Flat rolled aluminum sheets and coils commanded a market size of USD 16.6 billion in 2024 and are expected to grow at a CAGR of 5.7% from 2025 to 2034. Their adaptability and economic feasibility make them a top choice across core industries, especially where durability, flexibility, and lightweight characteristics are valued for mass production. These materials are commonly favored due to their ease of handling and compatibility with multiple manufacturing processes.

Clad and anodized sheets continue to attract interest for applications requiring corrosion resistance, visual appeal, and surface durability. These aluminum variants are preferred in precision-demanding sectors and are prompting innovation in coating technologies and alloy compositions to improve surface integrity. Their increased adoption is intensifying competition in specialized product categories.

Textured variants like patterned, corrugated, and perforated aluminum sheets find relevance in aesthetic and industrial applications, reflecting a trend towards functional design that also enhances performance and structure. These types are gaining attention for their versatility in structural reinforcement and architectural detailing.

Among alloy types, the 3xxx series reached a valuation of USD 14.7 billion in 2024 and is forecasted to grow at a CAGR of 6.1% through 2034. This series, along with the 1xxx group, dominates market share due to its corrosion resistance, electrical conductivity, and cost-effectiveness. These grades are especially popular in sectors where functional performance and affordability are key factors, and producers are focused on maintaining high output efficiency and consistent quality while keeping costs competitive.

Meanwhile, the 5xxx and 6xxx series continue to find steady demand in sectors requiring high-strength, weldable aluminum, notably in infrastructure and heavy-duty applications. Higher-grade aluminum from the 2xxx, 7xxx, and 8xxx series fulfills the need for performance in technologically advanced markets, where durability and precision are crucial.

In terms of processing methods, the cold rolled aluminum segment held a market value of USD 17.6 billion in 2024 and is anticipated to grow at a CAGR of 6.4% through 2034. This category benefits from superior surface finish, tight tolerances, and enhanced mechanical properties, contributing to its extensive use across critical applications. While hot rolled variants are less precise, they are often chosen for their strength and reliability in demanding environments.

Aluminum sheets and coils used in the automotive sector accounted for USD 12.6 billion in 2024, representing a 24% market share and are poised to grow at 6.1% CAGR through the forecast period. These materials are integral in modern vehicle design, particularly for reducing vehicle weight and achieving better fuel efficiency. Their application spans structural components and energy storage systems, as manufacturers continue to incorporate more aluminum into mainstream vehicle architecture.

The building and construction industry also contributes significantly to demand, leveraging aluminum’s resilience, light weight, and aesthetic properties for structural, roofing, and insulation needs. In packaging and electronics, aluminum remains a reliable choice due to its safety, recyclability, and resistance to contamination. The global emphasis on recycling further enhances its value in consumer packaging applications.

In regional terms, China led the market with a valuation of USD 22.7 billion in 2024, and it is expected to expand at a CAGR of 5.9% through 2034. With high domestic demand and the world’s most extensive aluminum production capacity, China remains a dominant force. Meanwhile, the United States continues to register stable consumption patterns, bolstered by policy shifts supporting infrastructure development and energy transformation. However, both nations navigate complex global trade dynamics, which are shaping sourcing strategies and encouraging localized supply chains.

Major market participants include Alcoa Corporation, China Hongqiao Group, Rusal, Rio Tinto, and Norsk Hydro ASA. These companies are advancing production capabilities through low-emission technologies and strategic investments in sustainable aluminum manufacturing. Industry leaders are focusing on digital innovation, high-grade alloys, and expanding recycling operations to remain competitive in a rapidly evolving market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this aluminum sheets and coils market report include:- Alcoa Corporation

- Novelis Inc.

- Arconic Corporation

- Kaiser Aluminum

- Hindalco Industries

- Constellium SE

- UACJ Corporation

- Norsk Hydro ASA

- JW Aluminum

- Aleris Corporation

- Hindalco Industries Ltd.

- BALCO (Bharat Aluminium)

- China Hongqiao Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

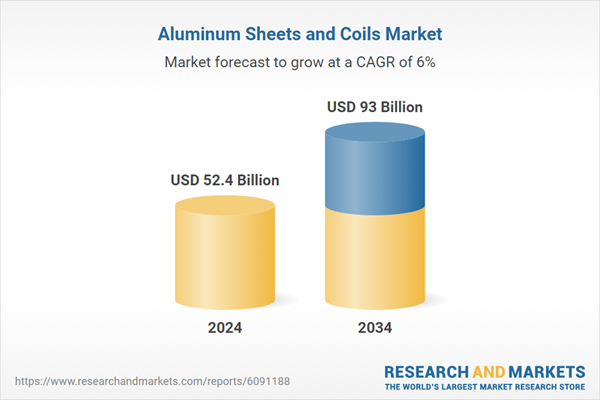

| Estimated Market Value ( USD | $ 52.4 Billion |

| Forecasted Market Value ( USD | $ 93 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |