The automotive exhaust systems market plays a crucial role in reducing vehicle emissions and improving fuel efficiency. Modern exhaust systems are designed not only to minimize harmful pollutants but also to optimize engine performance and contribute to a quieter driving experience. As environmental regulations become more stringent, manufacturers are investing heavily in advanced exhaust technologies to meet compliance requirements.

Recent developments include the integration of components such as catalytic converters, particulate filters, and selective catalytic reduction (SCR) systems. These innovations enable vehicles to meet Euro 6, Tier 3, and other global emissions standards while maintaining performance and fuel economy. Additionally, lightweight materials and advanced manufacturing techniques are helping to reduce the overall weight of exhaust systems, further enhancing vehicle efficiency.

Despite these advancements, the market faces challenges such as the transition to electric vehicles (EVs) and fluctuating raw material prices. While exhaust systems remain essential for internal combustion engine (ICE) vehicles, the growing adoption of EVs may reduce overall demand. However, the continued presence of hybrid vehicles and the need for emissions reduction in developing regions are expected to sustain the market in the near term.

Key Insights Automotive Exhaust Systems Market

One notable trend in the automotive exhaust systems market is the adoption of lightweight materials and modular designs. Using materials such as aluminum and advanced composites helps reduce the overall weight of the system, improving fuel efficiency and performance. Modular designs also simplify manufacturing and assembly, allowing for greater flexibility and cost savings.Another trend is the increasing use of advanced emissions control technologies. For instance, selective catalytic reduction (SCR) systems and gasoline particulate filters (GPFs) are becoming more prevalent in both passenger cars and commercial vehicles. These technologies help meet stringent emissions standards and support the shift toward cleaner transportation.

Stringent emissions regulations are a primary driver of the automotive exhaust systems market. Governments around the world are implementing tougher standards to combat air pollution and reduce greenhouse gas emissions. As a result, automakers and suppliers are investing in advanced exhaust technologies that ensure compliance while maintaining vehicle performance.

Another significant driver is the growing demand for fuel-efficient vehicles. Consumers and manufacturers alike are prioritizing efficiency to lower fuel costs and reduce carbon footprints. Advanced exhaust systems, which contribute to improved engine performance and reduced emissions, are essential components of modern fuel-efficient vehicles.

The transition to electric vehicles presents a major challenge for the automotive exhaust systems market. As EV adoption increases, the demand for traditional exhaust components is expected to decline. However, the market may find opportunities in hybrid vehicles and emerging markets where internal combustion engines remain prevalent.

Another challenge is the rising cost of raw materials. Fluctuating prices for metals and other materials can impact production costs and profitability. Additionally, maintaining compliance with evolving emissions standards requires ongoing investment in R&D and testing. Manufacturers must navigate these challenges while continuing to innovate and deliver cost-effective, high-performance exhaust solutions.

Automotive Exhaust Systems Market Segmentation

By Technology- Diesel Oxidation Catalyst (DOC)

- Diesel Particulate Filter (DPF)

- Selective Catalytic Reduction (SCR)

- Exhaust Gas Recirculation (EGR)

- Gasoline Particulate Filter (GPF)

- Other Technologies

- Passenger Cars

- Light Commercial Vehicle

- Truck and Bus

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA.

Automotive Exhaust Systems Market Analytics

The research analyses various direct and indirect forces that can impact the Automotive Exhaust Systems market supply and demand conditions. The parent market, derived market, intermediaries’ market are analyzed to evaluate the full supply chain and possible alternatives and substitutes. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Automotive Exhaust Systems market projections.Recent deals and developments are considered for their potential impact on Automotive Exhaust Systems's future business. Other metrics analyzed include Threat of New Entrants, Threat of Substitutes, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Automotive Exhaust Systems Market.

Automotive Exhaust Systems trade and price analysis helps comprehend Automotive Exhaust Systems's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Automotive Exhaust Systems price trends and patterns, and exploring new Automotive Exhaust Systems sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Automotive Exhaust Systems market.

Automotive Exhaust Systems Market Competitive Intelligence

The proprietary company revenue and product analysis model unveils the Automotive Exhaust Systems market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Automotive Exhaust Systems products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Automotive Exhaust Systems market update to stay ahead of the competition.Company offerings in different segments across Asia-Pacific, Europe, Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Automotive Exhaust Systems market. The competition analysis enables the user to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Your Takeaways From this Report

- Global Automotive Exhaust Systems market size and growth projections (CAGR), 2024 - 2034

- Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Automotive Exhaust Systems.

- Automotive Exhaust Systems market size, share, and outlook across 5 regions and 27 countries, 2024 - 2034.

- Automotive Exhaust Systems market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2024 - 2034.

- Short and long-term Automotive Exhaust Systems market trends, drivers, restraints, and opportunities.

- Porter’s Five Forces analysis, Technological developments in the Automotive Exhaust Systems market, Automotive Exhaust Systems supply chain analysis.

- Automotive Exhaust Systems trade analysis, Automotive Exhaust Systems market price analysis, Automotive Exhaust Systems Value Chain Analysis.

- Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

- Latest Automotive Exhaust Systems market news and developments.

Region-level intelligence includes

- North America Automotive Exhaust Systems Market Size, Share, Growth Trends, CAGR Forecast to 2034

- Europe Automotive Exhaust Systems Market Size, Share, Growth Trends, CAGR Outlook to 2034

- Asia-Pacific Automotive Exhaust Systems Industry Data, Market Size, Competition, Opportunities, CAGR Forecast to 2034

- The Middle East and Africa Automotive Exhaust Systems Industry Data, Market Size, Competition, Opportunities, CAGR Forecast to 2034

- South and Central America Automotive Exhaust Systems IndustryIndustry Data, Market Size, Competition, Opportunities, CAGR Forecast to 2034

The report will be updated to the latest month and delivered in 3 working days

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Benteler International AG

- Continental AG

- Eberspacher Group

- Faurecia SE

- Friedrich Boysen GmbH & Co. KG

- Tenneco Inc.

- MagnaFlow

- Borla Performance Industries

- Bosal Industries Limited

- Sejong Industrial Co. Ltd.

- Yutaka Giken Co. Ltd.

- Sango Co. Ltd.

- Futaba Industrial Co. Ltd.

- Kolbenschmidt Pierburg AG

- Delphi Technologies

- Tata AutoComp Systems Limited

- Eminox Ltd.

- Calsonic Kansei Corporation

- AP Exhaust Products Inc.

- Sankei Giken Kogyo Co. Ltd.

- Motus Integrated Technologies

- Meritor Inc.

- Sharda Motor Industries Ltd.

- Johnson Matthey plc

- Arvin Sango Inc.

- CECO Environmental Corporation

- Flowmaster Inc.

- Dynomax Inc.

- Crown

- Katcon SA de CV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

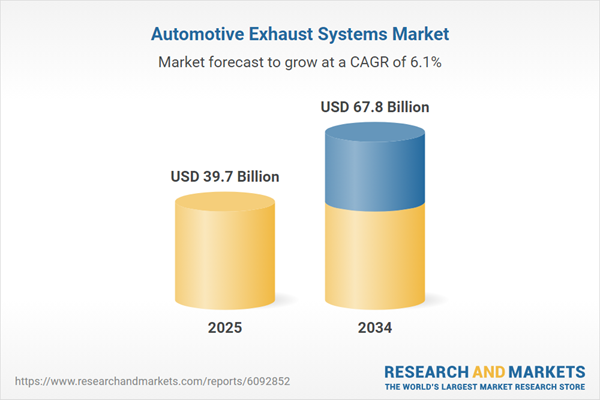

| Forecast Period | 2025 - 2034 |

| Estimated Market Value in 2025 | 39.7 Billion |

| Forecasted Market Value by 2034 | 67.8 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |