Compliance with updated environmental policies requires businesses to incorporate biodegradable materials, invest in green technologies, and re-evaluate end-of-life packaging solutions. This growing pressure from regulatory bodies creates competitive advantages for early adopters, positioning them as leaders in the shift toward sustainable packaging. In response, manufacturers are accelerating innovation, scaling up the use of plant-based inputs, and integrating sustainable design principles into machinery and product development to meet both compliance goals and consumer expectations. Accelerated urbanization and booming e-commerce sectors have intensified the demand for sustainable packaging technologies.

Among the various equipment types, the extruders segment generated USD 9.6 billion in 2024 and is forecast to grow at a CAGR of 9.6% during 2025-2034. These machines are essential for transforming biopolymers into usable materials like films, sheets, or molded packaging components. Their versatility and effectiveness in handling compostable raw materials make them highly favored across industries. Other machinery such as film-blowing units, cutting and sealing equipment, and printing presses witness increased demand, but extruders remain central to the conversion process.

From a distribution perspective, the indirect channel held a 55.1% share in 2024 and is projected to grow at a 9.4% CAGR through 2034. This model relies on third-party dealers, agents, or distributors to sell equipment, offering cost efficiency and better regional access. Manufacturers benefit from the local expertise and established customer networks of these intermediaries. This approach also helps navigate regulatory landscapes more efficiently, enabling quicker market penetration and scalability. These distribution partners often possess deep knowledge of regional preferences, procurement cycles, and regulatory requirements, making them critical to successful expansion strategies for global manufacturers. By leveraging these networks, companies can reduce operational complexity and focus on core activities like product innovation and customization.

China Compostable Packaging Equipment Market generated USD 8.5 billion in 2024. Regional policies favoring green technology, coupled with increased consumer awareness, are fueling further market expansion. Regional policies favoring green technology, coupled with increased consumer awareness, are fueling further market expansion. The rise of eco-conscious consumers, combined with government-backed initiatives promoting biodegradable alternatives, drives innovation across the region. This growing momentum positions APAC as a global hub for compostable packaging production and machinery development.

Key players in the Global Compostable Packaging Equipment Market include Braskem, Tetra Pak, BASF, Placon, EcoEnclose, Amcor, Smurfit Kappa, Ball, BioBag, Corbion, WestRock, Biome Bioplastics, Berry Global, Mondi, and International Paper. To strengthen their market presence, leading companies invest in innovation, sustainability, and strategic partnerships. Many firms are enhancing their R&D capabilities to develop advanced machines that process next-generation biodegradable materials. They are also expanding their global footprints through joint ventures and acquisitions, targeting emerging markets with high growth potential. Streamlining manufacturing to reduce operational costs and improve energy efficiency remains another vital tactic. Additionally, businesses are increasingly participating in eco-certification programs and forming alliances with regulatory bodies to ensure compliance and enhance credibility in the sustainable packaging ecosystem.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this compostable packaging equipment market report include:- Amcor

- Ball

- BASF

- Berry Global

- Biome Bioplastics

- BioBag

- Braskem

- Corbion

- EcoEnclose

- International Paper

- Mondi

- Placon

- Smurfit Kappa

- Tetra Pak

- WestRock

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

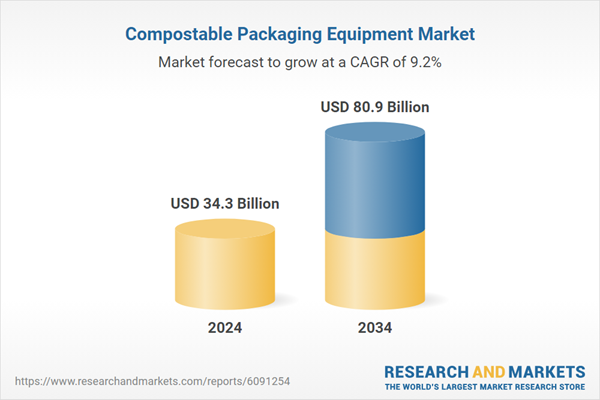

| Estimated Market Value ( USD | $ 34.3 Billion |

| Forecasted Market Value ( USD | $ 80.9 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |