Rising Demand for Liquid Nitrogen in Food & Beverages Industry Drives Europe Liquid Nitrogen Market

The growing food & beverages industry across various economies boosts the demand for liquid nitrogen. In the food & beverages sector, liquid nitrogen is majorly used to chill, freeze, cool, and preserve products. It is utilized in freezing baked goods, meat, poultry, and fish, along with prepared foods, fruits, and vegetables, while retaining their original color, scent, and flavor. Preservation involves cooling the food product or freezing it with the help of liquid nitrogen, thereby improving the product’s shelf-life. It is also used for storage and transportation of perishable food products.Compared to traditional mechanical freezers, liquid nitrogen has minimal adverse environmental effects and requires limited initial equipment investment. Moreover, the adoption of cryogenic freezing in the food & beverages industry is increasing due to growing concerns over the safety of food products. Cryogenic freezing does not affect the final product's quality and is more environmentally friendly and time efficient. Cryogenic freezing system use liquid nitrogen as the refrigerant. Thus, the preference for liquid nitrogen among various food and beverage manufacturers is increasing owing to the rising adoption of cryogenic freezing.

Additionally, liquid nitrogen infusions are one of the latest eye-catching food trends. With the ability to create fog-like effects and flash-freeze foods, liquid nitrogen has recently found applications in ice cream, snacks, and cocktails. Moreover, as per the Food & Drink Federation, the food & beverages industry is the biggest manufacturing sector in the UK; the food and beverage output increased by 8% in 2022 from 2021. Also, Russia has become the eighth largest market for processed food, with a trading volume of 27.5 metric tons, and drinks (alcoholic and soft), with a trading volume of 26 billion liters, as per the International Trade Administration (ITA). The increased volume shows significant demand for food and beverages across various countries.

Europe Liquid Nitrogen Market Overview

The growing demand from the metal fabrication and steel industries drives the Europe liquid nitrogen market. During the metal fabrication process, liquid nitrogen is used in steel production as a carrier and purge gas. Liquid nitrogen is a key component in the heat-treating process and is used to prevent oxidation during steel production. According to the European Steel Association, Europe is among the largest producers of steel. For instance, the region produces approximately 152 metric tons of steel annually. The region registered over 500 steel production facilities across the 22 European Member States as of 2023.Moreover, according to the American Frozen Food Institute, in 2022, frozen food sales increased by 8.6% to reach US$ 72.2 billion. Liquid nitrogen plays a vital role in the freezing and cooling of food products, which helps produce Individually Quick Frozen (IQF) foods. It also reduces spoilage of the frozen food products. Thus, the increasing consumption of frozen foods propels the demand for liquid nitrogen in Europe.

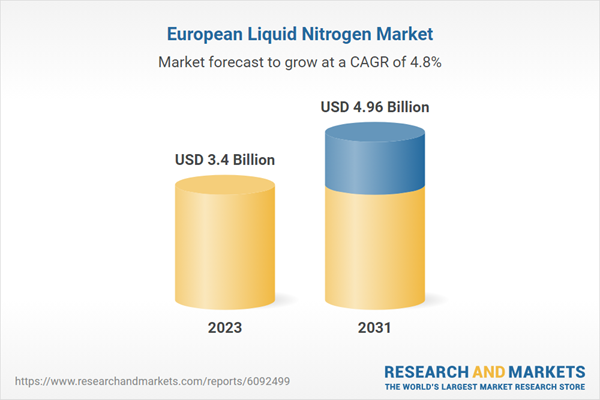

Europe Liquid Nitrogen Market Revenue and Forecast to 2031 (US$ Million)

Europe Liquid Nitrogen Market Segmentation

The Europe liquid nitrogen market is categorized into manufacturing method, end-use industry, and country.- Based on manufacturing method, the Europe liquid nitrogen market is bifurcated into cryogenic distillation and pressure swing adsorption. The cryogenic distillation segment held a larger Europe liquid nitrogen market share in 2023.

- In terms of end-use industry, the Europe liquid nitrogen market is segmented into aerospace and defense, automotive, chemical, food and beverage, metal fabrication, pharmaceutical, electronics and semiconductors, and others. The metal fabrication segment held the largest Europe liquid nitrogen market share in 2023.

- By country, the Europe liquid nitrogen market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe liquid nitrogen market share in 2023.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe liquid nitrogen market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe liquid nitrogen market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe liquid nitrogen market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Europe Liquid Nitrogen Market include:- Linde Plc

- L'Air Liquide SA

- Air Products and Chemicals Inc

- SOL SpA

- Praxair Technology Inc

- Nippon Sanso Holdings Corp

- Ube Corporation

- Air Water Inc

- Osaka Gas Co Ltd

- Messer SE & Co KGaA

- Matheson Tri-Gas, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | March 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.96 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 12 |