Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This has heightened the importance of advanced hydrogen detection technologies. Furthermore, regulatory frameworks mandating stringent safety protocols are pushing industries to adopt modern detection systems. Ongoing innovations have led to improved sensor reliability, cost efficiency, and smart features like IoT integration for real-time monitoring and predictive maintenance. The proliferation of hydrogen infrastructure, particularly in countries investing in green hydrogen initiatives, further amplifies market demand, establishing hydrogen detection as a cornerstone of future energy safety frameworks.

Key Market Drivers

Rising Adoption of Hydrogen as a Clean and Sustainable Energy Source

The rising use of hydrogen as a clean energy source is a major catalyst for the hydrogen detection market. As countries strive to meet emissions reduction targets, hydrogen is increasingly recognized as a versatile, low-carbon alternative for hard-to-electrify sectors such as heavy transportation, industrial heating, and power generation. Governments are actively promoting hydrogen initiatives with strategic investments and policy support. For example, Australia allocated USD 3.2 billion from its 2024 federal budget to support renewable hydrogen and related supply chains. Simultaneously, nations like Japan, Germany, and the U.S. are expanding hydrogen fueling infrastructure and industrial hydrogen integration, which necessitates robust safety measures, particularly leak detection. Hydrogen's role in fuel cell electric vehicles (FCEVs) and green manufacturing further drives demand for advanced detection technologies, reinforcing safety as a fundamental requirement in scaling up hydrogen deployment globally.Key Market Challenges

Technical Challenges in Hydrogen Detection and Sensor Limitations

Detecting hydrogen presents unique technical challenges that hinder broader adoption of detection systems. Hydrogen’s small molecular size and rapid diffusion make it difficult to detect in low concentrations before it disperses. Compounding this issue is hydrogen’s lack of color, odor, and taste, which renders it undetectable without specialized sensors.Current sensor technologies often face trade-offs between sensitivity, response time, and durability, especially in complex industrial settings with multiple gases. Many sensors also require regular calibration and are sensitive to environmental conditions like temperature and humidity, increasing operational complexity. Integrating these systems across varied applications - ranging from vehicles to industrial plants - adds to customization and cost challenges. Ensuring reliability and accuracy under diverse and often harsh environments remains a significant hurdle to scaling detection technologies effectively.

Key Market Trends

Integration of Smart Technologies and IoT in Hydrogen Detection Systems

The adoption of smart, connected technologies is a defining trend in the hydrogen detection market. IoT-enabled sensors and AI-driven systems are transforming hydrogen safety management by allowing real-time leak detection, remote monitoring, and automated alerts. These intelligent systems gather and analyze vast volumes of data to enable predictive maintenance and minimize risks.AI enhances system performance by differentiating true leak events from false alarms and optimizing detection thresholds. Industries such as oil & gas, chemicals, and hydrogen fueling infrastructure are leveraging these innovations to ensure safety, improve response times, and reduce manual intervention. The convergence of cloud computing with detection systems further supports centralized monitoring across multiple sites, enhancing scalability and efficiency. As digital transformation advances, smart hydrogen detection technologies are becoming integral to safety protocols in the evolving hydrogen economy.

Key Market Players

- Ametek

- Dragerwerk

- Extronics

- MSA Safety

- Sensaphone

- Honeywell

- Cambridge Sensotec

- Industrial Scientific

Report Scope:

In this report, the Global Hydrogen Detection Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Hydrogen Detection Market, By Technology:

- Electrochemical Sensors

- Catalytic Bead Sensors

- Solid State Sensors

- Infrared Sensors

Hydrogen Detection Market, By Application:

- Oil & Gas

- Chemical Industry

- Wastewater Treatment

- Mining

- Others

Hydrogen Detection Market, By Detection Method:

- Continuous Monitoring

- Portable Detection

- Fixed Detection System

Hydrogen Detection Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- South America

- Brazil

- Colombia

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hydrogen Detection Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ametek

- Dragerwerk

- Extronics

- MSA Safety

- Sensaphone

- Honeywell

- Cambridge Sensotec

- Industrial Scientific

Table Information

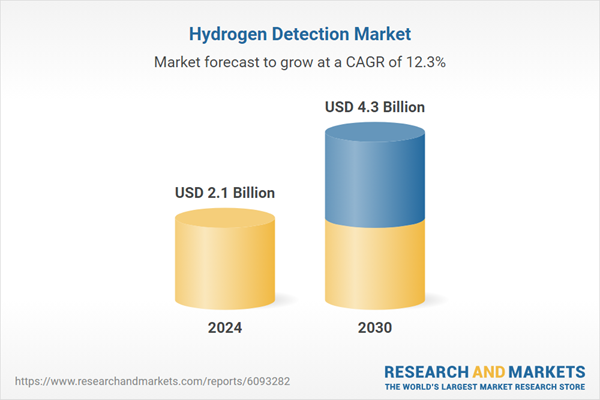

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 4.3 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |