In addition to food distribution, the pharmaceutical and healthcare industries are playing an increasingly important role in driving market expansion. Many medical items now require precise temperature conditions to remain effective throughout transit. The growing use of biologics and temperature-sensitive therapeutics has heightened the need for dependable cold chain infrastructure. Refrigerated trailers provide a solution that safeguards product efficacy, supports compliance with strict industry guidelines, and enhances patient safety. As health systems and pharmaceutical companies expand their reach, the demand for advanced temperature-controlled logistics solutions is expected to grow significantly.

By temperature type, the refrigerated trailer market is segmented into single temperature, multi-temperature, and cryogenic categories. In 2024, the single temperature segment accounted for approximately 57% of the global market and is projected to register a CAGR of over 5% through 2034. Single temperature trailers are widely preferred due to their efficiency in transporting uniform product types under consistent thermal conditions. This segment’s popularity stems from its straightforward design, ease of operation, and lower operational costs compared to more complex configurations. Fleet managers often favor single-temperature units for long-distance hauls, as they offer higher payload capacity and demand less maintenance. Their simplicity also aligns with numerous global transportation guidelines, which require specific temperature ranges to be maintained without fluctuation.

When analyzed by application, the market is categorized into food and beverages, pharmaceuticals, chemicals, and others. In 2024, the food and beverages segment dominated with a 56% market share and is expected to grow at a CAGR exceeding 5.4% from 2025 to 2034. This segment continues to lead due to the consistent need for cold storage during transport to prevent spoilage of perishable goods. Shifting dietary patterns, the rise in frozen food consumption, and the expansion of grocery delivery services have made refrigerated trailers indispensable in this field. Regulatory compliance surrounding food safety and storage also reinforces the critical role of temperature-controlled logistics. Enhanced demand from international supply chains and evolving retail formats has made efficient cold transport a top priority.

From a materials standpoint, aluminum holds the leading position in the market due to its favorable attributes, such as lightweight construction, strength, and resistance to environmental wear. Aluminum-based trailers are projected to maintain dominance due to their ability to improve fuel efficiency and increase load capacity. In 2024, aluminum was the preferred choice among manufacturers and end-users alike. Its excellent thermal conductivity ensures that internal temperatures remain stable, which is essential for preserving temperature-sensitive goods. Its long service life and low maintenance requirements also contribute to reduced operating costs. Furthermore, its recyclable nature appeals to companies prioritizing environmentally sustainable transport options.

Regionally, the United States led the refrigerated trailer market in North America in 2024, accounting for nearly 86% of the regional share and generating around USD 2.4 billion in revenue. The country’s strong position is driven by its extensive logistics networks, large-scale distribution of temperature-sensitive products, and the implementation of strict transportation standards. Advancements in trailer technologies, including energy-efficient systems and smart monitoring features, have made cold chain operations more efficient and reliable. As a result, operators are investing in new fleet technologies and real-time tracking to ensure temperature compliance and reduce spoilage risks.

Key market participants include companies that are investing heavily in sustainable technologies, advanced insulation, and smart telematics to meet environmental targets and operational needs. These companies are also developing electric and hybrid refrigeration units, offering better energy efficiency and lower emissions. Product innovation is a core focus, with firms prioritizing lighter materials, modular designs, and customizable features to serve diverse industry requirements. Strategic collaborations and geographic expansion remain essential tactics for reinforcing their market presence and enhancing customer service capabilities across regions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this refrigerated trailer market report include:- Carrier Transicold

- Faymonville

- Fruehauf Trailers

- Gray & Adams

- Great Dane Trailers

- Hwasung Thermo

- Hyundai Translead

- Kidron

- Kögel Trailer

- Krone Trailer

- Lamberet

- Manac

- MaxiTRANS

- Montracon

- Schmitz Cargobull

- Singamas Container

- Sinotruk

- Thermo King

- Utility Trailer Manufacturing Company

- Wabash National

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

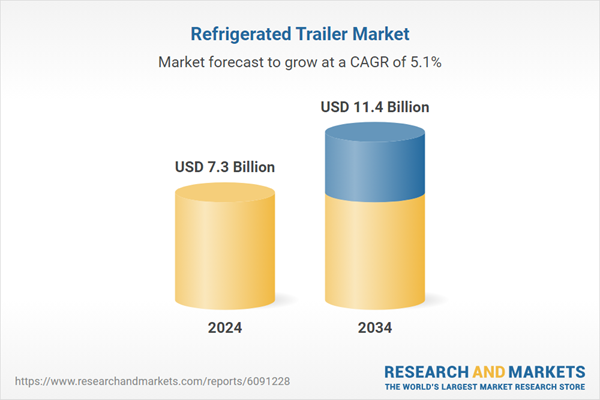

| Estimated Market Value ( USD | $ 7.3 Billion |

| Forecasted Market Value ( USD | $ 11.4 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |