Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Focus on Worker Safety and Regulatory Compliance in Hazardous Industries

The wireless gas detection market is driven by the rising focus on workplace safety and stringent compliance requirements in high-risk sectors such as oil & gas, chemicals, and mining. These industries frequently encounter hazardous gas leaks that can result in health hazards, production downtime, or fatal incidents. Regulatory agencies like OSHA, EPA, and the European Union have enforced strict guidelines mandating the deployment of reliable gas detection systems. Wireless gas detectors offer distinct advantages over traditional systems, such as rapid deployment, mobility, and real-time monitoring in dynamic environments.Their ability to function without extensive wiring makes them ideal for temporary worksites or areas where infrastructure modification is difficult. These systems integrate with central safety controls and SCADA platforms, enhancing emergency response capabilities. As legal liabilities and safety expectations increase, businesses are investing in advanced wireless gas detection to ensure early warning, protect personnel, and comply with global safety standards. Industries contributing to over 60% of global workplace fatalities - including oil & gas and mining - are seeing heightened adoption of such safety technologies.

Key Market Challenges

Infrastructure Limitations and Connectivity Constraints in Harsh Environments

A notable challenge for the wireless gas detection market is ensuring consistent connectivity in environments that are physically and electrically complex. Industrial facilities like offshore platforms, chemical plants, and mines often present barriers such as metal obstructions, electromagnetic interference, and environmental extremities, which can impede wireless communication. The effectiveness of wireless systems relies on stable transmission via Wi-Fi, cellular, or mesh networks, but these can be unreliable in such settings. Signal degradation and latency can lead to delays or loss of critical gas detection alerts, compromising worker safety and regulatory compliance.In remote regions lacking telecom infrastructure, deploying a reliable wireless system demands considerable investment in networking hardware, which may deter small and mid-sized firms. Moreover, interference from co-located industrial wireless systems can cause data loss, while system maintenance requires specialized technical skills. These limitations sometimes lead stakeholders to prefer traditional wired systems, especially where failure is not acceptable. Bridging this gap necessitates innovation in rugged wireless technology and hybrid solutions that combine wired dependability with wireless scalability.

Key Market Trends

Proliferation of IIoT Integration and Real-Time Monitoring Capabilities

A key trend in the wireless gas detection market is the increasing integration of IIoT (Industrial Internet of Things) technologies to enhance real-time monitoring and predictive maintenance. As industries digitize operations, IIoT-enabled gas detectors are being used to transmit data to centralized control rooms, cloud-based platforms, and mobile devices, improving responsiveness and reducing the need for manual inspection. These smart systems enable remote tracking of gas levels, historical data analysis, and trend visualization. The deployment of edge computing and machine learning further allows predictive analytics for system diagnostics and maintenance alerts.In industries where even minor leaks can lead to major hazards - like oil & gas, mining, and utilities - such capabilities are critical for minimizing risk and operational disruptions. Wireless detectors are also increasingly compatible with other smart safety devices such as automated valves and shutdown systems, contributing to comprehensive, real-time safety monitoring and faster emergency response. As a result, IIoT integration is becoming central to the evolution of wireless gas detection systems in modern industrial infrastructure.

Key Market Players

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- Teledyne Technologies Incorporated

- Emerson Electric Co.

- Agilent Technologies, Inc.

- Siemens AG

- Pem-Tech Inc.

- 3M Company

- Ambetronics Engineers Pvt. Ltd.

- Tek Troniks Limited

Report Scope:

In this report, the Global Wireless Gas Detection Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Wireless Gas Detection Market, By Detection Technology:

- Electrochemical Sensors

- Catalytic Bead Sensors

- Infrared Sensors

- Photoionization Detectors

- Ultrasonic Sensors

Wireless Gas Detection Market, By Gas Type:

- Toxic Gases

- Combustible Gases

- Oxygen

- Refrigerants

- Specialty Gases

Wireless Gas Detection Market, By Application:

- Industrial Safety

- Environmental Monitoring

- Healthcare

- Transportation

- Oil & Gas

Wireless Gas Detection Market, By Portability:

- Fixed Systems

- Portable Detectors

- Wearable Detectors

Wireless Gas Detection Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wireless Gas Detection Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- Teledyne Technologies Incorporated

- Emerson Electric Co.

- Agilent Technologies, Inc.

- Siemens AG

- Pem-Tech Inc.

- 3M Company

- Ambetronics Engineers Pvt. Ltd.

- Tek Troniks Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2025 |

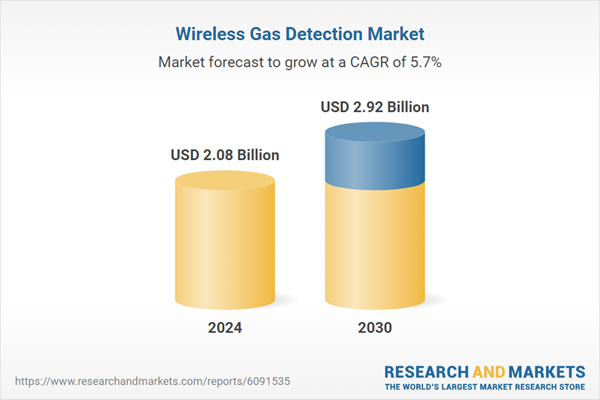

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.08 Billion |

| Forecasted Market Value ( USD | $ 2.92 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |