Over the past few years, the supply of certified organic DDGs has grown considerably, as ethanol producers shift toward organic grain inputs and seek certification for their production facilities. These developments come at a time when the demand for sustainable and transparent agricultural supply chains is reaching new heights. Producers and feed manufacturers are more eager than ever to embrace organic solutions that align with both sustainability goals and market demand. North America continues to lead in market adoption due to its well-established organic agriculture ecosystem. However, the Asia-Pacific region is quickly catching up, as countries invest in organic production models and enhance their certification and distribution infrastructure.

Corn-based dried distiller’s grain remains the dominant feedstock, generating USD 4.9 billion in revenue in 2024 and projected to grow at a 7% CAGR through 2034. Corn’s widespread availability, high starch content, and efficiency in ethanol fermentation make it a preferred crop for organic DDG production. The nutritional density of corn-derived DDGs, rich in protein and energy, also makes it especially well-suited for organic livestock systems. This consistency is vital for producers who rely on quality feed inputs to meet stringent organic certification standards. As livestock producers continue to prioritize nutrition and compliance, corn-based DDG is expected to retain its leadership in the organic feed segment.

In terms of animal application, dairy cattle represent the largest consumer segment. Valued at USD 4.3 billion in 2024 and forecasted to grow at a CAGR of 7.8%, this segment reflects the critical role that organic DDG plays in supporting the dietary needs of dairy operations. Organic dairy farms, which restrict the use of synthetic additives and antibiotics, increasingly rely on organic DDGs to deliver protein and fiber naturally. This not only helps maintain milk production levels but also supports overall herd health and vitality. As demand for organic dairy products grows globally, the importance of nutrient-rich, organically compliant feed will only become more central to the sector.

The United States Organic Dried Distiller’s Grain Feed Market generated USD 3.2 billion in 2024 and is expected to grow at a 7.3% CAGR. This growth is fueled by increased interest in regenerative agriculture and consumer trends favoring sustainable, transparently sourced animal products. US feed manufacturers are adapting swiftly by integrating organic DDGs into nutrition plans that support both performance and environmental goals. Given their role in circular agriculture - repurposing by-products of organic ethanol production - organic DDGs are becoming an attractive choice for American producers looking to boost both productivity and sustainability.

Leading companies such as Flint Hills Resources, Archer Daniels Midland Company (ADM), Green Plains Inc., POET LLC, and Valero Energy Corporation are actively investing in expansion and certification. These key players are upgrading facilities to meet organic standards, collaborating with organic grain suppliers, and tailoring their product lines to cater to specific livestock nutrition requirements. Strategic partnerships and a growing emphasis on traceability and transparency continue to define the market strategies of these firms as they position themselves for long-term growth in the evolving organic feed landscape.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this organic dried distiller’s grain feed market report include:- Bayer Animal Health

- ADM

- Agrifeeds

- Alcogroup SA

- Chimique India

- COFCO Biochemical (Anhui) Co. Ltd.

- Feedpedia

- Furst-McNess Company

- Greenfield Global Inc.

- Gulshan Polyols Ltd.

- Kemin Industries, Inc.

- Midas Overseas

- Nutrigo Feeds Pvt Ltd

- Poet LLC

- Valero Energy Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | April 2025 |

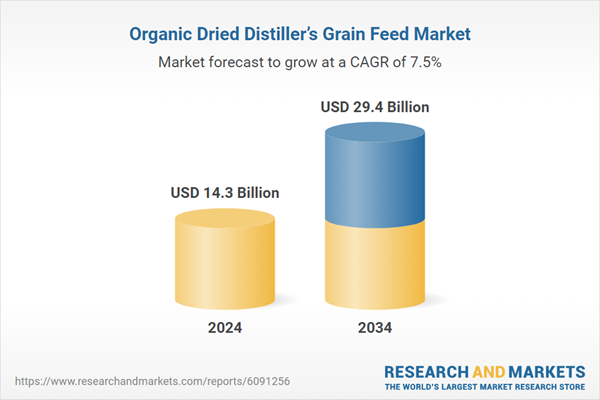

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 14.3 Billion |

| Forecasted Market Value ( USD | $ 29.4 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |