Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

They are widely used in municipal water treatment, industrial processes, wastewater management, and commercial settings such as swimming pools and bottled water facilities. Key technologies include corona discharge, ultraviolet radiation, cold plasma, and electrolytic generation, with corona discharge remaining dominant due to its scalability and energy efficiency. Market growth is being driven by rising global demand for clean water, tightening water quality regulations, growing industrial water reuse, and environmental awareness. With freshwater resources under pressure and over 2 billion people lacking access to safely managed drinking water, ozone generators are playing a pivotal role in advancing sustainable water treatment solutions.

Key Market Drivers

Rising Global Demand for Clean and Safe Water

The increasing demand for clean, safe water across residential, municipal, and industrial applications is a major catalyst for the adoption of ozone-based treatment systems. As global population growth, urban expansion, and industrialization place unprecedented stress on water resources, the need for efficient and sustainable disinfection technologies has intensified.Ozone treatment offers an effective, chemical-free alternative to chlorine and other traditional disinfectants, eliminating a broad spectrum of pathogens while leaving no toxic residues. It also improves water quality by enhancing taste and reducing odors. In municipal applications, ozone helps deliver potable water while complying with stringent regulatory standards. Globally, around 2.2 billion people lack access to safely managed drinking water, and over 50% of the population faces water scarcity for part of the year. Ozone’s effectiveness - estimated to be 3,000 times more potent than chlorine - makes it especially suitable for high-performance water treatment amid escalating public health and environmental concerns.

Key Market Challenges

High Capital and Operational Costs Limiting Adoption in Developing Regions

Despite its numerous advantages, the high cost of acquiring and operating ozone generator systems remains a critical barrier to broader adoption, particularly in developing economies. Industrial and municipal-scale ozone generators require substantial capital investment due to the need for advanced materials and robust engineering that can withstand ozone’s corrosive nature.In addition, operational expenses, especially electricity consumption, are significant, as ozone generation requires continuous power input. These costs are compounded in regions with unstable power infrastructure or limited access to skilled technical personnel for maintenance and monitoring. As a result, municipalities and small enterprises in lower-income countries often opt for more affordable, albeit less effective, disinfection technologies. The need for specialized training, routine servicing, and monitoring to avoid ozone exposure adds to the operational burden, reducing the appeal of ozone generators where budgets and technical capabilities are limited.

Key Market Trends

Escalating Demand for Chemical-Free and Sustainable Water Disinfection Solutions

There is a marked global shift toward chemical-free and environmentally sustainable water treatment methods, and ozone generators are at the forefront of this trend. Ozone’s ability to disinfect without generating harmful byproducts such as trihalomethanes (THMs) makes it a highly attractive solution in light of growing regulatory scrutiny over water safety.Municipal utilities, industrial users, and commercial facilities are turning to ozone to comply with tightening environmental standards while delivering high-quality water. Furthermore, ozone’s effectiveness in improving water clarity and taste is driving adoption in applications such as bottled water production and public swimming pools. The rise in public health awareness, environmental concerns, and regulatory mandates is propelling demand for advanced disinfection technologies. As the market continues to evolve, the demand for scalable, energy-efficient ozone solutions that align with green treatment strategies is expected to grow significantly.

Key Market Players

- Ebara Technologies Inc.

- Chemtronics

- Faraday Ozone Products Pvt. Ltd.

- Lenntech

- Mitsubishi Electric Corporation

- Ozonetek Limited

- Ozone Solutions

- Primozone Production AB

- SUEZ SA

- Toshiba Corporation

Report Scope:

In this report, the Global Water Treatment Ozone Generator Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Water Treatment Ozone Generator Market, By Technology:

- Ultraviolet

- Cold Plasma

- Corona Discharge

- Electrolytic

Water Treatment Ozone Generator Market, By Application:

- Wastewater Treatment

- Air Treatment

Water Treatment Ozone Generator Market, By End-User:

- Municipal

- Commercial

Water Treatment Ozone Generator Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Water Treatment Ozone Generator Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ebara Technologies Inc.

- Chemtronics

- Faraday Ozone Products Pvt. Ltd.

- Lenntech

- Mitsubishi Electric Corporation

- Ozonetek Limited

- Ozone Solutions

- Primozone Production AB

- SUEZ SA

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | May 2025 |

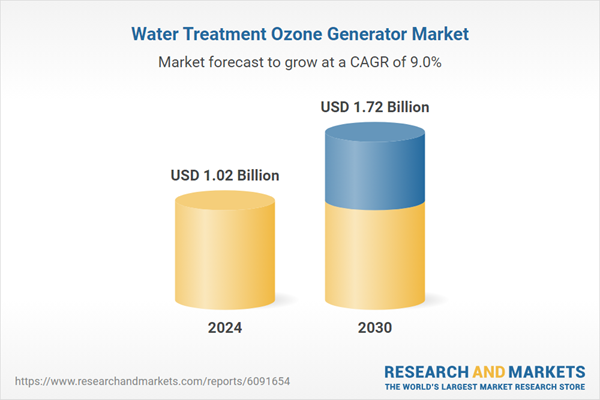

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.02 Billion |

| Forecasted Market Value ( USD | $ 1.72 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |