Their integration into Industry 4.0 and smart manufacturing setups makes them a critical asset in streamlining operations, improving product quality, and reducing waste. Moreover, the rising need for sustainable, energy-efficient production technologies further solidifies their position as an essential tool across various manufacturing verticals. Technological advancements, especially in beam control, cooling mechanisms, and modular design, are helping manufacturers scale operations without compromising on quality or efficiency. As a result, both established players and new entrants are capitalizing on this trend by enhancing product capabilities and expanding their presence in high-demand markets.

CO2 lasers are gaining traction in industries that demand intricate, contact-free solutions for cutting, welding, drilling, and engraving. Compared to traditional processing tools, these lasers deliver superior edge quality and reduce the need for secondary finishing, which significantly improves overall operational efficiency. Their ability to execute high-precision tasks at high speed makes them particularly suitable for mass production environments. As manufacturers aim to improve throughput while maintaining quality standards, CO2 lasers are increasingly being deployed to replace older, less efficient equipment.

Trade policies continue to play a role in shaping market dynamics, especially tariffs on imported components from countries that supply essential laser parts. These policy changes have increased manufacturing costs, prompting companies to rethink their sourcing and operational models. To mitigate these challenges, many firms are exploring alternative suppliers and increasing investments in domestic manufacturing capabilities. This shift not only helps reduce dependency on global trade but also supports quicker turnaround times and improved supply chain resilience. Despite these headwinds, market momentum remains strong due to the growing demand for automation and digitally integrated production ecosystems.

In terms of product segmentation, the medium power category - ranging from 100W to 1kW - generated USD 1.4 billion in 2024. This segment continues to gain popularity as it offers an ideal balance between high performance and affordability. Industries such as automotive, electronics, textiles, and packaging prefer medium-power CO2 lasers for their ability to deliver clean welding, intricate marking, and detailed engraving across various materials. Their compact design and energy efficiency make them especially attractive for small to mid-sized manufacturing facilities looking to implement automation without overextending budgets. These systems also integrate seamlessly with CNC machines and robotics platforms, making them a natural fit for smart factory environments.

The Continuous Wave (CW) CO2 laser segment held a dominant 61.2% market share in 2024, reflecting its widespread use in applications that demand uninterrupted, high-intensity laser output. CW lasers emit a constant beam, enabling deep penetration and consistent precision in processes like structural metal cutting, deep-hole drilling, and continuous welding. Key industries such as aerospace, shipbuilding, and heavy machinery rely on these lasers for their ability to operate efficiently in high-throughput production lines. Their reliability and capacity to reduce downtime align well with the global emphasis on lean manufacturing and productivity enhancement.

The United States CO2 laser market generated USD 836.9 million in 2024, driven by strong demand across advanced manufacturing sectors. These lasers are indispensable in industries where microscopic precision and seamless automation are critical. Aerospace, healthcare, and consumer electronics manufacturers are adopting CO2 lasers for their exceptional accuracy and material-handling flexibility - from metals to polymers. In the medical space, the growing use of laser-assisted cosmetic procedures like skin resurfacing and dermatological treatments is also expanding the market scope.

Leading companies, including Lumenis, Coherent, Inc., Epilog Laser, TRUMPF Group, and Kern Laser Systems, are reinforcing their positions through strategic R&D in high-performance laser modules. These players are expanding their product portfolios and customizing solutions to meet the unique requirements of specific industries. Collaborations with automation firms and key end-users are helping strengthen supply chains and improve service delivery. At the same time, investments in regional manufacturing facilities are enhancing market reach and providing faster response times to shifting trade dynamics.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this CO2 laser market report include:- Alma Lasers

- Baison Laser

- Boss Laser

- Camfive Laser

- Epilog Laser

- Eurolaser

- Gravotech

- Haotian Laser

- INTERmedic

- JEISYS Medical

- JenaSurgical

- Kern Laser Systems

- Lasering USA

- Lumenis

- Lutronic

- Novanta Inc.

- OmniGuide

- RedSail

- Thunder Laser

- Trotec Laser

- Wattsan

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

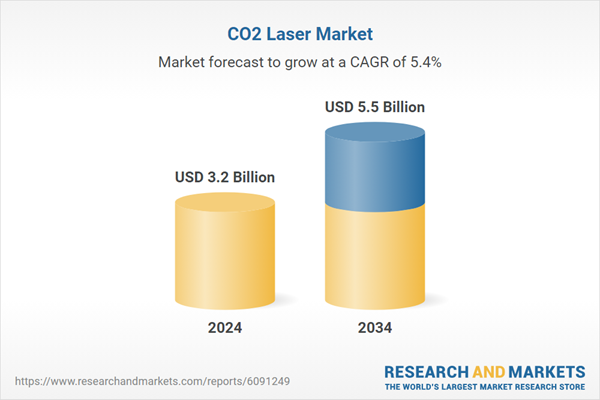

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |