The growing demand for sustainable, lightweight, and easily recyclable materials is reshaping the competitive landscape, with packaging no longer seen as a cost factor but as a strategic brand asset. Increasing awareness around food safety, traceability, and the origin of ingredients further elevates the role of packaging. This shift has also created opportunities for smart packaging technologies, offering features such as QR codes and smart labels that empower consumers to make better-informed choices. As retailers and e-commerce platforms seek packaging that is visually appealing, functional, and environmentally responsible, formats like tetra packs and eco-friendly cartons are gaining widespread traction across both online and offline channels.

The milk packaging market is segmented by packaging type into bottles, cartons, pouches, cans, and others. The cartons segment remains the largest, valued at USD 15.6 billion in 2024. Its growth is fueled by rising consumer demand for aseptic packaging solutions that extend shelf life while utilizing sustainable materials such as renewable paperboard. Cartons are also space-efficient, cutting down on transportation costs and emissions, making them a greener alternative to traditional plastic options. They are especially preferred for premium and value-added milk products like lactose-free and fortified milk, where strong light and oxygen barrier properties are critical.

Based on material, the market is segmented into plastic, glass, metal, paperboard, and others. Plastic dominates the material segment, with a market value of USD 14.1 billion in 2024. Materials like HDPE and PET remain top choices for their lightweight structure, impact resistance, and superior ease of handling across long-distance logistics and e-commerce distribution. Features such as resealable caps and ergonomic designs enhance user convenience and minimize spoilage. A growing focus on recycling is pushing manufacturers toward using recycled plastics (rPET), addressing environmental concerns while maintaining functionality.

Germany Milk Packaging Market was valued at USD 2.3 billion in 2024, reflecting strong regulatory standards and heightened consumer preference for recyclable and biodegradable packaging. The growing trend of organic dairy consumption further drives demand for premium, sustainable packaging solutions. Technological innovations such as smart labels and enhanced barrier materials are making a tangible impact on shelf life and traceability.

Key players in the global market include Tetra Pak, SIG, Smurfit Kappa, WestRock, Sonoco Products, Elopak, Ecolean, Berry Global, CDF Corporation, and Alfipa. To stay competitive, these companies are heavily investing in sustainable packaging innovations, developing biodegradable composites, recyclable paperboards, and solutions tailored for e-commerce logistics. Research and development efforts are focused on extending shelf life, reducing environmental footprint, and offering customized packaging for niche markets such as organic and premium dairy segments, ultimately strengthening brand loyalty.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this milk packaging market report include:- Alfipa

- Berry Global

- CDF Corporation

- CKS Packaging

- Ecolean

- Elopak

- Global Polybags Industries

- IPI

- Jagannath Polymers

- Nippon Paper Industries

- Parksons Packaging

- SIG

- Smurfit Kappa

- Sonoco Products

- Stanpac

- Stora Enso

- Tetra Pak

- WestRock

Table Information

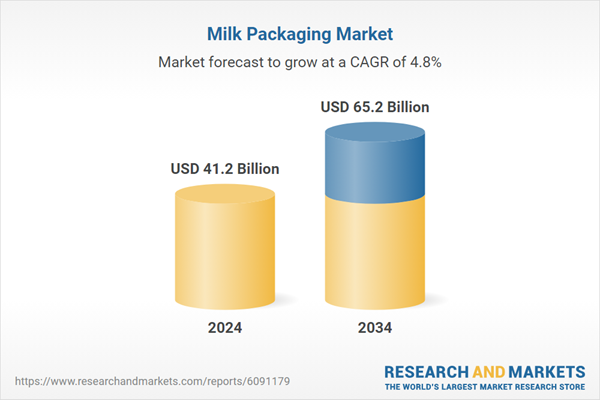

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 41.2 Billion |

| Forecasted Market Value ( USD | $ 65.2 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |