More brands within the snail-based product landscape are prioritizing transparency and environmental responsibility to meet consumer demand. Clean-label packaging is no longer just a marketing strategy; it is a direct response to the call for simple, understandable ingredient lists and ethically sourced materials. Companies are moving toward biodegradable packaging, minimalist branding, and plastic-free materials to strengthen their commitment to sustainability. These choices reflect a broader shift where every aspect of production is scrutinized by mindful consumers who expect authenticity and environmental stewardship.

Eco-conscious production practices are setting new industry standards. Producers are adopting energy-efficient processes, cutting down on water consumption, and sourcing snails from sustainable farms. These moves resonate with a growing demographic that prioritizes low-impact, eco-friendly products across skincare, food, and agriculture sectors. Snail-based offerings are now seen as functional, responsible, and innovative, capturing attention in a crowded marketplace.

Helix Aspersa holds a strong foothold in the global snail market, valued at USD 325.9 million in 2024. Its soft, nutrient-dense flesh makes it a popular choice in culinary circles, while its mucin is highly sought after in cosmetics for its ability to promote skin repair and hydration. The surge in demand for natural skincare solutions continues to drive this segment, with snail mucin gaining mainstream appeal across both medical and personal care categories.

Among product forms, frozen snails generated USD 221.5 million in 2024 and are forecasted to grow at a CAGR of 8.2% through 2034. Fresh snails remain in demand in regions that value traditional cooking and local sourcing, while dried and canned varieties offer accessible options for areas with limited access to fresh supply. The rise of gourmet food culture and health-conscious eating habits is boosting demand across all formats.

The U.S. snail market brought in USD 34 million in 2024. Though still emerging, the sector is gaining strong traction, especially in premium skincare, where snail mucin is praised for its regenerative, hydrating, and anti-aging properties. Luxury beauty brands are rapidly expanding product lines to include snail extract-based serums, creams, and masks. Beyond cosmetics, the pharmaceutical sector is exploring snail-derived compounds for wound healing, scar treatment, and tissue regeneration.

Leading companies like Lumaca Italia, Escal S.A., Sabarot Wassner, Gaelic Escargot, and Bourgogne Escargots are leveraging strategic expansions, diversifying into skincare and nutrition, investing heavily in R&D for sustainable farming, tapping into niche gourmet markets, and strengthening export operations. Cross-industry collaborations and marketing initiatives centered on natural benefits are enhancing brand visibility and consumer loyalty across the globe.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this snail market report include:- Aspersa Snails International

- Bages Cargol S.L.

- Bourgogne Escargots

- Darvja Ltd

- ESCAL S.A.

- Gaelic Escargot

- LUMACA Italia

- Peconic Escargot

- Romanzini

- SABAROT WASSNER

- SC EGAN PROD SSRL

- UAB Gardumeli

Table Information

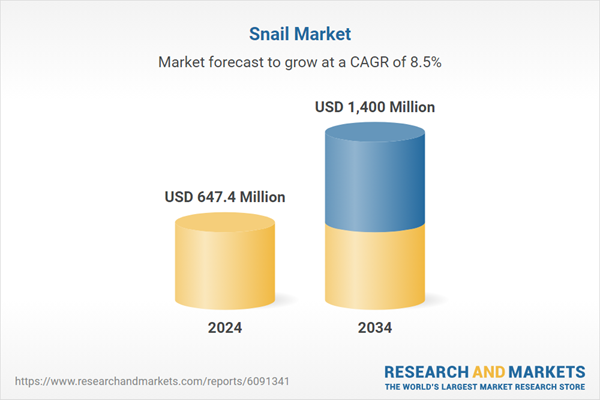

| Report Attribute | Details |

|---|---|

| No. of Pages | 263 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 647.4 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |