The push toward healthcare modernization, coupled with supportive reimbursement frameworks and an uptick in global research funding, is shaping a promising future for cardiac mapping technologies across both established and emerging economies. As hospitals increasingly prioritize precision medicine and personalized treatment plans, the demand for real-time cardiac diagnostics is accelerating. Healthcare systems are investing in cutting-edge electrophysiology labs, and governments are offering financial incentives to adopt minimally invasive procedures. At the same time, public and private funding bodies are channeling resources into research aimed at improving mapping accuracy, reducing procedural risks, and developing AI-powered mapping platforms.

In 2024, the mapping catheters segment held 74% share. This segment remains strong due to growing cases of complex heart rhythm disorders and the need for high-definition electroanatomical data during minimally invasive electrophysiological procedures. High-density and multi-electrode catheter systems are rapidly becoming the gold standard as they allow physicians to collect tens of thousands of data points within moments, offering unmatched detail and accuracy. These mapping solutions support the identification and treatment of atrial fibrillation and ventricular tachycardia by facilitating more targeted and efficient ablation.

The contact cardiac mapping segment generated USD 3 billion in 2024 and is forecasted to grow at a CAGR of 11.6% through 2034. These systems provide precise electrical and anatomical readings by maintaining continuous contact with cardiac tissue, producing exceptionally clear activation and voltage maps. This level of detail is particularly crucial in diagnosing and treating complex arrhythmias that often require pinpoint accuracy. Due to their superior signal quality, contact mapping tools are widely preferred in clinical electrophysiology. Furthermore, automated cardiac mapping systems capable of tracking electrical signals in real time are enabling clinicians to shorten procedures while improving success rates in ablation therapies by detecting problematic tissue with greater accuracy.

United States Cardiac Mapping Market generated USD 1.7 billion in 2024. The market is projected to grow at a CAGR of 10.6% from 2025 to 2034. The country benefits from a highly developed healthcare infrastructure, including specialized electrophysiology labs and cardiac centers outfitted with advanced mapping systems. Leading hospitals and academic research centers routinely perform complex ablation procedures with sophisticated technologies that enhance procedural accuracy and safety. A favorable reimbursement environment and wide insurance coverage for EP treatments support high procedure volumes and facilitate quicker technology adoption.

Key players shaping the competitive landscape in the Global Cardiac Mapping Market include Medtronic, Abbott Laboratories, Johnson & Johnson, Boston Scientific, Lepu Medical, Kardium, MicroPort Scientific, APN Health, and EnChannel Medical. These companies are actively contributing to market evolution through innovation and strategic initiatives. Major cardiac mapping firms are reinforcing their market standing through a combination of innovation, clinical partnerships, and geographic expansion. These companies are investing heavily in R&D to introduce next-generation catheters with enhanced electrode designs and faster signal acquisition capabilities. Collaborations with top-tier hospitals and academic institutions are enabling real-world testing of advanced electroanatomical mapping platforms. Many players are focusing on automation and AI-integrated software to improve data analysis during ablation procedures.

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Cardiac Mapping market report include:- Abbott Laboratories

- APN Health

- Boston Scientific

- EnChannel Medical

- Johnson & Johnson

- Kardium

- Lepu Medical

- Medtronic

- MicroPort Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | July 2025 |

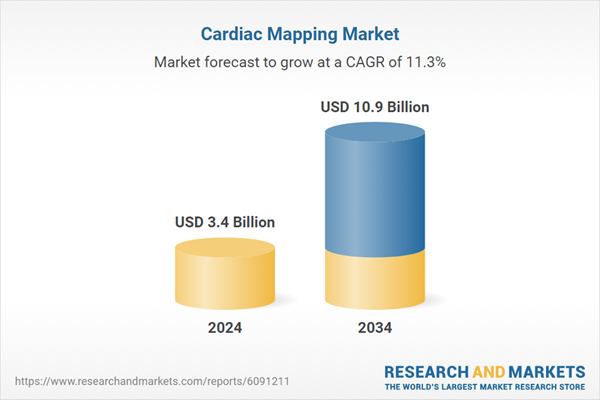

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 10.9 Billion |

| Compound Annual Growth Rate | 11.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |