In 2024, the segment for biohazard bags with a capacity of more than 35 gallons held the largest share, accounting for 48.2% of the total market. These large-capacity bags are preferred by facilities with high waste output, as they allow for more efficient collection and transportation. Reducing the number of smaller bags used not only cuts material costs but also simplifies logistical processes. Their ability to handle bulk waste makes them especially useful in large-scale operations where operational efficiency is critical. Facilities producing significant volumes of contaminated material such as surgical tools used PPE, and laboratory waste rely heavily on bags of this size to maintain compliance with hygiene and safety standards. The widespread preference for larger-capacity bags is also influenced by their role in streamlining waste handling and minimizing the frequency of waste collection.

When categorized by material, the market is dominated by polypropylene-based bags, which accounted for a 32.4% share in 2024. This material is favored for its high durability, chemical resistance, and exceptional strength under pressure. Polypropylene bags are especially useful in situations requiring sterilization, as they can withstand high temperatures commonly used in autoclaving. Their chemical resistance makes them ideal for containing biohazards without compromising structural integrity. In addition to being highly effective, these bags are cost-efficient to produce, allowing widespread use in environments where large quantities are consumed daily. Their ability to resist punctures and exposure to biological substances also makes them a go-to option for healthcare and research settings. As demands grow for reliable and compliant disposal methods, polypropylene continues to meet industry standards while supporting budget-conscious purchasing decisions.

From an end-use perspective, hospitals emerged as the leading consumers in 2024, representing 31.5% of the market. These facilities handle a constant influx of patients, generating various types of infectious waste that must be disposed of according to stringent regulations. Items such as used syringes, contaminated gloves, bandages, and other medical supplies are collected daily, making it essential for hospitals to rely on high-performance biohazard bags. In these settings, waste must be clearly segregated and managed to avoid health risks and environmental hazards. The demand from hospitals remains high due to the continuous generation of diverse waste streams, each requiring specialized containment solutions in compliance with safety guidelines. With their need for consistent, secure waste management, hospitals are the primary drivers of volume in the biohazard bags market.

In terms of regional performance, the United States led the North American market in 2024, with a revenue contribution of approximately USD 162.3 million. The country’s comprehensive healthcare infrastructure and strict enforcement of medical waste disposal laws are key contributors to this dominance. Domestic guidelines ensure that all biohazardous materials are disposed of in approved containers, pushing demand across hospitals, clinics, and labs. As the number of healthcare establishments continues to grow, so does the need for dependable disposal methods. The high frequency of medical interventions across the nation further fuels the requirement for secure and compliant waste management systems, making biohazard bags a staple across facilities.

Market competition remains strong, with a mix of international and domestic brands offering tailored solutions to meet evolving waste disposal needs. Industry leaders currently hold a combined market share of about 40%, competing on product quality, regulatory compliance, and price efficiency. Local manufacturers in emerging economies are pushing global players to provide affordable yet reliable products to retain market relevance. Customization, material innovation, and competitive pricing will continue to shape the strategic direction of key players in this sector.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this biohazard bags market report include:- Abdos Labtech

- Action Health

- Bel-Art Products

- Cole-Parmer Instrument Company

- Desco Medical

- Heathrow Scientific

- Lithey

- Medegen Medical Products

- Sharps Compliance

- Stericycle

- ThermoFisher Scientific

- Tilak Polypack

- Transcendia

- TUFPAK

- VWR International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | April 2025 |

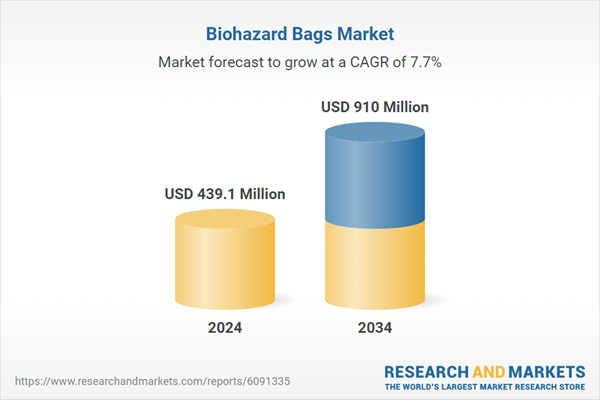

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 439.1 Million |

| Forecasted Market Value ( USD | $ 910 Million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |