The Maritime Satellite Communication Market plays a foundational role in enabling global connectivity across oceans for commercial shipping, offshore platforms, defense fleets, and recreational vessels. It delivers critical services such as real-time navigation, weather updates, crew welfare communications, IoT data exchange, and emergency response support.

Maritime SATCOM systems - built on geostationary (GEO), medium-earth (MEO), and low-earth orbit (LEO) satellite networks - offer voice, broadband internet, and secure data links in remote sea regions. With the rise of digital shipping, autonomous operations, and ESG mandates for emission monitoring, satellite communications are no longer optional but integral to efficient and safe maritime operations. The market is growing rapidly as vessel operators seek high-throughput, low-latency connectivity to power next-gen digital tools.

In 2024, the maritime satellite communication market experienced a strong uptick in adoption driven by the expansion of LEO constellations from companies like Starlink and OneWeb. These networks brought affordable, high-speed internet to previously underserved maritime corridors. Shipping companies upgraded their fleets with dual-band antennas and SD-WAN systems to ensure seamless connectivity.

Meanwhile, offshore rigs and cruise liners implemented advanced SATCOM solutions for onboard IoT systems, passenger entertainment, and predictive maintenance. Cybersecurity enhancements were also in focus, with encrypted channels and intrusion detection systems gaining priority. Regulatory compliance with IMO requirements for digital reporting and crew safety communications further spurred demand, especially in commercial and defense maritime sectors.

Looking ahead to 2025 and beyond, the maritime SATCOM market is expected to be reshaped by multi-orbit connectivity, AI-powered bandwidth optimization, and integration with autonomous vessel systems. LEO-MEO-GEO hybrid solutions will enable uninterrupted communication regardless of sea location or weather conditions. SATCOM vendors will bundle their services with IoT analytics, remote asset management, and real-time vessel diagnostics.

As autonomous ship trials scale up, ultra-low latency and edge processing capabilities via satellite will be critical. Governments will also use SATCOM for maritime domain awareness and surveillance. With green shipping mandates increasing, satellite communication will support continuous emissions reporting and ESG monitoring. Vendors offering scalable bandwidth plans, cybersecurity, and global customer support will dominate the future market landscape.

Key Insights Maritime Satellite Communication Market

- The proliferation of LEO satellite constellations is transforming maritime connectivity, offering faster, more reliable internet for shipping routes, offshore platforms, and remote exploration vessels at reduced costs.

- Multi-orbit satellite communication systems combining GEO, MEO, and LEO networks are becoming increasingly popular, ensuring consistent uptime and seamless data transmission even in polar and equatorial regions.

- Cybersecurity is a growing priority in SATCOM systems as vessels become more connected; encrypted communications, firewall integration, and secure data tunnels are being adopted to prevent cyberattacks on critical maritime infrastructure.

- Crew welfare initiatives are driving the adoption of broadband internet services for video calls, entertainment, and online education on long voyages, improving mental health and retention for seafarers.

- SATCOM systems are being integrated with real-time emissions monitoring, E-logbooks, and compliance platforms to support environmental reporting and meet IMO and regional regulatory requirements.

- Rising demand for real-time navigation, cargo monitoring, and digital compliance tools is pushing maritime operators to adopt high-speed satellite communication solutions across vessel classes and regions.

- Growth of offshore energy projects and remote maritime operations is increasing the need for reliable communication infrastructure to ensure worker safety, logistics coordination, and emergency preparedness.

- Expansion of global trade and longer shipping routes are driving investments in SATCOM systems that enable uninterrupted voice and data communication across open oceans and during multi-week voyages.

- Increasing reliance on onboard digital systems - including autonomous navigation and remote diagnostics - is making high-bandwidth satellite communication indispensable to modern vessel operations.

- High initial installation and subscription costs for advanced SATCOM equipment can deter small and medium-sized shipping companies from adopting these solutions, despite their long-term benefits.

- Bandwidth congestion and signal degradation in high-traffic maritime corridors or during adverse weather can limit the reliability and performance of SATCOM systems without robust multi-network failover mechanisms.

Maritime Satellite Communication Market Segmentation

By Type- Mobile Satellite Communication

- Very Small Aperture Terminal (VSAT)

- Solution

- Service

- Merchant Shipping

- Fishing

- Passenger Ships

- Leisure Vessel

- Offshore

- Government

- Other End-Users

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA.

Maritime Satellite Communication Market Analytics

The research analyses various direct and indirect forces that can impact the Maritime Satellite Communication market supply and demand conditions. The parent market, derived market, intermediaries’ market are analyzed to evaluate the full supply chain and possible alternatives and substitutes. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Maritime Satellite Communication market projections.Recent deals and developments are considered for their potential impact on Maritime Satellite Communication's future business. Other metrics analyzed include Threat of New Entrants, Threat of Substitutes, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Maritime Satellite Communication Market.

Maritime Satellite Communication trade and price analysis helps comprehend Maritime Satellite Communication's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist our clients in planning procurement, identifying potential vendors/clients to associate with, understanding Maritime Satellite Communication price trends and patterns, and exploring new Maritime Satellite Communication sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Maritime Satellite Communication market.

Maritime Satellite Communication Market Competitive Intelligence

The proprietary company revenue and product analysis model unveils the Maritime Satellite Communication market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Maritime Satellite Communication products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give our clients the Maritime Satellite Communication market update to stay ahead of the competition.Company offerings in different segments across Asia-Pacific, Europe, Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Maritime Satellite Communication market. The competition analysis enables the user to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Your Takeaways From this Report

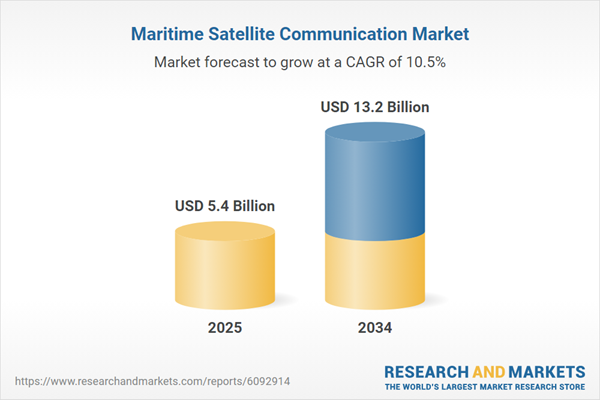

- Global Maritime Satellite Communication market size and growth projections (CAGR), 2024 - 2034

- Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Maritime Satellite Communication.

- Maritime Satellite Communication market size, share, and outlook across 5 regions and 27 countries, 2024 - 2034.

- Maritime Satellite Communication market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2024 - 2034.

- Short and long-term Maritime Satellite Communication market trends, drivers, restraints, and opportunities.

- Porter’s Five Forces analysis, Technological developments in the Maritime Satellite Communication market, Maritime Satellite Communication supply chain analysis.

- Maritime Satellite Communication trade analysis, Maritime Satellite Communication market price analysis, Maritime Satellite Communication Value Chain Analysis.

- Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

- Latest Maritime Satellite Communication market news and developments.

Region-level intelligence includes

- North America Maritime Satellite Communication Market Size, Share, Growth Trends, CAGR Forecast to 2034

- Europe Maritime Satellite Communication Market Size, Share, Growth Trends, CAGR Outlook to 2034

- Asia-Pacific Maritime Satellite Communication Industry Data, Market Size, Competition, Opportunities, CAGR Forecast to 2034

- The Middle East and Africa Maritime Satellite Communication Industry Data, Market Size, Competition, Opportunities, CAGR Forecast to 2034

- South and Central America Maritime Satellite Communication IndustryIndustry Data, Market Size, Competition, Opportunities, CAGR Forecast to 2034

The report will be updated to the latest month and delivered in 3 working days

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Inmarsat Global Limited

- Iridium Communications Inc.

- Thuraya Telecommunications Company

- Viasat Inc.

- Hughes Network Systems LLC

- KVH Industries Inc.

- ORBCOMM Inc.

- NSSLGlobal Limited

- Marlink SAS

- EchoStar Corporation

- Cobham SATCOM

- SES S.A.

- Speedcast International Limited

- ST Engineering iDirect

- Kongsberg Maritime AS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value in 2025 | 5.4 Billion |

| Forecasted Market Value by 2034 | 13.2 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |