Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This shift has significantly influenced product development and marketing strategies across the industry. The expanding middle class and rising disposable incomes further support demand for both functional and fashionable baby clothing. E-commerce continues to gain momentum, offering convenience and a broader selection, making it an increasingly dominant distribution channel. According to the 2023 Australia Post eCommerce Industry Report, over 5.6 million households in Australia made monthly online purchases, underscoring the digital pivot in consumer shopping habits.

Key Market Drivers

Growing Awareness of Eco-Friendly and Sustainable Products

Sustainability has emerged as a key growth driver in the Australia Baby Apparel Market. Increasingly eco-conscious parents are choosing baby clothing made from organic and environmentally friendly materials. Concerns about environmental degradation and carbon emissions are prompting a preference for textiles such as organic cotton, bamboo, and recycled polyester. These fabrics not only reduce the ecological footprint but also provide gentle and safe alternatives for infants’ sensitive skin.Australian consumers are increasingly aligning their purchasing habits with values around sustainability and ethical sourcing. Brands offering certified organic baby apparel and transparent supply chains are gaining consumer trust and loyalty. This growing environmental awareness continues to shape consumer expectations and is pushing more manufacturers to incorporate sustainable practices and materials into their product lines.

Key Market Challenges

Supply Chain and Logistics Disruptions

Supply chain instability remains a notable challenge for the Australian Baby Apparel Market. Global disruptions, driven by factors such as the COVID-19 pandemic, geopolitical tensions, and natural disasters, have affected the availability of raw materials and finished goods. These disruptions have increased production costs and caused delays in delivery schedules.Due to Australia's geographic isolation, the market relies heavily on imports from countries such as China, India, and Bangladesh. Any disruptions in these supply chains can significantly impact inventory levels and product availability. Fluctuating shipping rates, port congestion, and freight container shortages add further complexity. These logistical issues have underscored the need for better risk management and diversification in sourcing strategies within the baby apparel sector.

Key Market Trends

Growth of Gender-Neutral Baby Clothing

An emerging trend reshaping the Australia Baby Apparel Market is the increasing demand for gender-neutral clothing. Many parents are moving away from conventional gender-based color schemes and designs, opting instead for versatile, inclusive options that can be worn by any child regardless of gender.This shift aligns with broader societal movements toward gender inclusivity and diversity. Gender-neutral baby apparel typically features soft color palettes, minimalist designs, and universal fits, offering both practicality and modern aesthetics. Additionally, this trend appeals to expectant parents who prefer not to pre-select clothing based on gender or are seeking more sustainable, reusable options for future children.

Key Market Players

- Bed Bath & Beyond Inc.

- Burberry

- Carter’s Inc.

- Cotton On Group

- Gianni Versace S.r.l

- H & M Hennes & Mauritz AB

- Hanesbrands Inc.

- Industria de Diseño Textil S.A.

- Ralph Lauren Corporation

- The Children's Place Inc.

Report Scope:

In this report, the Australia Baby Apparel Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Baby Apparel Market, By Type:

- Outerwear

- Underwear

- Others

Australia Baby Apparel Market, By Gender:

- Boys

- Girls

Australia Baby Apparel Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online

- Others

Australia Baby Apparel Market, By Region:

- Australia Capital Territory & New South Wales

- Northern Territory & Southern Australia

- Western Australia

- Queensland

- Victoria & Tasmania

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Baby Apparel Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bed Bath & Beyond Inc.

- Burberry

- Carter’s Inc.

- Cotton On Group

- Gianni Versace S.r.l

- H & M Hennes & Mauritz AB

- Hanesbrands Inc.

- Industria de Diseño Textil S.A.

- Ralph Lauren Corporation

- The Children's Place Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | June 2025 |

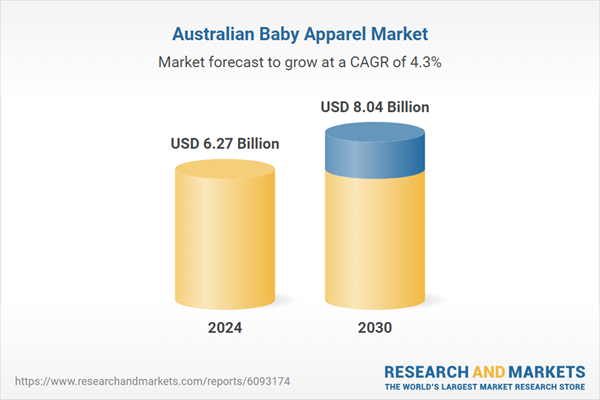

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.27 Billion |

| Forecasted Market Value ( USD | $ 8.04 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |