Modern composite textile machinery increasingly incorporates CNC capabilities and automated robotics. These systems reduce human error, boost output efficiency, and maintain consistent product quality. They also support quick transitions between different textile patterns or structures, enabling manufacturers to adapt quickly to shifting production needs. This agility is especially important as demand for customized and complex composite materials continues to rise. As industries prioritize precision and scalability, automated solutions are becoming essential for meeting market expectations. The ability to fine-tune operations in real-time makes these systems vital in scaling production without sacrificing consistency or efficiency.

In terms of equipment type, the market is segmented into weaving machines, knitting machines, braiding machines, prepreg machines, and others. Weaving machines emerged as the dominant segment in 2024, accounting for USD 2.64 billion in revenue and projected to grow at a CAGR of approximately 6.4% through 2034. Weaving remains one of the core processes in composite textile production due to its ability to transform yarn into high-strength, structurally stable fabric. Compared to knitted or nonwoven methods, woven textiles offer better durability and stress resistance, making them ideal for demanding applications. Their capability to handle complex fiber interlacing patterns using materials like carbon, glass, and aramid reinforces their importance in performance-critical environments. The need for advanced weaving equipment that ensures accuracy and speed is growing, particularly for producing high-performance composite fabrics.

The market is also categorized based on fiber type into carbon fiber, glass fiber, aramid fiber, natural fibers, and others. Glass fiber dominated this segment in 2024, representing 57.6% of the market share. It continues to be widely used due to its affordability and reliable performance across a range of applications. Unlike more expensive fibers, glass fiber offers an ideal combination of cost-efficiency, strength, and endurance. It suits large-scale production in sectors such as automotive, marine, and construction. Its adaptability to various textile processing techniques - such as weaving, knitting, and nonwoven formats - adds to its appeal. Manufacturers benefit from its compatibility with existing machinery, reducing the need for specialized production equipment and minimizing capital investment.

From an end-use perspective, the transportation sector led the market in 2024 and is expected to maintain its leadership through 2034. Demand for lightweight, high-strength composite materials is particularly high in this industry, where structural efficiency translates directly into improved fuel economy and safety performance. Vehicles, trains, and ships are incorporating fiber-reinforced textiles more extensively, favoring materials that offer corrosion resistance and energy absorption. As emissions regulations tighten globally, manufacturers in the transportation sector are increasingly turning to composite materials and the specialized machinery required to produce them at scale.

In North America, the United States led the regional market with a valuation of USD 590 billion in 2024, growing at a CAGR of 5.9%. The rise in lightweight composite applications across defense, automotive, and aerospace sectors continues to drive domestic innovation in textile production technologies. Investments in automation, sustainability, and digitalization are supporting the development of next-generation equipment designed for minimal energy use and waste reduction.

Industry players are focusing on energy-efficient processes such as solvent-free systems and precision-based fiber placement. Efforts are also being made to enhance the recyclability of inputs and integrate eco-friendly materials. Growing emphasis on transparency, traceability, and compliance with international environmental standards is influencing the purchasing decisions of manufacturers, pushing the market toward cleaner, more responsible production methods.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this composite textile production equipment market report include:- Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd.

- Cygnet Texkimp

- Dashmesh Jacquard And Powerloom Pvt. Ltd.

- Griffith Textile Machines

- Hangzhou Dengte Textile Machinery Co., Ltd

- IMESA S.r.l.

- Itema Group

- KARL MAYER Holding SE & Co. KG

- Lamiflex S.p.A.

- Lindauer DORNIER GmbH

- McCoy Machinery Company, Inc.

- Optima3D Ltd

- Sino Textile Machinery

- Trutzschler Nonwovens GmbH

- TSUDAKOMA Europe s.r.l.

Table Information

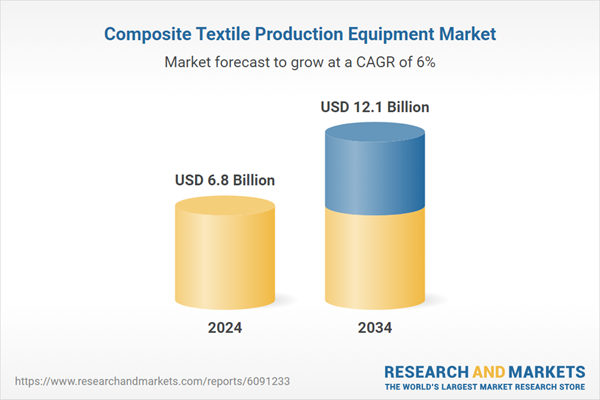

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 6.8 Billion |

| Forecasted Market Value ( USD | $ 12.1 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |