Growing consumption from sectors like construction, automotive, packaging, and electronics is reinforcing market expansion, especially across developing economies focused on sustainable industrialization. Additionally, a heightened focus on energy-efficient solutions, government policies promoting circular economy practices, and increased integration of aluminum in renewable energy infrastructure are further fueling demand. The market’s evolution is tightly linked to technological innovations, with AI-driven scrap sorting, blockchain-enabled traceability, and smart logistics creating new efficiencies. As industries continue to prioritize lightweight materials for electrification, especially in transport and energy, secondary aluminum is securing its role as a cornerstone material for future global development.

Growing emphasis on carbon reduction and resource optimization has pushed manufacturers to aggressively adopt secondary aluminum, while advancements in scrap processing and alloy engineering continue to enhance the material’s competitiveness. Rising recycling rates worldwide are speeding up the transition, with emerging economies playing a critical role, supported by technology-driven supply chain optimization. Enhanced tracking systems and digitized scrap management solutions are improving material recovery rates and ensuring better product quality across industries. As the use of aluminum intensifies in electrical grids, battery systems, and renewable installations, demand for secondary sources is witnessing an unprecedented surge. The global focus on cleaner production methods and reducing reliance on primary extraction methods is making secondary smelting and alloying a pivotal pillar of the aluminum value chain.

The aluminum scrap segment accounted for a 79.6% market share in 2024, driven by its easy accessibility, widespread use in construction and transportation, and significant sustainability advantages. Scrap-based aluminum production, offering lower emissions and major energy savings, directly supports corporate decarbonization targets and global environmental regulations. Technological innovations are breathing new life into previously discarded materials like dross and skimming, turning them into valuable, eco-friendly aluminum sources as companies intensify waste reduction efforts.

The automotive industry remains the top consumer of secondary aluminum, with lightweighting strategies critical for electric vehicle development. Aluminum alloys are increasingly used in battery housings, chassis systems, and structural frames to boost performance and meet stringent carbon neutrality goals.

China Secondary Smelting and Alloying of Aluminium Market generated USD 15.9 billion in 2024 and is forecasted to reach USD 29.6 billion by 2034. The country’s growth is fueled by strong manufacturing capabilities, widespread aluminum use in infrastructure and EVs, and proactive government initiatives supporting recycling. The adoption of smart technologies in scrap handling is further driving production efficiency.

Key market players include Dowa Holdings Co., Ltd., Real Alloy, Hydro Aluminium AS, Novelis Inc., Constellium SE, Kaiser Aluminum Corporation, Raffmetal S.p.A., ELVALHALCOR Hellenic Copper and Aluminium Industry S.A., Befesa S.A., and Century Aluminum Company. Companies are securing competitive advantages by investing in next-gen recycling technologies, forging partnerships with scrap suppliers, expanding regional footprints, and adopting digital platforms for compliance and traceability.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this secondary smelting and alloying of aluminium market report include:- Novelis Inc.

- Hydro Aluminium AS

- Constellium SE

- Real Alloy

- Kaiser Aluminum Corporation

- Century Aluminum Company

- Raffmetal S.p.A

- ELVALHALCOR Hellenic Copper and Aluminium Industry S.A.

- Befesa S.A.

- Dowa Holdings Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | April 2025 |

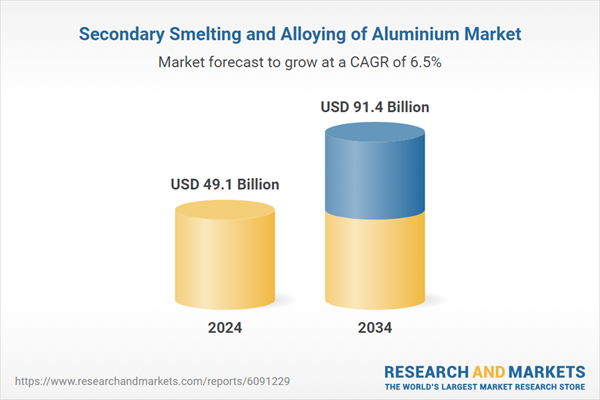

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 49.1 Billion |

| Forecasted Market Value ( USD | $ 91.4 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |