Bipolar electrosurgical instruments are designed to perform both cutting and coagulation with exceptional precision while limiting harm to the surrounding tissue. This translates to a lower rate of post-operative infections and complications. With advancements in vessel sealing capabilities, improved thermal control, and ergonomic tool designs, these instruments continue to enhance procedural outcomes. The heightened focus on precision and tissue conservation supports their growing use in surgical fields such as neurosurgery, orthopedics, gynecology, and others, further driving market expansion. The adoption of newer devices compatible with robotic and laparoscopic systems also reinforces their position in standardized surgical protocols.

These devices operate using high-frequency electrical energy applied through a bipolar configuration, where the current flows only through the tissue between two forceps-like electrodes. This design ensures localized energy delivery and minimal tissue trauma. The market is segmented based on product types, with categories including bipolar electrosurgical generators, bipolar electrosurgical instruments, and accessories and consumables. Among these, bipolar electrosurgical generators accounted for the highest revenue share at 47.2% in 2024. These generators act as the core energy source for all connected instruments and accessories, making them essential for any electrosurgical setup. Their high cost compared to reusable instruments and accessories contributes significantly to overall market revenue.

Bipolar electrosurgical instruments are further divided into forceps, scissors, and probes or electrodes. While these tools are widely used across various surgical procedures, their affordability relative to generators places them as mid-level revenue contributors within the segment. Generators, being capital-intensive and indispensable for system functionality, maintain a dominant hold on product-based segmentation.

Based on application, the market is categorized into general surgery, neurosurgery, cardiovascular surgery, gynecological surgery, and other specialized fields. General surgery led the segment with a market share of 40.4% in 2024. The prevalence of age-related conditions such as gallbladder disease, appendicitis, and hernias has grown alongside the expanding global elderly population. Older adults are more likely to undergo surgical procedures due to the higher frequency of degenerative and chronic illnesses, which boosts the demand for reliable and safe surgical tools like bipolar devices. Their efficiency in managing bleeding and enabling precise incisions makes them a preferred choice across general surgery departments.

By end user, the market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and academic or research institutions. Hospitals dominated this segment, with revenue amounting to USD 2.5 billion in 2024. Their focus on enhancing patient safety, improving procedural accuracy, and reducing recovery time has spurred investments in advanced surgical equipment. Bipolar devices offer key advantages such as minimal thermal spread, reduced bleeding, and fewer accidental burns, supporting better clinical outcomes and shorter procedure durations. As hospitals continue to upgrade to equipment that is compatible with cutting-edge surgical systems, including robotics and laparoscopic tools, the demand for bipolar electrosurgical devices is expected to climb.

Regionally, North America plays a pivotal role in shaping market trends. The bipolar electrosurgical devices market in the United States alone is projected to rise from USD 1.8 billion in 2024 to USD 2.9 billion by 2034. A surge in lifestyle-related diseases, including cardiovascular disorders, diabetes, and obesity, has led to a growing number of surgeries. As chronic conditions become more prevalent, the need for efficient, precision-driven surgical instruments becomes more pressing. Bipolar electrosurgical units meet these clinical demands effectively, reinforcing their value across U.S. healthcare facilities.

The competitive landscape of the bipolar electrosurgical devices market features a blend of global and regional players offering tailored solutions to meet rising surgical demands. Leading companies such as Medtronic, Johnson & Johnson, B. Braun, Stryker, and Olympus together represent approximately 65% of the global market. These organizations compete through continuous innovation, product customization, and pricing strategies to maintain relevance across both developed and emerging markets. In cost-sensitive regions, domestic players challenge multinational brands by delivering affordable, quality devices, prompting global leaders to adapt their approach while ensuring compliance with safety and performance standards.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this bipolar electrosurgical devices market report include:- Applied Medical

- B Braun

- Boston Scientific

- Bovie Medical

- BOWA Medical

- ConMed

- Encision

- Erbe Elektromedizin

- Johnson and Johnson

- KLS Martin Group

- Medtronic

- Olympus

- Smith and Nephew

- Stryker

- Zimmer Biomet

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

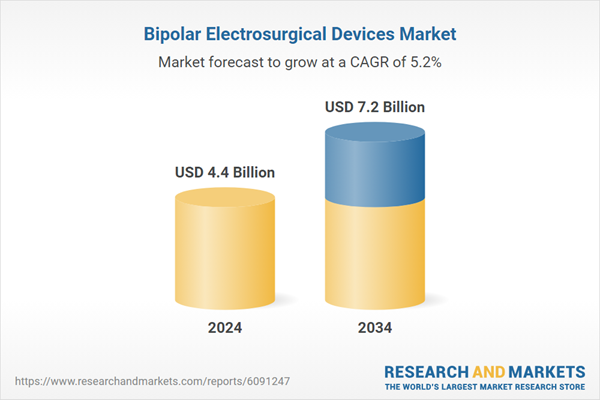

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 7.2 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |