The industry is experiencing a shift due to advancements in sealant formulations, with newer materials offering enhanced durability, better adhesion, and long-term protection. Sealants containing fluoride and other protective compounds are improving clinical outcomes and gaining trust among dental professionals. This innovation is helping the product line evolve beyond basic cavity prevention into a crucial part of comprehensive dental care. Increased accessibility to preventive oral treatments, coupled with growing support from national oral health programs, is further accelerating the market’s expansion.

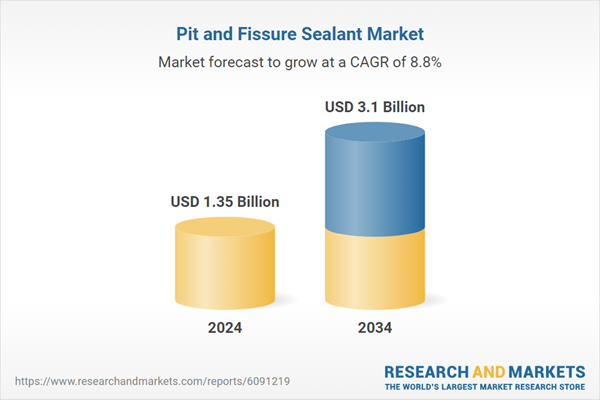

Based on product type, the market is segmented into resin-based sealants, glass ionomer sealants, polyacid-modified resin (compomer) sealants, fluoride-releasing sealants, and others. In 2024, the total value for all product types combined stood at USD 1.35 billion and is forecasted to grow to USD 3.10 billion by 2034. Among these, resin-based sealants held the largest share, accounting for 44.3% of the market in 2024. Their widespread use is attributed to their reliable adhesive properties, ease of use, and long-lasting protection. Glass ionomer sealants are also gaining traction due to their ability to release fluoride over time, making them ideal for patients at higher risk of developing cavities. Compomer sealants bridge the gap between aesthetics and performance, offering both visual appeal and fluoride release, which appeals to a broad patient demographic.

When looking at the end user landscape, the market is divided into dental clinics, hospitals, and other facilities. Dental clinics emerged as the dominant end-user segment in 2024, holding a market value of USD 800 million and representing 59.2% of the total market. This dominance is fueled by the high volume of patients visiting clinics for specialized and preventive dental care. Clinics are typically well-equipped with modern dental tools, making them a reliable choice for the application of sealants. Their flexible scheduling and competitive pricing structures also contribute to their popularity. Hospitals, while offering comprehensive dental services, serve a more generalized patient base, which accounts for their smaller market share in comparison.

In terms of distribution channels, the market is categorized into direct sales, online retail, distributors and wholesalers, and hospital procurement. Direct sales accounted for 33.78% of the market share in 2024. This channel remains the most preferred due to its ability to provide bulk pricing, personalized services, and strong manufacturer-to-practice relationships. Dental chains and specialized clinics tend to rely heavily on this route to secure a consistent supply of professional-grade materials. Online retail is showing steady progress, driven by its convenience and accessibility, although it still plays a secondary role in the sales of professional dental products. Distributors and wholesalers are key players in regional distribution, ensuring timely delivery and availability, while hospital procurement remains centralized within large healthcare institutions.

In the global landscape, the United States accounted for a significant 17.56% of the market in 2024, representing a value of USD 240 million. This figure is projected to climb to USD 570 million by 2034. Growth in the US market is supported by enhanced consumer knowledge around oral hygiene and the inclusion of dental sealants in various insurance and public health programs. These efforts have helped normalize the use of sealants as part of regular dental checkups for children and adolescents.

Competitive dynamics in the pit and fissure sealant industry are shaped by several prominent manufacturers who are leveraging innovation, regional expansion, and strategic partnerships to maintain their market presence. Collectively, the top five companies are responsible for over 55% of the total market share in 2024. Each company focuses on differentiated strengths, such as extensive product portfolios, strong distribution channels, or customer-centric service models, to sustain growth and secure long-term client relationships in a competitive marketplace.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this pit and fissure sealant market report include:- 3M Company

- DenMat Holdings, LLC

- Dentsply Sirona Inc.

- DMG America, LLC

- GC Corporation

- Henry Schein, Inc.

- Ivoclar Vivadent AG

- Kuraray Noritake Dental Inc.

- Mydent International

- Patterson Companies, Inc.

- Premier Dental Products Company

- Shofu Dental Corporation

- Tokuyama Dental Corporation

- Ultradent Products Inc.

- VOCO GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.35 Billion |

| Forecasted Market Value ( USD | $ 3.1 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |