Tariffs imposed in recent years particularly impacted North American manufacturers, prompting some companies to shift operations back domestically. Meanwhile, European suppliers were forced to reevaluate and restructure their supply chains, creating short-term inefficiencies. On the other hand, manufacturers in Asia developed local capabilities to reduce reliance on imports, signaling a global trend toward regionalizing production. Although reshoring helped stabilize some aspects of the supply chain, the overall market experienced slower uptake in certain sensor technologies, especially those used in unmanned systems.

In contrast, demand for sensors has surged in rapidly growing segments such as unmanned aerial vehicles (UAVs) and electric vertical takeoff and landing (eVTOL) aircraft. These platforms require highly specialized sensors for navigation, obstacle avoidance, and operational safety. As these technologies become more prevalent, particularly in urban and commercial use cases, the need for ultra-reliable and energy-efficient sensors will continue to rise. Furthermore, increasing levels of automation and integration of artificial intelligence are pushing manufacturers to develop more sophisticated sensor systems that can support autonomous functions and real-time decision-making.

Another major growth driver lies in the implementation of predictive maintenance programs by airlines and maintenance providers. These programs rely on IoT-enabled sensors to monitor aircraft systems in real time, detecting early signs of wear and tear. This approach significantly reduces unexpected maintenance events and extends aircraft service life. Sensors that measure vibration, sound, and corrosion are particularly useful in monitoring older fleets. These technologies are enabling a shift from reactive to proactive maintenance, boosting demand in the aftermarket segment.

Meanwhile, defense budgets worldwide continue to rise, fueling demand for rugged, high-performance sensors suitable for next-generation aircraft. Military aircraft depend on advanced technologies such as radar, electronic warfare, and thermal imaging sensors that must operate in extreme conditions. Increased investments in stealth technologies and drone capabilities are accelerating sensor innovation in the defense sector, making it one of the fastest-growing areas within the broader aircraft sensors market.

To maintain competitiveness, manufacturers are prioritizing research and development in lightweight, energy-efficient sensor technologies tailored for fuel-efficient aircraft and autonomous platforms. The development of MEMS and LiDAR-based systems is gaining momentum as companies aim to meet the needs of UAVs and automated flight. Enhancing predictive maintenance capabilities using AI-powered IoT sensors is also becoming a central focus, especially for fleets approaching the end of their operational lifespan.

In 2024, the fixed-wing aircraft sensor segment accounted for USD 4.8 billion of the total market value. These aircraft dominate global demand due to their extensive use across both commercial and military applications. Sensors in this category are essential for flight control, engine monitoring, and fuel management. With the introduction of more technologically advanced aircraft, the adoption of lightweight, data-driven sensors has accelerated. Additionally, the growing use of high-endurance UAVs in surveillance and military operations has further amplified the need for high-performance sensor systems.

Pressure sensors, which are vital for maintaining cabin pressure, engine performance, and hydraulic system integrity, represented the largest share by sensor type with a valuation of USD 979.9 million in 2024. These sensors are a staple in aviation due to their wide application across all aircraft types. Technological advancements have made these components smaller, more durable, and more power-efficient, contributing to their expanding role in modern aircraft systems.

On the end-user front, the OEM segment led the market in 2024 with a value of USD 3.42 billion. These original equipment manufacturers are responsible for integrating high-reliability sensors into newly developed aircraft systems. They focus on engine diagnostics, avionics, and advanced flight control sensors. However, challenges such as certification delays and raw material shortages continue to impact their operational efficiency.

Regionally, the United States dominated the aircraft sensors market with a valuation of USD 1.85 billion in 2024. The country's leadership in aerospace innovation, driven by robust manufacturing capabilities and significant defense investments, ensures strong demand for cutting-edge sensors. Regulatory frameworks also encourage continuous improvement in safety and predictive maintenance technologies, contributing to overall market growth.

The competitive landscape remains intense, with leading companies holding a combined 48.5% market share. These firms are channeling resources into developing AI-enhanced, customizable, and eco-friendly sensor solutions, aligning with both market demand and evolving regulatory standards. Their strategies include forming alliances, adopting digital manufacturing processes, and diversifying their product lines to support various aircraft platforms, from traditional jets to emerging autonomous aerial systems.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this aircraft sensors market report include:- Honeywell International Inc.

- Safran S.A.

- Thales

- TE Connectivity

- Collins Aerospace

- RTX

- Meggitt PLC.

- AMETEK.Inc.

- Curtiss-Wright Corporation

- L3Harris Technologies, Inc.

- Saywell International

- Garmin Ltd.

- HBK, Inc

- PCB Piezotronics

- Kistler Group

- Bosch Sensortec GmbH

- Eaton

- Baker Hughes Company

- Humanetics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

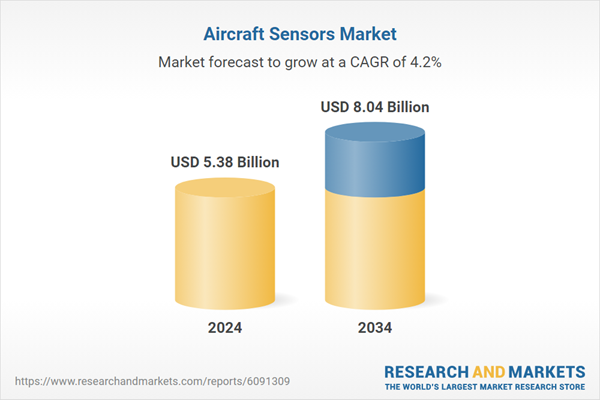

| Estimated Market Value ( USD | $ 5.38 Billion |

| Forecasted Market Value ( USD | $ 8.04 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |