Rising environmental concerns, tighter regulatory frameworks, and the urgent need for disaster-resilient infrastructure are further boosting market demand. Technological innovation is also reshaping the industry, with stakeholders seeking real-time, non-invasive survey methods that provide faster, safer, and more accurate results. As emerging economies ramp up urban development and resource exploration projects, the appetite for cost-effective and eco-conscious geophysical services is accelerating. Companies are investing heavily in AI-integrated solutions, mobile survey units, and remote sensing platforms to stay competitive in an evolving market that prioritizes speed, sustainability, and precision.

Governments worldwide are stepping up investments in resilient infrastructure and disaster mitigation, helping fuel consistent demand for advanced land based geophysical services. Customers today expect smarter survey technologies that deliver accurate insights without disrupting the environment. In emerging regions, traditional land exploration methods are increasingly unviable due to operational costs and environmental challenges, creating opportunities for innovative geophysical solutions. Players are responding with AI-powered platforms that meet evolving safety and sustainability standards while delivering real-time data for better decision-making.

Environmental stewardship is becoming a crucial factor, pushing stakeholders to prefer non-invasive, eco-friendly surveying methods for land reclamation, resource extraction, and environmental cleanup projects. In developing regions, operational hurdles and high exploration costs make geophysical services an attractive option for efficient mineral and energy resource identification. Shifts in government trade policies are also impacting equipment sourcing and service models, pushing providers to adopt cost-efficient, technology-driven strategies. The need for real-time, high-precision subsurface insights is driving a fundamental shift in how the industry approaches exploration and development.

The seismic segment is expected to reach USD 8.7 billion by 2034, supported by advancements in imaging resolution and the growing use of time-lapse seismic technologies. Seismic services remain the gold standard for high-definition subsurface data, critical to hydrocarbon exploration. Magnetic and electromagnetic surveys are gaining traction, especially in hard-to-reach mining areas where accurate geological mapping is essential.

The oil and gas sector dominated the end-use segment with a 52% share in 2024, where gravity and magnetic surveys continue to play a vital role in reducing drilling costs and improving exploration outcomes. Rising demand for critical minerals needed in electronics and renewable energy industries is also fueling greater adoption of geophysical services in mining applications.

The U.S. Land Based Geophysical Services Market stood at USD 2.7 billion in 2024, powered by major infrastructure investments and regulatory incentives promoting sustainable and electrified operations. Seismic refraction and ground-penetrating radar technologies are widely used for underground utility mapping and construction safety. In Canada, the push for non-invasive, environmentally sensitive survey methods is also gaining ground, particularly for natural resource assessment and environmental reclamation.

Key players defining the competitive landscape include CGG, Fugro, SLB, Getech Group, Abitibi Geophysics, Weatherford, TGS, PGS, Gardline, Ramboll Group, Dawson Geophysical Company, SAExploration, and Spectrum Geophysics. Companies are focusing on real-time data analytics, AI integration, and expanding into emerging markets to strengthen their positions. Strategic partnerships with energy and mining sectors, along with investments in sustainable survey methods, are becoming core growth strategies. Innovation in mobile survey units and remote sensing technologies is emerging as a major differentiator in a market driven by precision and speed.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this land-based geophysical services market report include:- Abitibi Geophysics

- CGG

- Dawson Geophysical Company

- Fugro

- Gardline

- Getech Group

- PGS

- Ramboll Group

- SAExploration

- SLB

- Spectrum Geophysics

- TGS

- Weatherford

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | April 2025 |

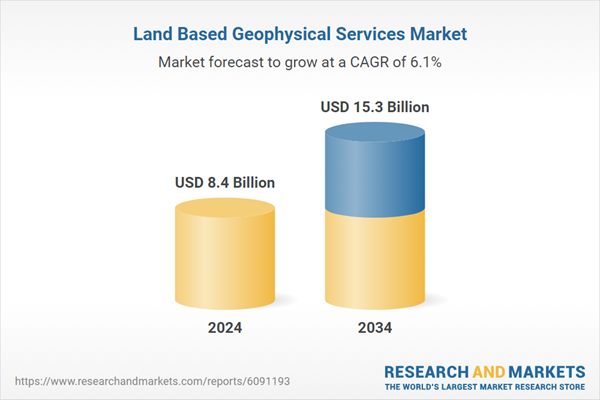

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 8.4 Billion |

| Forecasted Market Value ( USD | $ 15.3 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |