Transparent packaging materials, including polyethylene terephthalate (PET), polyethylene (PE), and polypropylene (PP), are gaining significant traction for their excellent clarity, resilience, and recyclability. The shift toward online shopping has intensified the need for packaging that showcases products effectively without compromising protection. In addition, a strong emphasis on sustainability is pushing companies to innovate with biodegradable and recyclable materials to satisfy environmental mandates and consumer expectations.

Recent trade policies have created hurdles for the transparent packaging market. The U.S. administration’s tariffs on imports from countries like China and Mexico have pushed up the cost of key raw materials such as PET, PE, and PP resins. Rising production costs are leading to higher prices for transparent packaging solutions. In response, companies are diversifying supply chains, seeking alternative suppliers, and ramping up domestic production capabilities to manage the tariff impact and maintain competitiveness.

The plastics segment, which includes PET, PE, and PP materials, is forecasted to generate USD 96 billion by 2034, fueled by plastics' lightweight, cost-efficiency, and durability. PET and PP, in particular, are prized for their exceptional transparency, allowing consumers to inspect products without breaking seals, thus enhancing product appeal and trust. Innovations in recyclable and biodegradable plastics are also making plastic packaging a more sustainable and attractive choice for eco-conscious buyers.

Flexible packaging dominated the market, holding a 59.8% share in 2024, driven by the versatility and cost-efficiency of PE, PP, and PET materials. Lightweight and resilient, flexible packaging is well-suited for pharmaceuticals, personal care, and food and beverage products, offering tamper resistance, resealability, and enhanced product visibility.

The U.S. Transparent Packaging Market is projected to reach USD 19.7 billion by 2034, fueled by surging e-commerce activities and the growing demand for eco-friendly packaging. The food and beverage sector remains the top contributor, with transparent, sealable packaging boosting consumer confidence and supporting the rising consumption of organic and ready-to-eat foods.

Key players in the Global Transparent Packaging Industry include Futamura Group, NatureWorks LLC, Amcor plc, Biome Bioplastics, Bio Futura, Corbion, Genpak, IIC AG, FKuR, ITC Packaging, Novamont S.p.A., Sealed Air Corporation, J. Landworth Company, Stora Enso, TIPA LTD, Tetra Pak International S.A., Walki Group Oy, and Xiamen Changsu Industrial Co., Ltd. Companies are navigating tariff challenges by diversifying supply chains, boosting automation, closely monitoring trade policy shifts, leveraging data-driven strategies, and focusing on value-added offerings such as sustainable materials and innovative packaging designs to maintain a competitive edge.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this transparent packaging market report include:- Amcor plc

- Bio Futura

- Biome Bioplastics

- Corbion

- FKuR

- Futamura Group

- Genpak

- IIC AG

- ITC Packaging

- J. Landworth Company

- NatureWorks LLC

- Novamont S.p.A.

- Sealed Air Corporation

- Stora Enso

- Tetra Pak International S.A.

- TIPA LTD

- Walki Group Oy

- Xiamen Changsu Industrial Co., Ltd.

Table Information

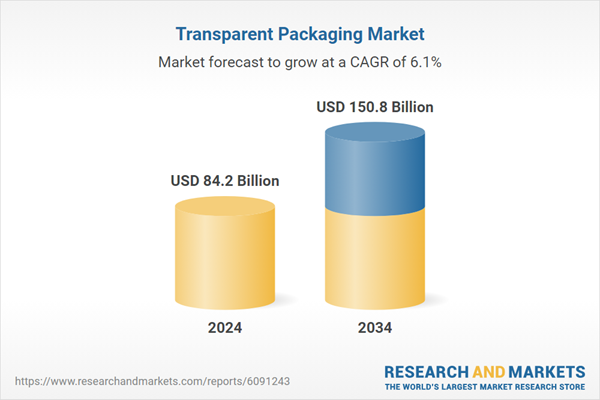

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 84.2 Billion |

| Forecasted Market Value ( USD | $ 150.8 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |