Rapid Growth in Residential Construction Sector Fuels North America One-Component Polyurethane Foam Market

Within residential construction, the versatility of one-component polyurethane (polyurethane) foam extends beyond insulation to other applications such as sealing, bonding, and filling. It is commonly used to seal gaps around windows and doors, adhere to drywall panels, fill voids in concrete structures, and soundproof interior spaces. The ability of one-component polyurethane foam to provide reliable adhesion, moisture resistance, and durability makes it a valuable asset in ensuring the structural integrity and longevity of residential buildings. As urbanization and population continue to surge globally, there is an increasing demand for housing, leading to a significant uptick in residential construction activities. Several government bodies across different countries support the development of the residential construction sector.Therefore, various government-supportive measures for the development of the residential construction sector are leading to an increase in residential construction activities. This is creating demand for different construction materials, thereby driving the one-component polyurethane foam market growth.

North America One-Component Polyurethane Foam Market Overview

One-component polyurethane foam, a versatile material, finds applications in diverse industries such as automotive, construction, and electronics. Its ability to provide insulation, seal gaps, and adhere to various surfaces makes it indispensable in modern manufacturing and construction practices. In the construction sector, the demand for energy-efficient solutions is propelling the adoption of one-component polyurethane foam.According to a report released by the US Census Bureau, the value of total construction (private and public) investment in 2023 was US$ 1.97 trillion, a 7% increase from investments in 2022 of US$ 1.84 trillion. As energy efficiency regulations become more stringent, builders and homeowners alike are turning to polyurethane foam as an effective solution for thermal insulation in residential and commercial buildings. Its ability to seal gaps and cracks efficiently and ease of application make it an attractive option for insulation projects.

The expanding automotive industry is fueling the growth of the one-component polyurethane foam market in North America. In the region, passenger vehicles are the most common mode of transportation, and their use is increasing with the rise in per capita income. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in North America increased by 20%, from ~14.8 million in 2022 to 16.2 million vehicles in 2023.

The increasing demand for comfort and noise reduction in vehicles from consumers has encouraged automakers to increase the use of polyurethane foam for soundproofing and vibration damping purposes. Additionally, the lightweight nature of polyurethane foam contributes to improved fuel efficiency, aligning with the industry's focus on sustainability and environmental responsibility. Thus, the North America market for one-component polyurethane (polyurethane) foam is anticipated to witness significant growth in the coming years.

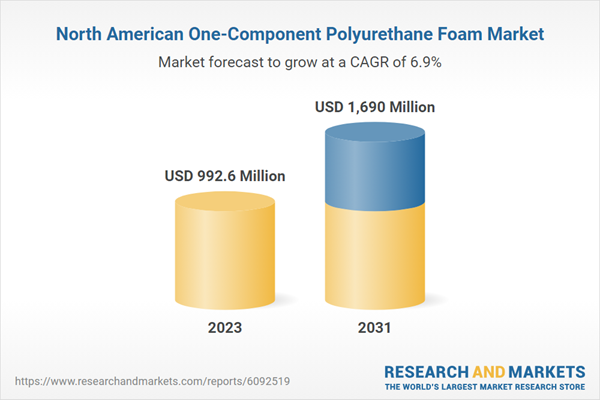

North America One-Component Polyurethane Foam Market Revenue and Forecast to 2031 (US$ Million)

North America One-Component Polyurethane Foam Market Segmentation

The North America one-component polyurethane foam market is categorized into raw material, application, end use, and country.- Based on raw material, the North America one-component polyurethane foam market is divided into methylene diphenyl diisocyanate, toluene diisocyanate, polyether polyols, polyester polyols, and others. The polyether polyols segment held the largest North America one-component polyurethane foam market share in 2023.

- In terms of application, the North America one-component polyurethane foam market is segmented into construction, insulation, packaging, automotive, and others. The construction segment held the largest North America one-component polyurethane foam market share in 2023.

- By end use, the North America one-component polyurethane foam market is bifurcated into residential and commercial. The residential segment held a larger North America one-component polyurethane foam market share in 2023.

- By country, the North America one-component polyurethane foam market is segmented into the US, Canada, and Mexico. The US dominated the North America one-component polyurethane foam market share in 2023.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America one-component polyurethane foam market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America one-component polyurethane foam market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America one-component polyurethane foam market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America One-Component Polyurethane Foam Market include:- Henkel AG & Co KGaA

- Sika AG

- The Dow Chemical Co

- BASF SE

- Huntsman Corp

- Industrial Products LTD.

- Selena Group

- Tremco CPG Inc.

- Soudal Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | March 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 992.6 Million |

| Forecasted Market Value ( USD | $ 1690 Million |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |