Among these, the demand for EV reducers has surged, as these critical components play a vital role in optimizing drivetrain performance by converting high-speed motor output into manageable torque for the wheels. As electric vehicle production scales up - from compact passenger cars to heavy-duty commercial fleets - the need for reliable, high-efficiency reducers is becoming more crucial than ever. Original equipment manufacturers and tier-1 suppliers are now under intense pressure to deliver next-generation reducer solutions that align with evolving EV architectures and performance expectations. This rising momentum positions the reducer market as a key enabler in the broader electrification landscape.

The rising global demand for electric vehicles has directly boosted the need for EV reducers, which are essential in converting the high rotational speed of electric motors to usable torque for driving wheels. As adoption rates grow, the production of electric passenger cars, commercial vehicles, and fleet systems is increasing significantly, leading to higher consumption of reducers. Manufacturers are responding to this demand by optimizing reducers for performance, durability, and energy efficiency. Particularly in commercial and logistics applications, advanced multi-stage reducers are in high demand due to their ability to handle continuous operations while minimizing energy losses. Fleet operators are increasingly seeking high-torque, low-maintenance solutions that reduce the total cost of ownership and enhance drivetrain reliability, which further underscores the importance of efficient reducer systems.

Electric vehicles are making substantial inroads in last-mile delivery, ride-hailing services, and public transportation, expanding the scope of the EV reducer market. Suppliers are under growing pressure to innovate, producing compact, high-torque-density reducer designs that seamlessly integrate into both light-duty and heavy-duty EV platforms. The performance expectations are rising, and so is the need for scalable, modular solutions that meet the demands of various vehicle classes. As a result, major suppliers are heavily investing in R&D to improve energy efficiency and reduce mechanical losses in reducer systems, reinforcing their role in the EV value chain.

In terms of vehicle type, the market is segmented into passenger cars, commercial vehicles, off-highway vehicles, and two- and three-wheelers. In 2024, passenger vehicles led the market with USD 700 million in revenue, capturing a 40% market share. This dominance is largely due to the rapid expansion of electric car sales, especially in urban areas where clean energy vehicles offer substantial benefits in terms of emissions reduction, fuel savings, and lower maintenance costs. Automakers are embedding reducers into purpose-built EV platforms to enhance driving performance and efficiency.

The EV reducer market is also categorized by sales channels, including original equipment manufacturers (OEMs) and the aftermarket. OEMs dominated in 2024, accounting for 89% of total sales. Because reducers are core drivetrain components typically installed during vehicle assembly, OEMs play a pivotal role in market expansion. Global EV manufacturers such as Tesla, BYD, and Volkswagen are driving demand for custom-engineered reducers that meet strict performance benchmarks, fueling OEM-led growth across all regions.

The China Electric Vehicle Reducer Market contributed USD 163.9 million in 2024, reflecting the country’s leadership in EV production. China’s vertically integrated supply chain, massive production capabilities, and competitive pricing make it a global hub for EV component manufacturing, including reducers. The ability to fulfill high-volume orders quickly and cost-effectively positions China as a dominant player in the global market.

Key players in the global EV reducer market include ZF Friedrichshafen, BorgWarner Inc., Robert Bosch, Schaeffler AG, GKN Automotive, Magna International, and Nidec Corporation. These companies are heavily focused on technological innovation, developing next-generation reducers that deliver improved performance, longevity, and integration flexibility. Strategic collaborations with automakers allow them to tailor reducer systems for specific EV platforms, further solidifying their market position.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this electric vehicle reducer market report include:- Aichi Machine Industry

- BorgWarner

- GKN Automotive

- Hyundai Transys

- Jatco

- JTEKT

- Magna International

- Nidec Corporation

- Punch Powertrain

- Ricardo plc

- Robert Bosch

- RSB Global

- Schaeffler

- TATA Autocamp

- Valeo

- Vitesco Technologies

- ZF Friedrichshafen

- Zhejiang Wanliyang

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2025 |

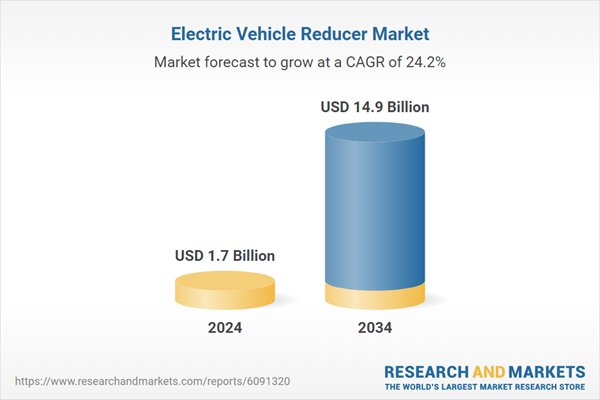

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 14.9 Billion |

| Compound Annual Growth Rate | 24.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |