Social Media Influence and Celebrity Endorsement Fuel South & Central America Cosmetic Preservatives Market

Market players increasingly prefer social media platforms to promote their skincare and makeup products instead of traditional commercial advertising. YouTube videos and celebrity promotions on Instagram, Twitter, Facebook, and various other social media platforms have significantly impacted the demand for skincare and makeup products across the globe. Skincare influencers on Instagram, including skin doctors or dermatologists, natural and organic skincare promoters, and skincare routine professionals, upload a wide diversity of content on their accounts, which further influences consumers to buy cosmetics and personal care products.They share daily skincare rituals, reviews on various products they use, tips and tricks on how to apply products optimally, and trusted brand endorsements and recommendations. Further, social media influencers collaborate with skincare and cosmetic brands. As a result, influencers are becoming conduits for customer feedback, shaping brand perception.

Various celebrities across the globe own their own skincare and makeup brands, such as Rare Beauty by Selena Gomez, Fenty by Rihanna, Honest Beauty by Jessica Alba, Pattern by Tracee Ellis Ross, and Kylie Cosmetics by Kylie Jenner. The past four years have seen an increase in the number of celebrities launching their own brands. In June 2023, Beyoncé revealed on Instagram that she is starting a hair care product line in the coming years.

Thus, the rising influence of social media platforms and celebrity endorsement is expected to create a huge opportunity for the cosmetic preservatives market growth during the forecast period.

South & Central America Cosmetic Preservatives Market Overview

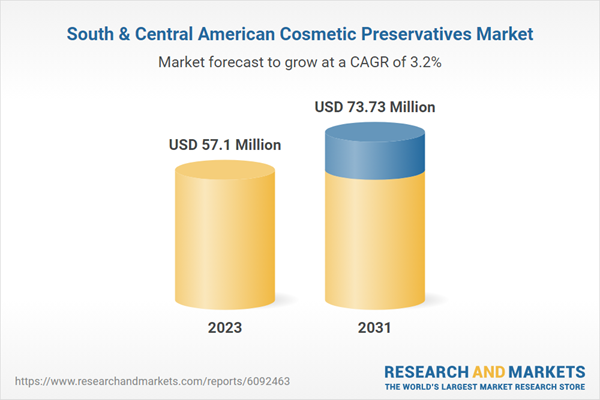

The cosmetic industry in Brazil is one of the largest industries worldwide. The industry encompasses an array of products such as skincare, hair care, perfumes and deodorants, makeup, etc. The Brazilian culture highly emphasizes beauty, making grooming and cosmetic products a part of their daily lifestyle. The cosmetic industry in Brazil capitalizes on this culture and offers customized products that suit different hair types and skin tones of consumers. In addition, there is a global trend of natural and organic cosmetic products, which leads to a rise in consumption and demand for cosmetic products produced with natural preservatives in the country.South & Central America Cosmetic Preservatives Market Revenue and Forecast to 2031 (US$ Million)

South & Central America Cosmetic Preservatives Market Segmentation

The South & Central America cosmetic preservatives market is categorized into source, product type, application, and country.By source, the South & Central America cosmetic preservatives market is bifurcated into natural and synthetic. The synthetic segment held a larger share of the South & Central America cosmetic preservatives market share in 2023.

- In terms of product type, the South & Central America cosmetic preservatives market is segmented into parabens, formaldehyde releasers, organic acids, quaternary compounds, phenol derivatives, alcohols, and others. The organic acids segment held the largest share of the South & Central America cosmetic preservatives market share in 2023.

- Based on application, the South & Central America cosmetic preservatives market is segmented into hair care, skin care, makeup products, toiletries, perfumes and deodorants, and others. The skin care segment held the largest share of the South & Central America cosmetic preservatives market share in 2023.

- Based on country, the South & Central America cosmetic preservatives market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil segment held the largest share of South & Central America cosmetic preservatives market in 2023.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South & Central America cosmetic preservatives market.

- Highlights key business priorities to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the South & Central America cosmetic preservatives market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth South & Central America market trends and outlook coupled with the factors driving the South & Central America cosmetic preservatives market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the South & Central America Cosmetic Preservatives Market include:- Akema S.R.L.

- Ashland Inc

- BASF SE

- Clariant AG

- Evonik Industries AG

- Lanxess AG

- Symrise AG

- Celanese Corp

- Tate & Lyle Plc

- INEOS Group Holdings SA

- Biosynth AG

- Valtris Specialty Chemicals Inc

- Sharon group

- CHEMIPOL, S.A.

- SEIWA KASEI Co, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 164 |

| Published | March 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 57.1 Million |

| Forecasted Market Value ( USD | $ 73.73 Million |

| Compound Annual Growth Rate | 3.2% |

| No. of Companies Mentioned | 15 |