As urbanization continues to boom, the demand for packaging solutions that cater to mobile lifestyles has surged. Self-cooling packaging is emerging as a game-changer for consumers who prioritize convenience and speed without compromising freshness. With growing awareness around health and wellness, many buyers are leaning toward products that support quick, hassle-free consumption during travel, at events, or in outdoor environments. The integration of self-chilling technology provides a much-needed edge in retail environments, where shelf appeal and functional benefits are increasingly influencing purchase decisions. This format brings in a unique value proposition - instant refreshment anytime, anywhere.

Trade tensions and import tariffs initiated by previous U.S. administrations have significantly impacted the availability and pricing of raw materials like aluminum, which is a critical component in self-cooling packaging formats. These policy shifts have triggered widespread disruptions across global supply chains, compelling manufacturers to rethink their procurement strategies. As a result, many companies are now leaning into local sourcing models and investing more heavily in R&D. This strategic pivot not only helps mitigate raw material price fluctuations but also enhances supply chain resilience. By reengineering their frameworks, brands are aiming for long-term operational sustainability while maintaining product quality.

Among various product types, self-cooling cans continue to dominate and are projected to grow at a CAGR of 5.3% through 2034. These cans are especially popular in the beverage industry due to their compatibility with pressure-based cooling systems and simple user functionality. Consumers appreciate their durable structure and reliable cooling performance, which make them ideal for travel, outdoor activities, and sporting events - scenarios where refrigeration is often out of reach. For beverage brands competing in mature markets, self-cooling cans offer a clear advantage in delivering a more engaging and premium user experience.

The push-button activation segment is projected to reach USD 46.2 million by 2034, gaining traction due to its intuitive and user-friendly design. This segment relies on a built-in chemical-based reaction that initiates the cooling function with a simple press, making it perfect for time-sensitive use cases. From busy commuters to adventure seekers, this mechanism fits seamlessly into active lifestyles. As demand rises for easy-to-carry meals and beverages, more manufacturers are embracing this activation method across product lines. It’s also being explored in sectors like emergency preparedness and defense, where quick access to cooled products can add significant value.

The U.S. Self-Cooling Packaging Market generated USD 14.3 million in 2024. With increasing popularity of grab-and-go beverages, meal kits, and smart convenience food options, this market continues to expand rapidly. U.S.-based manufacturers are pushing innovation by advancing thermal regulation technologies and refining chemical engineering processes to deliver more consistent, reliable cooling features. The market’s momentum is also tied to shifting consumer interests toward active, outdoor-oriented lifestyles. This change has driven increased demand from both the recreational and defense segments. As American consumers grow more environmentally and convenience conscious, local producers are stepping up with packaging solutions that align with both trends.

Key players in the Global Self-Cooling Packaging Market include Icetec, deltaH Innovations, Therapak, Tempra Technology, Gobi Technologies, and Joseph Company International. These companies are taking aggressive steps to expand their footprint by forming strategic alliances, refining activation technologies for speed and reliability, and investing in tailored solutions. By syncing product design with evolving consumer preferences and focusing on sustainable, user-centric innovations, these market leaders are tapping into emerging opportunities and setting the stage for future growth in the self-cooling space.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this self-cooling packaging market report include:- deltaH Innovations

- Gobi Technologies

- Icetec

- Joseph Company International

- Tempra Technology

- Therapak

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

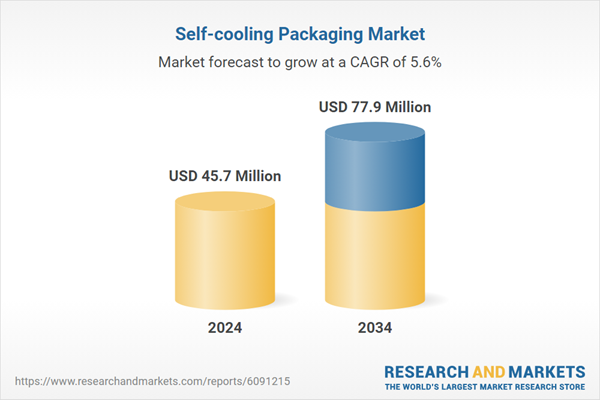

| Estimated Market Value ( USD | $ 45.7 Million |

| Forecasted Market Value ( USD | $ 77.9 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |