Miniaturization of Temperature Sensors Fuels North America Temperature Sensor Market

Miniaturized devices play a crucial role in monitoring and controlling temperature in a wide range of applications such as medical, wearables, diagnostics, and automotive. Advancements in microelectromechanical systems (MEMS) and nanotechnology have enabled the development of smaller and more precise temperature sensors. These technologies allow seamless integration of temperature-sensing capabilities into smaller devices without hampering accuracy and reliability. Furthermore, market players are highly adopting advanced technologies and entering partnerships to meet industry-specific requirements. For instance, in May 2022, Heraeus Holding collaborated with accensors GmbH to jointly develop solutions that support the miniaturization trend.The companies are planning to integrate miniaturized temperature sensors into film sensors to increase measurement accuracy. Moreover, the emergence of numerous other industries, including agriculture and environment monitoring, has surged the demand for miniaturized temperature sensors for monitoring soil conditions and climate change indicators. Thus, the rising demand for miniaturized temperature sensors is projected to drive the market soon.

North America Temperature Sensor Market Overview

The data center industry in North America has witnessed continued demand and growth in recent years. This growth in the data center industry in North America was majorly attributed to the substantial rise in demand from cloud providers. In the US, Texas, North California, and certain areas of San Antonio registered relatively higher cloud activity. However, the overall absorption and demand for data centers in the US and other prominent countries is growing. Various companies are launching new data centers in the region. For instance, in April 2023, Equinix announced plans to construct a new data center in Montreal, Canada.Also, in November 2023, Vertiv introduced Vertiv SmartMod Max CW, a prefabricated modular data center designed to address the growing demand for rapid deployment of computing. Temperature sensors continuously monitor the ambient temperature in different areas of the data center. Thus, with the increasing data centers, the demand for temperature sensors is also growing in the region.

The automotive industry in the region is growing significantly, boosting the demand for temperature sensors. The governments in the region are increasing their investments to boost their automotive manufacturing industry. In January 2021, the US President announced the plan to strengthen the US manufacturing sector under the "Made in America" initiative, which focused on making the manufacturing sector technologically advanced and automated. He announced an investment of US$ 300 billion for the R&D and inclusion of advanced technologies to boost the country's production output, focusing on electric vehicle production.

To meet the growing demand for temperature sensors in electric vehicles, various companies are launching new temperature sensors for the automotive industry in the region. For instance, in October 2023, in an ongoing effort to expand its product offering for the North American automotive aftermarket, AISIN introduced its OES Engine Coolant Temperature Sensors. The new products were unveiled at the 2023 AAPEX Show in Las Vegas. Thus, the temperature sensor market is growing significantly in North America.

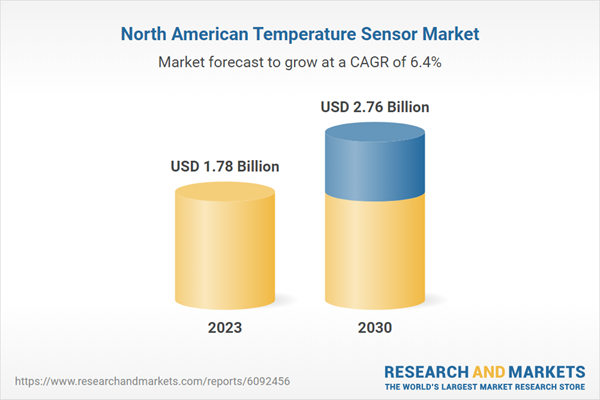

North America Temperature Sensor Market Revenue and Forecast to 2030 (US$ Million)

North America Temperature Sensor Market Segmentation

The North America temperature sensor market is categorized into type, connectivity, end user, and country.- Based on type, the North America temperature sensor market is segmented into thermocouple, resistance temperature detectors (RTD), thermistor, infrared, and others. The thermocouple segment held the largest share of North America temperature sensor market share in 2023.

- In terms of connectivity, the North America temperature sensor market is bifurcated into wired and wireless. The wired segment held a larger share of North America temperature sensor market in 2023.

- By end users, the North America temperature sensor market is segmented into semiconductor manufacturing, healthcare & pharma, food and beverage, data center, aerospace, energy & utilities, and others. The semiconductor manufacturing segment held the largest share of North America temperature sensor market in 2023.

- By country, the North America temperature sensor market is segmented into the US, Canada, and Mexico. The US dominated the North America temperature sensor market share in 2023.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America temperature sensor market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America temperature sensor market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America temperature sensor market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Temperature Sensor Market include:- Texas Instruments Inc.

- Siemens Ltd.

- TE Connectivity Ltd.

- Amphenol LTW Ltd.

- Analog Devices Inc.

- Emerson Electric Co.

- Microchip Technology Inc.

- Panasonic Corporation

- Honeywell International, Inc.

- NXP Semiconductors N.V

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | March 2025 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 1.78 Billion |

| Forecasted Market Value ( USD | $ 2.76 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | North America |

| No. of Companies Mentioned | 11 |