The demand for secure and efficient identification solutions, coupled with the expansion of contactless payment and verification systems, is propelling the smart card IC market forward. Although the market has experienced turbulence due to trade restrictions, especially the Trump-era tariffs on Chinese imports, it remains positioned for steady growth. These tariffs increased the cost of raw materials and packaging components, leading to supply chain disruptions. Companies heavily reliant on Chinese suppliers faced higher costs and shifted production to alternative regions such as Taiwan, Mexico, and Vietnam to mitigate risks. While these adjustments have strengthened long-term supply chain resilience, they caused short-term procurement delays and operational cost hikes.

The smart card IC market includes various types designed to meet specific security needs and applications. Among these, the contact-based ICs segment generated USD 1.08 billion in 2024. These ICs require physical contact with a reader for communication and are widely used in secure environments, including national identity cards, banking cards, and access control systems. Their ability to securely store and transmit sensitive data makes them indispensable across industries where security is critical.

The microcontroller-based ICs segment generated USD 1.7 billion in 2024. These ICs are predominantly used in financial cards adhering to EMV standards. Featuring embedded microcontrollers, they support secure on-card data processing, encryption, and identity verification. With rising cyber threats, the need for robust security measures is escalating, making microcontroller-based ICs a critical component for secure transactions and identity protection.

The U.S. Smart Card IC Market was valued at USD 746.9 million in 2024 and is seeing strong growth fueled by increasing investments from both government and private sectors in digital identity systems, IoT payment solutions, and secure access control technologies. The U.S. government's focus on improving cybersecurity and implementing advanced identity verification programs, such as REAL ID, is driving the adoption of smart card ICs across federal and state initiatives. As industries prioritize secure digital transactions and identity management, the demand for smart card ICs in the U.S. continues to rise.

Key players in the Global Smart Card IC Market include Infineon Technologies AG, NXP Semiconductors N.V., and STMicroelectronics N.V. These companies are leading innovations in secure payments, identity verification, and digital services. They are focusing on strengthening product security, expanding chip capabilities, forming strategic partnerships across banking, telecom, and government sectors, and investing heavily in R&D to develop next-generation chips with advanced encryption, greater durability, and faster processing speeds. The establishment of manufacturing hubs in low-cost regions is helping them control production costs and streamline supply chains, while marketing efforts continue to raise global awareness about secure digital payment systems and government ID programs.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this smart card IC market report include:- CPI Card Group Inc.

- Eastcompeace Technology Co., Ltd.

- EM Microelectronic-Marin SA (Swatch Group)

- Giesecke+Devrient GmbH (G+D)

- HED Technologies

- Hubei Dinglong Co., Ltd.

- IDEMIA

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- Shanghai Fudan Microelectronics Group Co., Ltd.

- STMicroelectronics N.V.

- Thales Group

- Unigroup Guoxin Microelectronics Co., Ltd.

- Watchdata Technologies

- Winbond Electronics Corporation

- Wuhan Tianyu Information Industry Co., Ltd.

- Xingtera Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 156 |

| Published | April 2025 |

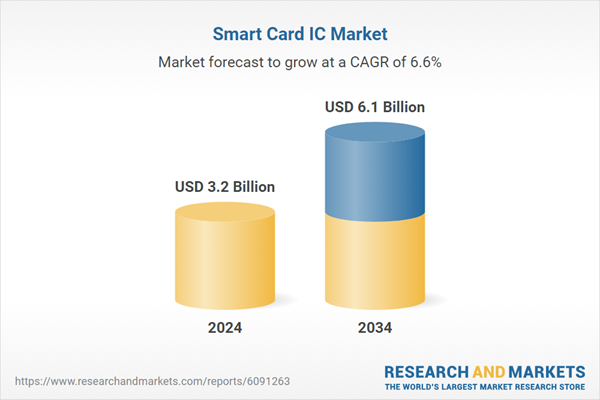

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |