Global Embedded FPGA Market - Key Trends & Drivers Summarized

Why Are Embedded FPGAs Emerging as the Next Frontier in Semiconductor Design?

Embedded Field-Programmable Gate Arrays (eFPGAs) are transforming the semiconductor landscape by offering a highly flexible and reconfigurable hardware logic option that can be integrated directly into SoCs (Systems-on-Chip) and ASICs (Application-Specific Integrated Circuits). Unlike traditional standalone FPGAs, eFPGAs are licensed as IP cores and embedded into chips during the design phase, enabling on-chip programmability without the need for separate FPGA hardware. This innovation allows chipmakers to deliver post-silicon customization, in-field hardware updates, and application-specific optimization - without re-spinning the entire chip. As industries demand more agile and adaptable hardware platforms to accommodate rapidly evolving protocols, standards, and AI models, eFPGAs provide a cost-effective path to future-proofing devices. Their ability to offload compute-intensive tasks, accelerate signal processing, and support parallel execution is especially valuable in domains such as 5G, AI inference, defense, automotive ADAS, and industrial automation. With the growing push for edge computing and localized intelligence, eFPGAs allow system designers to add compute flexibility at the edge while maintaining low latency and power efficiency. Their integration also reduces board footprint, lowers component count, and enhances security by enabling custom cryptographic functions within the chip. As semiconductor design cycles shorten and functional complexity increases, embedded FPGAs are poised to become a cornerstone technology in next-generation system architecture.How Are Technological Advancements Driving the Performance and Adoption of Embedded FPGAs?

Recent technological strides in silicon IP design, process nodes, and EDA (Electronic Design Automation) tools have significantly enhanced the capabilities and accessibility of embedded FPGAs. Modern eFPGAs are being developed with advanced logic density, low power consumption, and robust timing closure, making them suitable for integration into chips fabricated at 16nm, 7nm, and even 5nm process nodes. High-performance logic fabrics and adaptable routing architectures now allow eFPGAs to match or exceed the performance of standalone FPGAs for many targeted applications. EDA vendors and IP providers have also refined toolchains to support easier implementation of eFPGAs into ASIC and SoC design flows, with automated logic synthesis, floorplanning, and verification. This has lowered the barrier to entry for chip designers who may not traditionally work with reconfigurable logic. Power gating and clock gating techniques are increasingly used within eFPGA blocks to minimize dynamic and leakage power, making them viable for battery-powered devices and IoT edge systems. Furthermore, some eFPGA vendors offer hardened IP variants with embedded DSP blocks, memory interfaces, and interface controllers, enhancing their utility in compute-intensive workloads like image processing, signal analysis, and encryption. The combination of advanced process compatibility, growing IP maturity, and EDA tool integration is accelerating the inclusion of eFPGAs in both high-end chips and cost-sensitive embedded platforms.Why Are Embedded FPGAs Gaining Ground Across a Range of Industry Verticals?

The versatility and reconfigurability of embedded FPGAs are driving their adoption across a wide spectrum of industry sectors, each with distinct performance, power, and customization requirements. In the telecommunications space, eFPGAs are increasingly used to enable flexible 5G infrastructure, where rapid updates to baseband processing, protocol stacks, and encryption algorithms are critical to keeping pace with evolving standards. In the automotive sector, particularly in ADAS and autonomous driving systems, eFPGAs provide hardware-level flexibility to support sensor fusion, radar and LiDAR signal processing, and evolving safety algorithms. Defense and aerospace applications, which demand secure, rugged, and adaptable computing platforms, are also benefiting from eFPGAs that allow for in-field reprogramming and mission-specific configuration. In data centers, embedded FPGAs are accelerating AI inference workloads, packet processing, and storage optimization tasks while reducing overall power consumption and latency. The medical device industry is using eFPGAs to develop customizable diagnostic tools and imaging systems that can evolve post-deployment to meet regulatory or functional updates. Even in consumer electronics, eFPGAs are starting to appear in smart appliances and wearables, where long product lifespans benefit from hardware that can adapt without physical replacement. This cross-sector adoption is evidence of the universal need for post-fabrication flexibility, real-time adaptability, and performance efficiency - core strengths of embedded FPGA technology.What Are the Key Forces Fueling the Expansion of the Embedded FPGA Market?

The growth in the embedded FPGA market is driven by several interconnected trends rooted in technology convergence, application complexity, and the need for future-proof hardware architectures. One of the primary drivers is the increasing demand for hardware customization and upgradability in the face of rapidly changing industry standards, protocols, and AI workloads - conditions that static silicon cannot keep pace with. The rise of edge computing and AI inference at the device level is pushing developers to integrate adaptable compute blocks that can optimize power, latency, and function dynamically - an ideal role for eFPGAs. The need for enhanced security in an era of heightened cyber threats is also contributing to market momentum, as eFPGAs allow for on-chip, customizable encryption modules and secure boot implementations. Economic factors are at play as well: eFPGAs reduce long-term costs associated with chip redesigns and allow OEMs to support multiple product variants or regional requirements using a single hardware platform. The growing ecosystem of IP providers, foundry support, and EDA tool compatibility has also made eFPGA integration more accessible and standardized, enabling broader adoption. Government and defense contracts that require programmable, export-controlled, or standards-compliant solutions are further accelerating demand. As chipmakers and system integrators prioritize agility, adaptability, and time-to-market, embedded FPGAs are quickly becoming a preferred design choice, positioning the market for sustained expansion in the years ahead.Report Scope

The report analyzes the Embedded FPGA market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Electrically Erasable Programmable Read-Only Memory, Antifuse, Static Random Access Memory, Flash, Other Technologies); Application (Data Processing, Consumer Electronics, Industrial, Military & Aerospace, Automotive, Telecom, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electrically Erasable Programmable Read-Only Memory segment, which is expected to reach US$54.8 Million by 2030 with a CAGR of a 14.2%. The Antifuse segment is also set to grow at 16.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.5 Million in 2024, and China, forecasted to grow at an impressive 19.1% CAGR to reach $34.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Embedded FPGA Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Embedded FPGA Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Embedded FPGA Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

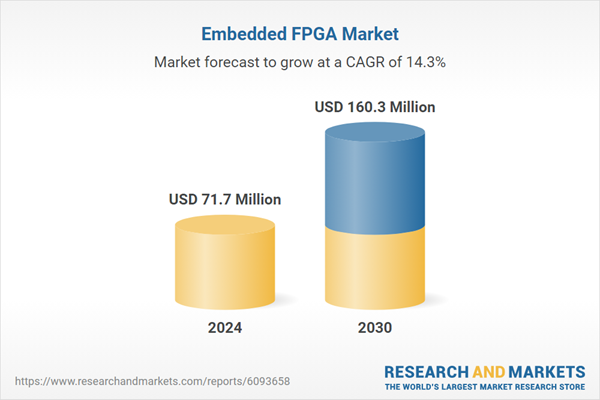

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acromag, Inc., ADLINK Technology Inc., Advantech Co., Ltd., AMETEK, Inc., Analog Devices, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Embedded FPGA market report include:

- Achronix Semiconductor Corporation

- Advanced Micro Devices, Inc.

- Alphawave IP Ltd

- Analog Devices, Inc.

- Broadcom Limited

- Cologne Chip GmbH

- Cypress Semiconductor Corporation

- Efinix, Inc.

- Flex Logix Technologies, Inc.

- GOWIN Semiconductor Corporation

- Intel Corporation

- Lattice Semiconductor Corporation

- Microchip Technology Inc.

- Microsemi Corporation

- NanoXplore

- NXP Semiconductors N.V.

- Qualcomm Technologies, Inc.

- QuickLogic Corporation

- Renesas Electronics Corporation

- Xilinx (AMD)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Achronix Semiconductor Corporation

- Advanced Micro Devices, Inc.

- Alphawave IP Ltd

- Analog Devices, Inc.

- Broadcom Limited

- Cologne Chip GmbH

- Cypress Semiconductor Corporation

- Efinix, Inc.

- Flex Logix Technologies, Inc.

- GOWIN Semiconductor Corporation

- Intel Corporation

- Lattice Semiconductor Corporation

- Microchip Technology Inc.

- Microsemi Corporation

- NanoXplore

- NXP Semiconductors N.V.

- Qualcomm Technologies, Inc.

- QuickLogic Corporation

- Renesas Electronics Corporation

- Xilinx (AMD)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 303 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 71.7 Million |

| Forecasted Market Value ( USD | $ 160.3 Million |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |