A large portion of the global fleet is now over ten years old, especially in mature boating markets like North America and Europe. Boat owners are increasingly focused on performance upgrades, and modern control levers are at the heart of these improvements. These upgrades go beyond aesthetics - they enhance control precision, fuel efficiency, and operational safety. As electronic control systems become the new norm, boat owners are actively switching from mechanical configurations to digital ones. Leading manufacturers are making this transition easier through plug-and-play retrofit kits that simplify installation. This trend is creating a vibrant aftermarket segment, especially for multi-station or dual-lever systems. For vendors and service providers, this segment continues to be a reliable source of recurring revenue.

The single lever systems segment held a 45% market share and is expected to hit USD 1 billion by 2034. Their success stems from their space-saving and intuitive design, merging throttle and gear functions into one seamless movement. These systems are particularly well-suited for compact vessels and personal watercraft, which are gaining popularity in regions like North America and Asia-Pacific. Whether a first-time boater or a seasoned enthusiast, users are increasingly drawn to controls that simplify their boating experience. Boat manufacturers catering to small and mid-sized models are also aligning with this trend, opting for systems that reduce dashboard clutter and support the growing consumer demand for hassle-free operation.

The motorboats segment accounted for a 49% share in 2024, securing its position as the dominant vessel type in the global market. Motorboats continue to lead the charge in recreational boating due to their speed, versatility, and adaptability across a wide range of activities - from fishing and watersports to cruising. As personal boat ownership rises and rental fleets expand, the demand for highly responsive, reliable control levers is growing rapidly. Manufacturers are focused on enhancing control technologies specific to motorboats, integrating both single and dual lever systems that promise smoother operation and precision handling under all conditions.

North America dominated the global boat control lever market with a 35% share, with the United States alone contributing USD 506.7 million. The region's strong culture of recreational boating - whether for weekend escapes, sport fishing, or coastal cruising - continues to drive demand for modern, intuitive control systems. US consumers are increasingly favoring joystick-style and single-lever configurations that make navigation effortless and enjoyable. This consumer shift is fueling innovation across the supply chain, with vendors competing to deliver systems that elevate user experience through smart design and digital connectivity.

Key players like Yamaha, Twin Disc, ZF Friedrichshafen, Vetus, SeaStar Solutions, Livorsi Marine, Volvo Penta, Mercury Marine, Ultraflex, and Honda are stepping up with cutting-edge digital control systems that meet evolving customer expectations. These companies are doubling down on R&D, focusing on features that enhance usability, automation, and compatibility with next-gen marine electronics. From expanding retrofit offerings to strengthening aftermarket support and forming strategic partnerships, market leaders are pulling all the levers to secure long-term customer loyalty and market dominance.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this boat control lever market report include:- BRP

- Centek Industries

- Dockmate

- Edson International

- Fusion Marine

- Gaffrig Performance Industries

- Honda

- Imtra

- Kobelt Manufacturing

- Livorsi Marine

- Mercury Marine

- SeaStar Solutions

- Tohatsu

- Twin Disc

- Uflex USA

- Ultraflex

- Vetus

- Volvo Penta

- Yamaha

- ZF Friedrichshafen

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | April 2025 |

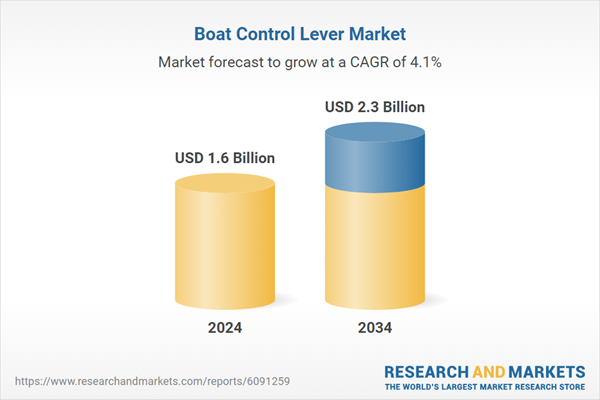

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.3 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |