectors require packaging solutions that not only protect product integrity but also align with eco-conscious values and compliance requirements.

To maintain a competitive edge, industry leaders like Amcor, Smurfit Kappa, Mondi, Sealed Air, and Pregis are heavily investing in R&D, sustainability innovation, and customized packaging systems. They are also expanding their regional manufacturing footprint to better serve omnichannel retail models and address complex logistics demands.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this flexible protective packaging market report include:- Sealed Air Corporation

- Pregis LLC

- Smurfit Kappa Group

- Amcor plc

- Mondi Group

- Huhtamaki Oyj

- Sonoco Products Company

- ProAmpac LLC

- Storopack Hans Reichenecker GmbH

- DS Smith Plc

- Winpak Ltd.

- Mondi Flexible Packaging

- Rengo Co., Ltd.

- AptarGroup, Inc.

- Toray Plastics (America), Inc.

- Schur Flexibles Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | April 2025 |

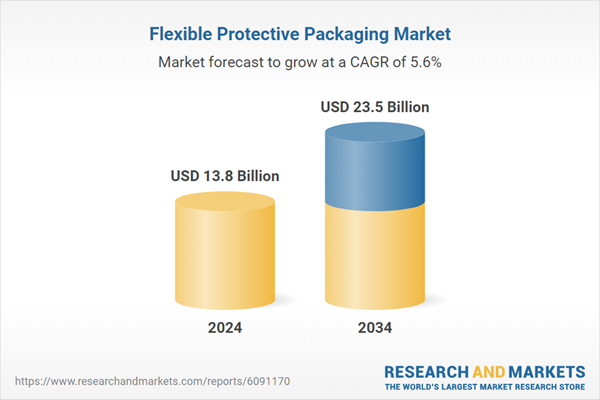

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 13.8 Billion |

| Forecasted Market Value ( USD | $ 23.5 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |