The shift toward more innovative and robust packaging solutions is further supported by growing investments in cold chain logistics and an expanding global base of biologic drug consumers. Biopharmaceutical companies are responding by adopting high-performance materials that can endure extreme temperatures and maintain product efficacy from manufacturing sites to point-of-care delivery. Rising emphasis on sustainability is also influencing design choices. As healthcare providers and end users alike demand safer and greener options, packaging firms are accelerating the development of recyclable, biodegradable, and reusable solutions.

Trade policy shifts, especially the retaliatory tariffs placed on pharma-related imports, have added another layer of complexity to market dynamics. These tariffs are increasing raw material costs, particularly for high-grade plastics and pharmaceutical-grade glass sourced internationally. The resulting cost surge has made domestic manufacturing more expensive, which is impacting procurement strategies across the value chain. Companies are now exploring localized supply chains and alternative sourcing models to offset rising input costs while maintaining compliance and quality standards.

At the same time, technology is reshaping how biopharmaceutical products are packaged and monitored. Smart packaging formats are becoming a game changer, especially for temperature-sensitive biologics. Solutions integrated with RFID tags and sensors are enabling real-time tracking of critical parameters like temperature, humidity, and product integrity. These intelligent systems help minimize waste, reduce the risk of compromised products, and improve overall patient safety. As demand for precision in drug delivery and storage continues to grow, smart packaging is quickly moving from a luxury to a necessity in this high-stakes industry.

In 2024, biodegradable packaging materials accounted for 66.1% of the global market, underlining a decisive shift toward sustainability. This trend reflects not just a response to growing environmental awareness among consumers but also stronger regulatory pressure to phase out single-use plastics in pharmaceutical applications. Biodegradable materials have evolved significantly and now offer the durability, chemical resistance, and barrier protection required for pharmaceutical use. These innovations have helped biodegradable packaging move beyond niche status, making it a competitive alternative to traditional plastic solutions across a broad range of drug formats.

Despite this shift, plastic packaging still held a dominant position in 2024, with a market value of USD 14.5 billion. Its widespread use continues to be supported by its cost-effectiveness, design flexibility, and excellent protective qualities. Plastics are especially favored in applications requiring tamper-evident features, high moisture resistance, and compatibility with specialized components like child-safe closures and single-use systems. Continuous advancements in polymer science have enhanced the performance of plastic packaging, enabling it to meet the increasingly stringent demands of pharmaceutical storage and distribution.

The U.S. Biopharmaceutical Packaging Market is projected to hit USD 2.5 billion by 2034, driven by the country’s strong pharmaceutical manufacturing ecosystem and innovation in biotech. A combination of strict regulatory standards and rising consumer expectations around safety, integrity, and sustainability is pushing packaging firms to innovate faster. Smart, traceable, and eco-conscious packaging formats are becoming essential as the industry adapts to new challenges and opportunities in drug delivery and compliance.

Companies like Amcor, Schott AG, Gerresheimer AG, Becton, Dickinson & Co., and CCL Industries are actively investing in R&D to stay ahead. These firms are partnering with pharmaceutical companies to co-develop next-gen packaging solutions, scale up eco-friendly alternatives, and adopt digital tools for supply chain visibility and regulatory alignment. As the global market matures, strategic innovation in biopharmaceutical packaging will remain central to supporting the safe and efficient delivery of the world’s most advanced therapies.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this biopharmaceutical packaging market report include:- Adelphi

- Amcor

- Becton, Dickinson & Co.

- Berry Global

- CCL Industries

- Gerresheimer AG

- LOG Pharma Packaging

- Medical Packaging Inc., LLC

- Merck KGaA

- PCI

- Piramal Glass Private Limited

- Schott AG

- Shandong Pharmaceutical Glass Co

- Sonoco

- Stevanato Group

- West Pharmaceutical Services, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2025 |

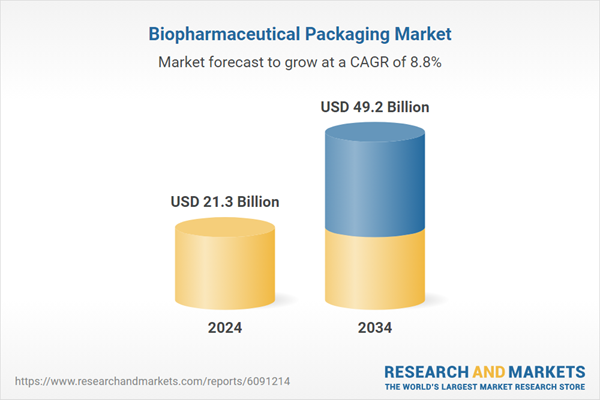

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 21.3 Billion |

| Forecasted Market Value ( USD | $ 49.2 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |