Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

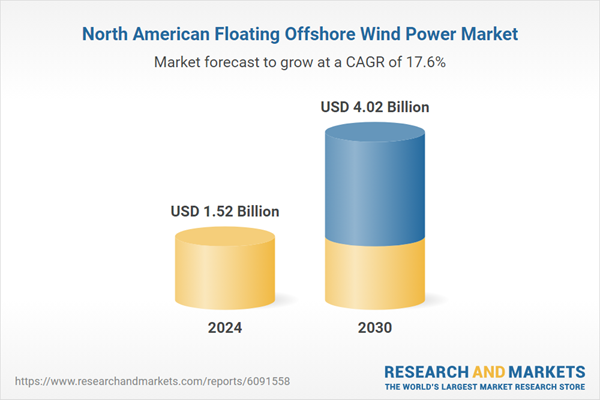

The United States aims to install 15 gigawatts of floating wind by 2035, and states like California and Oregon offer ideal conditions for development due to their deep coastal waters. Lower technology costs, improved turbine efficiency, and strategic investments in infrastructure and supply chains are accelerating commercialization. The transition from pilot to utility-scale projects, combined with over 2,000 gigawatts of estimated potential along the U.S. coastline, positions this market for exponential growth in the coming years.

Key Market Drivers

Regulatory Commitment to Renewable Energy Expansion

Government-backed climate action plans and clean energy mandates are significantly driving the growth of floating offshore wind in North America. Federal and state-level agencies in the U.S. and Canada are prioritizing this technology in their decarbonization strategies due to its ability to harness powerful wind resources in deep waters. Initiatives such as the U.S. Floating Offshore Wind Shot aim to cut costs by over 70% by 2035, signaling long-term policy support. Coastal states like California, Oregon, Maine, and Hawaii have enacted targets specifically favoring floating offshore installations. California, for instance, plans to deploy between 2 to 5 gigawatts by 2030. These regulatory measures provide market certainty, encourage investment, and de-risk project development, fostering a strong pipeline of upcoming installations.Key Market Challenges

High Capital Investment and Cost Uncertainty

The North America floating offshore wind sector faces significant challenges due to high capital intensity and uncertainties around long-term costs. Floating projects involve complex engineering for platforms, mooring systems, and flexible subsea cabling, all of which increase upfront expenses. As the market is still maturing, economies of scale and cost benchmarks have yet to be fully realized.Additional infrastructure requirements, including specialized ports and vessels, further elevate investment barriers. Financial institutions and developers often face difficulty in securing funding due to a lack of established revenue models, price stability, and long-term power agreements. The absence of standard metrics for project bankability, such as levelized cost of electricity and return on investment, adds to the risk. These factors collectively delay investment decisions and limit participation to only the most capital-rich players, slowing the pace of deployment.

Key Market Trends

Rising Interest in Deepwater Lease Auctions Along the Pacific Coast

A defining trend in the North America floating offshore wind market is the increasing participation in federal lease auctions, particularly for deepwater sites off the Pacific coast. States like California and Oregon, with steep continental shelves, are ideal for floating wind platforms. In response, federal agencies have launched lease sales specifically for floating offshore wind projects, drawing significant interest from multinational developers and clean energy investors. California, for example, has committed to several gigawatts of offshore wind by the early 2030s, most of which will rely on floating technologies. These lease initiatives are prompting accelerated planning around grid integration, transmission upgrades, and port readiness. As auction processes become more structured, they are catalyzing the formation of long-term project pipelines and aligning stakeholder efforts around permitting, infrastructure, and investment readiness.Key Market Players

- TotalEnergies SE

- RWE Renewables GmbH

- Ørsted A/S

- BP p.l.c.

- Shell plc

- Dominion Energy, Inc.

- Enel SpA

- General Electric Company

Report Scope:

In this report, the North America Floating Offshore Wind Power Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Floating Offshore Wind Power Market, By Water Depth:

- Shallow Water (Less Than 30 M Depth)

- Transitional Water (30 M to 60 M Depth)

- Deep Water (Higher Than 60 M Depth)

North America Floating Offshore Wind Power Market, By Turbine Capacity:

- Up to 3 MW

- 3-5 MW

- Above 5 MW

North America Floating Offshore Wind Power Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Floating Offshore Wind Power Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- TotalEnergies SE

- RWE Renewables GmbH

- Ørsted A/S

- BP p.l.c.

- Shell plc

- Dominion Energy, Inc.

- Enel SpA

- General Electric Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.52 Billion |

| Forecasted Market Value ( USD | $ 4.02 Billion |

| Compound Annual Growth Rate | 17.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |