Rising investments in clean transportation, coupled with growing government support for electric mobility, are shaping the future of this market. Numerous state and federal policies now offer tax rebates, incentives, and subsidies that reduce the cost burden for consumers and manufacturers alike. At the same time, public and private stakeholders are ramping up efforts to create integrated charging and refueling infrastructure to support hybrid mobility. The growth of shared mobility platforms and the increasing adoption of last-mile delivery services have also played a pivotal role in driving hybrid e-scooter sales. This trend is particularly noticeable in densely populated urban hubs where quick, affordable, and emission-compliant transport is in high demand. Hybrid e-scooters are not just a lifestyle upgrade - they’re fast becoming a strategic tool for achieving smarter urban mobility.

Hybrid e-scooters offer a distinct edge by allowing riders to switch seamlessly between electric and fuel modes. This dual functionality ensures a longer range, reduced charging anxiety, and a smoother riding experience in traffic-heavy zones. Urban riders and gig economy workers are especially drawn to these benefits, as they need vehicles that are low-maintenance yet high-performing. The rising use of lithium-ion batteries has further fueled the demand. Known for their higher energy density, faster charging time, and extended lifespan, these batteries significantly enhance the practicality of hybrid scooters. Their lightweight and compact design improves handling and boosts energy efficiency, aligning perfectly with the needs of modern-day commuters.

Environmental concerns are another key growth driver. As air quality worsens and climate change intensifies, governments worldwide are enforcing stricter emission norms to curb vehicular pollution. Hybrid e-scooters, which emit significantly less than their gasoline-only counterparts, are quickly becoming the go-to option for eco-conscious consumers. These scooters meet the demand for cleaner transport without compromising on range or power, making them an attractive solution in regions that are clamping down on high-emission vehicles. Consumers are increasingly choosing hybrid e-scooters as a cost-effective and environmentally friendly alternative for short to mid-range travel.

The market is primarily segmented by battery type, with lithium-ion batteries taking the lead in 2024, generating USD 1 billion in revenue. These batteries are favored for their energy efficiency, durability, and ability to deliver consistent performance. They pack more power into a smaller, lighter unit, helping boost the overall range and reducing the vehicle’s weight, which in turn improves fuel efficiency and maneuverability - critical features for urban use.

By end-use, personal hybrid e-scooters dominated the market with an 83% share in 2024. Urbanization and rising demand for flexible commuting options are pushing consumers toward personal transport solutions that are both cost-efficient and low-emission. These scooters offer electric riding for short distances and fuel-powered assistance for longer routes, making them ideal for daily city travel. Budget-conscious consumers are especially drawn to them due to their lower fuel and maintenance costs compared to traditional scooters or cars.

The Asia Pacific Hybrid E-Scooter Market accounted for 35% share in 2024, thanks to the region’s heavy reliance on two-wheelers and its densely populated urban centers. With increasing traffic congestion and limited parking availability, hybrid e-scooters present a highly practical and eco-friendly transport alternative. China, in particular, continues to lead the way due to its strong local manufacturing capabilities, robust supply chain, and favorable government regulations.

Key players such as Yadea Group, Yamaha, Kymco, and NIU Technologies are investing heavily in product innovation, expanding their production lines, and strengthening distribution channels. These companies focus on creating energy-efficient, user-centric scooters with advanced features, aiming to meet rising consumer expectations. Strategic partnerships with both local distributors and international suppliers are central to boosting their global market presence and staying ahead in the competitive landscape.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this hybrid e-scooter market report include:- Gogoro

- Green Tiger Mobility

- Honda

- Jiangsu Xinri E-Vehicle

- Kymco

- Meladath Auto Components

- NIU Technologies

- Okinawa Autotech

- Piaggio Group

- Sanyang Motor

- Silence Urban Ecomobility

- Sunra Electric Vehicle

- Verge Motors

- Yadea Group

- Yamaha

- Zhejiang Luyuan Electric Vehicle

Table Information

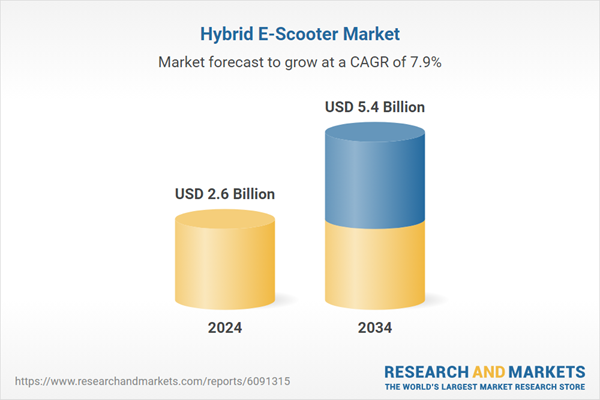

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |